Explore Benefits on your

American Express® Platinum Card

Platinum brings you generous rewards, unrivalled experiences and exclusive invitations - you'll find all your benefits here.

Now Earn 5X Membership Rewards® points on every purchase through

Terms & Conditions apply

Your all-new metal Platinum Card Benefits

Your Platinum Card now comes in a new, sleek design made of stainless steel giving you a differentiated look. Your Card number and expiry date can be found etched on the reverse of the Card.

Being a Charge Card, your American Express® Platinum Card comes with no pre-set spending limit*, giving you greater purchasing power and the flexibility to enjoy your privileges, the way you like it.

*This means that your charges are approved basis your spending pattern, financials, credit record and account history. Please note that 'no pre-set limit' does not mean your spending is unlimited.

Activating your Card

Activate your Card and select a PIN via any the following ways:

- Download the American Express® App.

- Enter Card Details. Create User ID and Password.

- Set a PIN of your choice and Activate your Card.

- If you already have the Amex App, log in and go to ‘Account’ tab and select ‘Activate and Add Card to your Account’ option.

Manage your Card account on-the-go, and get more done with a few taps on the American Express App

- Enjoy quick & secure access with just your fingerprint.

- Set up real-time purchase alerts, spend tracking alerts, payment due date reminders, and weekly balance alert.

- Access last 6 months’ statements in a simple PDF format.

- View and redeem the reward points you have earned.

- Reset your Online Account User ID or Password.

- Block your Card temporarily if you have misplaced it*.

- Chat with us on the App for quick support.

- View, change, or unlock your PIN. Know more

Click below to download or give us a missed call at 7043337788 to receive a download link on your mobile phone.

- Register for online services at americanexpress.com.in/activate

- Set a PIN of your choice and activate your Card.

Register and enjoy the ease of managing your account anytime, anywhere.

- View your Account balance and pay your bill online

- Set up SMS and email alerts to help keep up to date

- Register for special offers and updates

- View, change or unlock your PIN. Know more.

- Track your Membership Rewards® Points balance

- Call the helpline number printed on the reverse of your Card.

- Follow the IVR to set a PIN of your choice and activate your Card.

Register for online services at americanexpress.co.in or via the Amex App.

Using your Card

Saving your new American Express Card details at your favourite online retailers is the most convenient and secure way to quickly make purchases online.

Don’t miss out on being rewarded for each and every spend that you make, and check out faster whenever you shop online at places like Amazon, Uber, Spotify, Paytm and more.

Not only is your Card great to look at, it is also the safest and most secure way to pay for all your purchases.

When you shop at an online merchant, the SafeKey screen will appear towards the end of your checkout process. We will send you a six-digit One Time Password (OTP) by text and/or email. Simply enter the OTP to complete your transaction. You are automatically registered for SafeKey.

In addition to the usual Chip and Pin, your Card contains contactless technology, making your purchases quicker and easier.

Enjoy a seamless process so you can shop on the go, faster than ever.

- In-store/point of sale (Chip)

- Online Websites and Mobile Apps

- Contactless - Tap and Pay

- ATM*

You can manage the controls in 3 easy steps:

1. Log in to your Online Card Account or Amex App

2. Go to ‘Account Management’ (Online Account) or ‘Account’ (App)

3. Go to ‘Transaction Security Settings’ to manage and modify your transactions security settings

Once saved, the transaction settings will be effective immediately on your Card.

If your Card gets renewed or replaced in the future, onlyin-store/point of sale (Chip), and ATM transactions within India will beenabled by default. You will be required to enable online, international, andcontactless transactions on your Card by following the steps above.

Refer to the FAQ page should you have any queries.

*You need to be enrolled in the Express Cash facility towithdraw cash from ATM. International ATM transaction may be enabled basis your international spend behavior.

Membership Benefits

Whether it is the latest addition to your watch collection, a unique art masterpiece, or a stylish wardrobe update, enjoy an elevated experience with 20X* Rewards. Shop online & in-store* with our handpicked selection of brands and earn extra points with RewardXcelerator.

- Earn 10X Rewards on shopping with Bulgari, Kapoor, Watch Co., BIRKENSTOCK, Forest Essentials & more.You earn 50 Membership Rewards® points on every ₹200 spent.

