On your phone? Download the American Express® App to access and manage your account everywhere you go.

A M E R I C A N E X P R E S S O N L I N E S E R V I C E S

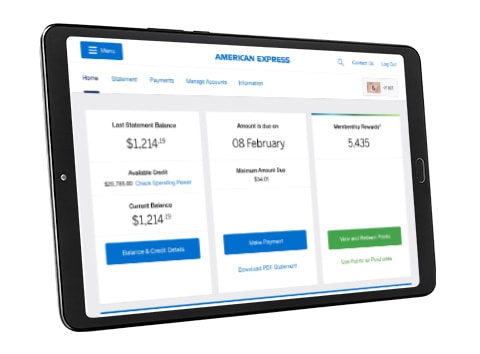

Enjoy more control, more convenience and more rewards

Already have an Online Services account? Log in now.

Account servicing

Change your PIN and contact information or add someone to your account all in one place.1

Account safeguards

Lost or misplaced your Card? Temporarily freeze your eligible Card to help prevent it from being used for select new purchases, without replacing your Card2, all while being backed by our Fraud Protection Guarantee.3

Control over your Card’s spend power

Request a change to your credit limit4 on your Credit Card or find out if a large purchase can be approved on your Charge Card with Check Spending Power. Terms apply.5

Get more out of your points

Keep track of the points you’ve earned on each transaction on eligible Cards. Plus, turn your Membership Rewards® points into statement credits towards eligible purchases charged to your Card.6

Keep rewards coming with Amex Offers

With Amex Offers you can be rewarded with statement credits or points when you use your eligible Card at some of the places you love to shop, dine, and travel. We’re always adding new offers tailored to your lifestyle.7

Refer a friend and get rewarded

As a Basic Cardmember, introduce your friends and family to the benefits of being a Cardmember and you could both get rewarded if they’re approved.8

Monitor purchases

Review recent and pending transactions on your Account Summary or quickly filter through older transactions by date range and type.

Go paperless

Enrol in Online Services with eligible Cards to access billing statements electronically with Online-Only Statements and have the flexibility of receiving your statement as soon as it’s ready. Plus, download recent statements up to the last six months.

Activate a Card

Instantly activate your new or replacement Cards.

Pay your bill from anywhere

Enrol a bank account in your online account and easily make a payment.9

Pre-Authorized Payment Plan

Never miss a payment when you register your eligible Card for automatic monthly payments with your enrolled bank account.10

Take your time with Plan It™

For more flexibility, choose a purchase or an amount you’d like to pay in installments with a fixed monthly fee.11

Two-Step Verification

For additional protection, we can email or text you a temporary verification code to confirm your identity when you log in to your account.

Account Alerts

Receive account balance updates, payment reminders, and more by email or text when you register for Account Alerts.12

Replace a Card

Lost or misplaced your Card? Easily request a replacement in a few clicks, so you can carry on with no hassle.

Simply visit our Online Services Welcome Page and enter your 15-digit Card Number and 4-digit Card ID to begin. It only takes a few minutes to create an account and then enjoy more American Express features and benefits.

Yes. Log in to Online Services and the Amex App using the same User ID and Password.

Yes. If there is an occasion when you require a previous paper statement sent by mail, please call the phone number on the back of your Card for us to process the request.

Yes, you can view and update your physical home and email addresses and phone numbers by navigating to ‘Edit Account Details’ under Manage Accounts after logging in.

As part of our regular screening of Cardmember transactions, our systems will look for unusual transactions such as purchases outside your normal spending habits. Where our fraud detection programs identify suspicious activity, we may try to contact you to verify whether the transaction is legitimate. However, there may be cases where we will try to prevent a potential fraudulent transaction by putting a hold on your account transactions.

Amex Offers is a program that provides offers to eligible Cardmembers for either a statement credit or bonus points on shopping, dining and more.

Amex Offers is available on your online account or on the Amex App. Simply register your Card for the offers you want, then use your registered Card to make qualifying purchases during the offer period. You could earn either a statement credit or bonus points as applicable.

Not Eligible: American Express® Corporate Cards, American Express® Gift Cards and Prepaid Cards are not eligible to participate. Please see offer specific terms and Program Terms for more information.

There is more waiting for you with an American Express Online Services account.

On the go? Take your account with you.

Scan the QR code to download the Amex App. The convenient way to keep track of your account information, rewards, offers, and more.

On the go? Take your account with you. The convenient way to keep track of your account information, rewards, offers, and more.