- Earn 20X Rewards on shopping with Darveys and RAS Luxury Skincare. You earn 100 Membership Rewards® points on every ₹200 spent.

Explore the many ways you can turn your spends into rewards with -

- 1 Membership Rewards® Point for every INR 401 spent on your card except for Fuel, Insurance and Utilities.

- 5 Membership Rewards points for every INR 100 spent on Fuel.

From travel, dining, shopping to charging all your expenses to your Card, get more value from all your spends.

What's more? Your points never expire!

Turn your overseas spends into experiences you’ll cherish with 3X Membership Rewards Points on all your purchases made when traveling abroad.

Maximise your Cardmembership with this special feature exclusively for you.

Whether it’s a new pair of headphones, a family trip away or even your morning coffee and pastry, when we say you can use them for pretty much anything, we mean exactly that.

- Our Membership Rewards catalogue offers you a wide range of entertainment, travel and dining products including electronics, fitness gadgets, kitchen accessories, luggage and much more to choose from.

- Book travel on the American Express Online Travel website including flights, hotels and experiences. You can even use your points to pay for taxes and fees.

- Pay with points at online retailers

- Purchase Gift Cards or eVouchers from a choice of well-known brands.

- Transfer points to travel, hotel and retail loyalty programmes.

- Use points to offset any purchase made on your Card once it appears on your statement.

Taj Epicure Plus

Enjoy exclusive benefits when you dine or stay at the Taj, SeleQtions and Vivanta Hotels

Hilton Honors Elite Gold Status

Enjoy complimentary Gold status with no minimum stay requirements across 10 hotel brands. Get privileges that will make your travel experience more rewarding.

Marriott Bonvoy™ Gold Elite Status

Discover a preferential level of service with Marriott Bonvoy™ - a program that offers you the best rates at over 6,500 hotels across 29 brands in 127 countries.

Radisson Rewards Premium Status

- Upgrade to Premium Status where you enjoy more relevant benefits

- Choose how you want to get rewarded: Triple points or up to 20% discount

- Room upgradeand late check-out when available

Hertz Gold Plus Rewards

As a Platinum Cardmember, enjoy special benefits such as discounts, upgrades, and priority service when renting with Hertz or Avis

1. You earn 1 Membership Rewards Point for every Rs. 100 spent on Fuel. Fuel includes petrol, diesel, CNG from Oil Marketing Companies (OMCs). Effective June 1,2021 you will earn 4 additional Bonus Membership Rewards Point for every Rs. 100 spent on Fuel with a maximum of 5000 additional Membership Rewards points per calendar month. Bonus points

fulfillment may take up to 90 days from the date of transaction. If a Cardmember has not received the points, they can call the number at the back of their Card and the bonus Membership Rewards Points will be awarded only if the transaction is eligible for Bonus points. You will continue to earn 1 Membership Rewards point on every Rs 100 spent on fuel with no limit of maximum points. You will not earn any Membership Rewards Points on all your spending on insurance and utility (electricity, water and gas bills) payments. Other utility services include providers of household/domestic electricity, gas and water. These providers can be government departments and agencies including local, state, municipal organizations, public housing societies and apartment associations.

2. Limited period offer. Subject to Terms and Conditions

Global Lounge Collection

Relax in one of the 1,400+ Airport Lounges across more than 130 countries.

The American Express Global Lounge Collection includes access to:

• Priority PassTM Lounges - To be used only for International access.

• Delta Sky Club® Lounges when flying Delta

• Domestic Partner Lounges in India

Important Update: We are now seeing some partner lounges reopen. Pace of reopening varies by region and is dependent on local regulations and conditions. Please continue to check Lounge Finder and partner sites as needed for the latest information. Kindly check lounge locator link for latest status of all the lounges

International Airline Program

As a Platinum Cardmember, enjoy exclusive deals on some of the world's finest airlines like Qatar Airways, Virgin Atlantic, Air France, KLM, Delta Airlines, Air India and more.

These offers can be availed by bookings on American Express Travel Online, by calling up the toll free number 1800-419-0150 or dropping an email to onlinetravelindia@aexp.com

American Express Travel Online

With a huge selection of great value flights, hotels and car hire to choose from, your perfect holiday is just a few clicks away with American Express Travel Online. You can pay for your travel, including taxes, with your Membership Rewards® points with no booking fee.

Earn reward points as per the standard earn rate on your bookings on American Express Travel.

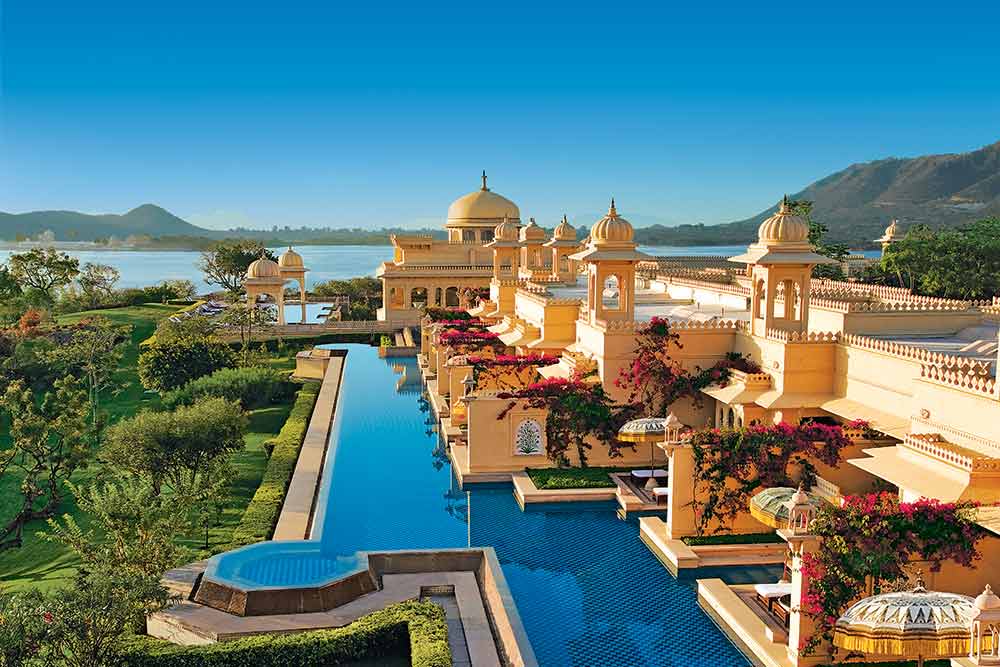

Fine Hotels and Resorts

Receive complimentary suite of benefits that offer an average total value of INR 44,3001 at over 1,300 extraordinary properties worldwide, everytime you book Fine Hotel & Resorts®

The benefits include a room upgrade when available3 daily breakfast for two, guaranteed 4pm late check-out and more.

Some of the hotels included are Four Seasons Hotels & Resorts, Mandarin Oriental, The Ritz-Carlton

The Hotel Collection

With a US$100 experience credit and a room upgrade, when available. The Hotel Collection offers you a world of luxurious comfort that you can use for dining, spa and resort activities when you book a stay for two consecutive nights with American Express® Travel Online.

Get exclusive treatment at over 600 hotels in over 30 countries3. Some of the hotels included are, Grand Hyatt, Goa Intercontinental, London, Conrad, New York, Sofitel, Singapore

1. Average value based on Fine Hotels & Resorts bookings in 2021 for stays of two nights. Actual value will vary based on property, room rate, upgrade availability, and use of benefits. Indulge even more at some of the world’s most luxurious hotels. Terms and Conditions apply.

2. Certain room categories are not eligible for upgrade

3. For detailed Terms and Conditions, please click here

4. The Cardmember will receive the credit in the form of deduction from the final hotel bill when checking out of the hotel, $1 for each eligible dollar spent up to $100. For more TnCs refer to American Express Travel Online. Benefit is not redeemable or transferable for cash. Fine dining experience is valid only for Centurion or Platinum cardmembers and those travelling on the same booking, excluding alcoholic beverages, to the value of US$100 per person. Fine dining experience will be booked pre or post departure depending on specific itinerary. Not applicable for Venice Simplon-Orient Express Istanbul journeys. All US$ amounts refer to U.S. dollars. Certain room categories are not eligible for upgrade. Experience credit varies by property. To receive THC benefits, requires a two-night minimum stay. Benefits are only applicable on bookings made through Platinum Travel Service with a valid American Express card.