1. Account must be in good standing. An additional Card is a Supplementary Card. Supplementary Cardmembers must be at least 13 years old. Maximum of 9 Supplementary Cards per account for Consumer Cards.

2. Available to American Express Consumer and Small Business Cards. Not applicable for all new purchases. The following purchases do not qualify and will still be processed even if the Cardmember has frozen the Card: automated or pre-authorized payments, recurring bills or subscriptions, transactions on any Supplementary Cards if only the Basic Card is frozen (each Supplementary Card must be frozen separately), mobile wallet transactions (including adding a Card to a mobile wallet), using the Card for online payments at merchants where the Card is stored on file or set up as the method of payment, and offline and delayed authorizations (such as purchases made aboard airlines). After freezing the Card, it will automatically unfreeze after 7 days.

3. Use the American Express Card online or off, and you won’t be held responsible for any fraudulent charges, as long as you’ve taken reasonable care to protect your account details, PIN and any device on which you have added your account information.

4. To be eligible, you must be an American Express Cardmember for more than six (6) months and account must be in good standing. Credit limits are subject to change in accordance with your Cardmember Agreement. This does not apply to Charge Cards including Charge Cards with Flexible Payment Option.

5. This approval is based on your current account status. Certain changes to your account could affect the approved amount such as additional purchases, past due balance, a returned payment, a significant change in your spending pattern, or a fraud risk on your card. This approval is based on your overall ability to spend and is not related to the Flexible Payment Option limit on your account.

6. You can redeem Membership Rewards points for a statement credit towards an Eligible Purchase charged to an Eligible Card. You must redeem a minimum of 1,000 points per redemption. Statement credits on your Card Account should not exceed the aggregate amount of the Eligible Purchase(s) on your Eligible Card. You can register for Online Services to view your Eligible Purchases and to redeem online. Only Eligible Purchases posted to your Card Account during the last 3 months, up to 150 most recent Eligible Purchases, will be displayed for redemption. If you wish to redeem points towards an Eligible Purchase within the last 12 months that is not displayed online, please contact us at the number listed on the back of your Card. All Eligible Purchases: 1,000 points = $10 statement credit.

For full Membership Rewards Program Terms and Conditions, visit membershiprewards.ca or call 1-800-668-AMEX (2639). Small Business Cardmembers, please call 1-888-721-1046.

7. Eligible Cards will vary by offer and are subject to change. Select Canadian American Express Cards issued by Amex Bank of Canada and cards issued by a licensed third-party issuer (as applicable) are eligible Cards for the offer. The following cards are not eligible: American Express Corporate Cards, American Express® Gift Cards and Prepaid Cards. Offers are subject to terms and conditions and full program terms.

8. Terms and conditions apply. Not all Card products are eligible for a referral bonus. For details, visit americanexpress.com/en-ca/referral.

9. Your initial payment can only be scheduled 3 calendar days after you have successfully enrolled in the Payment Program. Subsequent payments can be credited to your account same day if submitted prior to 8 P.M. (ET).

10. With the Pre-Authorized Payment Plan, a predetermined amount is debited from your bank account on the payment due date each month. This payment option is only available to Consumer or Small Business Accounts. The Pre-Authorized Payment Plan is currently not available for Corporate Accounts.

Any Canadian dollar deposit bank account held at a Canadian financial institution is eligible for enrollment in the Pre-Authorized Payment Plan. The account must belong to you or, for joint accounts, you must have signing authority for the account. Foreign accounts are not eligible. If you choose to register a business account, you must be a signatory on that account.

Your enrollment in pre-authorized payments or changes made to your enrollment will not take effect until your next billing cycle. You are still required to make a manual payment for the current billing period.

Depending on your financial institution, it may take up to 3 business days for your deposit account to be debited by your financial institution. Please check with your financial institution for details. Please ensure there are sufficient funds in your bank account when making payments. Fees for a returned payment are listed within your disclosure statement. For full terms and conditions of the Electronic Payment Program Agreement, visit americanexpress.ca/AutomaticPaymentTerms.

11. When you create an installment plan, you will be charged a monthly installment fee. The monthly installment fee percentage will be disclosed to you during plan

creation. This is not a promotional or special rate offer. The fee charged is comparable to the interest you would have paid if you carried this balance on your account, without being in an installment plan. Please see the Plan It (American Express Installment Program) section in your Cardmember Agreement or the Program Terms and Conditions for more details. Plan It is currently not available in Quebec, Nova Scotia, PEI or Nunavut.

12. Account Alerts is a free service for American Express Cardmembers. However, your cell phone service provider may apply fees for incoming text messages. Please contact them for further details.