Book Travel Online

Enjoy the confidence that comes with booking your next domestic trip from one of the world's largest travel networks. You can use your Membership Rewards® points to pay for your trip.

Enjoy every trip you take with 25% savings on stays at the Grand Palaces of Taj.

25% off on Best Available Rates on all Taj, SeleQtions and Vivanta hotels across the globe

Valid for bookings till 31 December 2024

For reservations kindly contact Platinum Travel and Lifestyle services.

50% off at Oberoi Hotels & Resorts

Enjoy 50% discount2 on Suites and 3rd night complimentary on room reservations for 2 nights will be confirmed at the time of reservation. This offer includes complimentary breakfast and bottle of wine.

For reservations, please contact Platinum Travel and Lifestyle services.

Terms Conditions for Oberoi Hotels

American Express® Terms and Conditions

- Below mentioned offers are open to American Express Cardmembers holding one of the following Cards and whose accounts are valid and in good standing. An American Express Cardmember ("Cardmember") for the purpose of this offer means aperson holding one of the following Cards in India, issued in India by American Express® (“Card”) The American Express® Platinum Card

- The offer is not available for Cardmembers holding any other Cards issued by American Express Banking Corp

- This program is being offered by the participating service establishment only and shall be valid for the period mentioned in the offer.

- This offer is being made purely on a “best effort” basis. The Cardmembers are not bound in any manner to participate in thisoffer and any such participation is purely voluntary.American Express is neither responsible for availability of services nor guarantees the quality of the goods/services and is notliable for any defect or deficiency of goods or services so obtained/availed of by the Cardmembers under this offer. Any disputeswith regard to the quality of goods/services availed shall be taken up with the merchant/service establishment directly.American Express shall have no liability whatsoever with regard to the same.

- American Express shall not be liable whatsoever for any loss/damage/claims that may arise out of use or non-use of any goodsor services availed by Cardmember under this offer. American Express reserves its absolute right to withdraw and/or alter any ofthe terms and conditions of the offer at any time without prior notice.

- Nothing expressed or implied in the program shall in any way waive or amend any of the Terms and Conditions of theexisting Cardmember agreement with the Card issuer.

- To receive this offer, purchase should be charged in full to the American Express Card. No cash alternative is available.

- Any disputes arising out of and in connection with this program shall be subject to the exclusive jurisdiction of the courts in thestate of Delhi only.These offers are subject to partner terms and conditions.

- In the wake of COVID-19, while the merchants/service establishments may be maintaining all safety measures, we request you to ensure safety at your end as well. In no event shall American Express be held liable for any fallouts/illness or anyconcerns arising/occurring due to the Cardmember choosing to order/use services from the merchant/service establishment.

Suites Offer – Terms and conditions

- Cardmembers will receive an instant discount of 50% on the Best Available Rate on applicable Suite categories at The Oberoi Hotels and Resorts in India.

- Offer is valid for bookings and stays between 4th September 2020 and 31st March, 2025.

- The rate is discounted from the Best Available Rate Only, subject to availability. The offer cannot be combined with any other offer.

- Reservations must be made via American Express Platinum Travel Services.

- Maximum of 3 suites can be booked by a cardmember in a single transaction under this offer.

- A cardmembers cannot book more than 5 nights per stay.

- This offer is non-transferable and cannot be used in conjunction with any other The Oberoi Hotels & Resorts offer or promotion.

- Rates are subject to availability, applicable taxes, fees, and other standard service charges may apply.

- The offer would not be valid on ‘Presidential/Kohinoor Suites’A deposit through the American Express® Platinum Card needs to be made at the time of reservation for room and taxes.

- All bills will need to be settled at the time of Check-out by the cardmember through the same American Express® Platinum Card only

- No request for cashback/discount would be entertained after the booking or stay period if the guest doesn’t avail the offer during reservation/payment.

- The card member needs to be present and stay to avail the discounted price.

- Offer would be applicable for both primary and supplementary cardmembers.

- Rates and Taxes are subject to change without prior notice.

- American Express and The Oberoi Hotels & Resorts reserve the right to withdraw the promotion or amend these terms and conditions without prior notice at any time, for whatever reason, and without any liability for doing so.

- Queries related to the offer will be entertained only till 15 days from transaction date.

- Please contact The Oberoi Hotels & Resorts Contact Centre or Platinum Travel Services for any queries related to the offer.

- The offer would be valid at below mentioned properties only:

| S.NO | PROPERTY |

| 1 | THE OBEROI, MUMBAI |

| 2 | THE OBEROI GURGAON |

| 3 | THE OBEROI, BANGALORE |

| 4 | THE OBEROI AMARVILAS |

| 5 | THE OBEROI, NEW DELHI |

| 6 | THE OBEROI UDAIVILAS, UDAIPUR |

| 7 | THE OBEROI GRAND, KOLKATA |

| 8 | THE OBEROI RAJVILAS, JAIPUR |

| 9 | THE OBEROI CECIL, SHIMLA |

| 10 | THE OBEROI SUKHVILAS RESORT & SPA, NEW CHANDIGARH |

| 11 | WILDFLOWER HALL, SHIMLA IN THE HIMALAYAS |

Room Offer- 3rd night complementary

- Offer Details:

- On every paid two nights receive the third night complimentary

- Room upgrade, subject to availability, at the time of check-in depending upon availability (Not applicable on room to a suite).

- Complimentary breakfast for two guests, per day.

- On every paid spa therapy enjoy savings of 25%

- Complimentary bottle of wine (once during the stay)

- Complimentary transfers from nearest Airport or Railway Station (Applicable only for The Oberoi Rajvilas, The Oberoi Amarvilas, The Oberoi Vanyavilas and The Oberoi Udaivilas)

- Offer is valid for bookings and stays between 1st April’21 and 31st March, 2025 (black out period will apply).

- Room type: Applicable on all room categories (except suites)

- Participating Hotels: All Oberoi Hotels in India

- Maximum of 3 rooms can be booked by a cardmember in a single transaction under this offer. Cardmember will not be allowed to split the booking into multiple reservations and avail the offer on more than 3 rooms.

| S.NO | PROPERTY |

| 1 | THE OBEROI, MUMBAI |

| 2 | THE OBEROI GURGAON |

| 3 | THE OBEROI, BANGALORE |

| 4 | THE OBEROI AMARVILAS |

| 5 | THE OBEROI, NEW DELHI |

| 6 | THE OBEROI UDAIVILAS, UDAIPUR |

| 7 | THE OBEROI GRAND, KOLKATA |

| 8 | THE OBEROI VANYAVILAS WILDLIFE RESORT, RAMTHAMBORE |

| 9 | THE OBEROI RAJVILAS, JAIPUR |

| 10 | THE OBEROI CECIL, SHIMLA |

| 11 | THE OBEROI SUKHVILAS RESORT & SPA, NEW CHANDIGARH |

| 12 | WILDFLOWER HALL, SHIMLA IN THE HIMALAYAS |

Taj 25% Discount : Terms and conditions

- This offer is open to American Express Platinum Cardmembers whose accounts are valid and in good standing.

- An American Express Platinum Card member ("Card member") for the purpose of this offer means a person holding Platinum Card in India, issued in India by American Express® Banking corp.

- These offers are being made purely on a “best effort” basis. Card members are not bound in any manner to participate in these offers and any such participation is purely voluntary.

- To receive these offers, purchase should be charged in full to the American Express Card. No cash alternative is available.

- American Express Banking Corp. is neither responsible for availability of services nor guarantees the quality of the goods/services and is not liable for any defect or deficiency of goods or services so obtained/availed of by the Card members under these offers. Any disputes with regard to the quality of goods/services availed shall be taken up with the merchant/service establishment directly. American Express shall have no liability whatsoever with regard to the same.

- American Express shall not be liable whatsoever for any loss/damage/claims that may arise out of use or non-use of any goods or services availed by Card member under these offers. American Express reserves its absolute right to withdraw and/or alter any of the terms and conditions of the offer at any time without prior notice.

- Nothing expressed or implied in the program shall in any way waive or amend any of the terms and conditions of the existing Card member agreement with the Card issuer.

- Any disputes arising out of and in connection with this program shall be subject to the exclusive jurisdiction of the courts in the state of Delhi only.

- This offer is subject to partner Terms and Conditions.

- In the wake of COVID 19, while the merchants/service establishments may be maintaining all safety measures, we request you to ensure safety at your end as well. In no event shall American Express be held liable for any fallouts/illness or any concerns arising/occurring due to the cardmember choosing to order/avail services from the merchant/service establishment.

Offer Terms and Conditions

Offer: Taj 25% discount offer

- Offer : 25% off on Best Available Rates on all Taj, SeleQtions and Vivanta hotels across the globe till 31 December 2024.

- Cards Eligible: American Express Platinum Card.

- To view participating list of locations for Offer A kindly click here.

- Offer Fulfilment Process-

- American Express Platinum Cardmembers needs to make the reservations through Platinum Travel & Lifestyle Services (for Platinum cardmembers).

- The American Express® Platinum Card number needs to be shared by the card member at the time of reservation for room and taxes.

- All bills will need to be settled at the time of Check-out by the cardmember through the above American Express® cards only. If any other card or medium is used for payment of the bills, then the card member will not be eligible for the benefits under this offer and shall be charged as per the prevailing rate at the time.

Offer Terms & Conditions-

- Offer is valid from 11 July 2022 till 31 December 2024 (both days included) only for American Express Platinum Cards (including supplementary cards).

- The rate is discounted from the Best Available Rate, Room + Breakfast rate, subject to availability. Blackout dates may apply. Cardmembers are requested to check blackout dates at the time of reservation. No further discounts or amenities, including Fine hotels and resorts amenities, will

be applicable. - This offer is non-transferable and cannot be used in conjunction with any other Taj offer or promotion.

- Discount will be applicable on the amount exclusive of taxes.

- Cardmembers can avail the offer multiple times during the offer period.

- The offer is applicable on all room types.

- Offer can be utilized for a maximum of 5 rooms with not more than 10 guests in a single booking at a given time. 10 guests will be including cardmember.

- Reservations must be made via Platinum Travel & Lifestyle Services (for Platinum cardmembers).

- Rates are subject to availability, applicable taxes, fees, and other standard service charges.

- The American Express® Platinum Card number needs to be shared at the time of reservation.

- All bills will need to be settled at the time of Check-out by the cardmember through the same American Express card only through which the reservation was done.

- Limited room inventory would be available under this offer.

- The hotel reserves the right to change the rate for any other card types.

- The card member needs to be present and stay to avail the discounted price.

- Names of participating hotels are subject to change.

- Rates and taxes are subject to change without prior notice.

- IHCL and American Express reserves the right to withdraw the promotion or amend these terms and conditions without notice for whatever reason, and without any liability for doing so.

- Any disputes arising out of and in connection with this offer shall be subject to the exclusive jurisdiction of the courts of Mumbai only.

- For queries, cardmembers can contact Taj at corporate.reservations@tajhotels.com and Taj will respond in 4-5 Business days.

- Last day to raise queries regarding the offer will be 31 December 2024.

- Covid guidelines will apply however cardmembers are requested to check Covid guidelines with Taj at the time of reservation.

Ask for the impossible anytime, the answer is always “yes".

'Do anything’ across the globe with the Platinum Concierge, renowned for bringing the most special experiences to you.

Whether you are struggling for last minute reservations or simply forgot to send flowers to your spouse on your anniversary, with the powerful backing of American Express, you can stay assured. Our team is there to put it all together for you 24X7. Please call us on 1800 419 1255

Platinum Travel Service - Our experts can help arrange complex itineraries and holidays, we do the hard work to make them happen. Please call on 1800 419 1255 to know more

Emergency Services

When you travel across the world, we are there to help you with things you need and the things that are essential:

• Visa assistance

• Lost baggage

If you feel the need to get referrals from lawyers, advances for lawyer fees and advance for a bail bond, we are here to assist you.

In the event of loss or theft of important documents, or incase of an inability to obtain cash when travelling overseas, get up to US$ 1,000 as emergency advance delivered to you. Refer to General Terms and Conditions1 mentioned below for details. While the Hotline coordination and assistance services are offered at no additional charge from American Express, Cardmembers are responsible for the costs charged by third-party service providers.

Some situations are often unforeseen when you are travelling abroad. For your trips less than 90 days, we have created a service for you that gives you medical assistance like:

• Emergency funds for medical expenses of up to US$ 8,000

• Medical assessment

• Medical evacuation and repatriation

• Repatriation of dependent children below 16 years to the country of residence

• Emergency hotel expenses of up to 5 nights at US$200 per person, per night

• Repatriation of travelling companion (one-way Economy Class transportation for return to the country of residence).

In case your Card is lost, stolen or damaged, a Replacement Card will be rushed to you, usually within 2 business days, free of charge, anywhere in the world. No matter where you, we got your back.

Platinum Protection

Use your Card with confidence the world over, knowing you have the powerful backing of American Express no matter where you are 24x7.

Your Platinum Cardmembership gives you protection when you travel and also saves you travel insurance premium.

Under Air Accident Cover, the primary card is insured with the sum of INR 50,000,000. Platinum Protection provides you with worldwide cover in unforeseen situations.

Cover your possessions from uncertainties if they are purchased on your Card (Get a cover value of up to INR 5 Lacs).

Get protection against loss or damage within 90 days, due to fire, burglary or natural calamities.

Purchase Protection2 exclusions:

• Electrical/mechanical breakdown of appliances

• Loss or damage to precious items like gold, silver,antiques, securities, etc.

To ensure your peace of mind, we give you complimentary3 Overseas Medical Insurance for US$ 50,000 for the first seven days of your trip.

Register your trips by contacting ICICI LOMBARD GIC LTD. by sending the SMS ‘OMI’ to 575758 or email at delhitravel@icicilombard.com and a representative from ICICI Lombard will get in touch with you.

Important points: Overseas Medical Insurance is for the Basic Cardmembers. Supplementary Cardmembers do not enjoy complimentary Overseas Medical Insurance • Your cover is valid only if you receive an email/letter of confirmation prior to your trip • Your claims would be settled once you are back in India • For details of insurance coverage, exclusions, Terms and Conditions please refer to policy document • Insurance is the subject matter of solicitation Misc. 63 • Product Underwritten ICICI Lombard General Insurance Company Ltd.

Take to the highways with fewer worries in sight. Travel every mile with a smile knowing you are backed by us.

• Dedicated helpline and priority claim processing

• Opt in for Zero Depreciation cover - get coverage on replaced parts with no deduction for depreciation

• Get cashless servicing at 3500+ network garages across India

• Quick issuance of digitally signed policy online

• No paperwork

General Terms and Conditions Apply1

IMPORTANT INFORMATION: The descriptions of the insurance related benefits available on your Platinum Card are for information purposes. All the provisions of the coverage are contained in the Certificates of Insurance. All insurance coverage is subject to the terms and conditions of the respective master policies.

- The benefits and offers are being brought to you by American Express/ Partners of American Express/ third party entity exclusively for American Express Platinum Cardmembers on a “best effort basis”

- All the benefits and offers are subject to availability and Cardmembers must exercise due diligence in understanding specific terms and associated charges/fees that may be applicable to such benefits

- The benefits can be used only in conjunction with the American Express Platinum Card and cannot be combined with any other promotion or offer and any participation/availment of the benefits by American Express Platinum Cardmember shall be purely voluntary

- American Express is neither responsible nor guarantees the quality of the goods/services and nor is it liable for any defect or deficiency of goods or services so obtained/availed by Cardmember as a benefit/privilege associated with the American Express Platinum Card American Express and the partners reserve the right to change/withdraw the Terms and Conditions of any offer at any time without prior notice.

- These Terms and Conditions are to be read in conjunction with the Cardmember Terms and Conditions and Most Important Terms and Conditions governing the usage of the Platinum Card and may be deemed as the Terms and Conditions governing the American Express Platinum Cardmembership.

2. Purchase Protection Terms and Conditions

The Company/Partner of American Express providing the Purchase Protection will not make any payment in respect of: Loss or damage to gold or silver articles, watches or jewellery or precious stones or medals or coins or curios, sculptures, manuscripts, rare books, plans, models, moulds. In the following events, this Policy shall cease to be in force and no claim shall be admissible, unless in every event, the consent of the Company to the continuance of the Policy is obtained in writing and signified on the Policy, or the Company has been duly informed and has acknowledged continuance of the Policy. (i) If the premises shall have been left uninhabited by day and night for ten or more consecutive days and nights, any burglary occurs during the period that the premises are left uninhabited. (ii) If the Insured shall cause or suffer any material alteration to be made in the premises or anything to be done whereby the risk is increased. (iii) If the interest of the Insured in any property passes from the Insured otherwise than by will or operation of law. (iv) The cover under this Section shall be available only up to 90 (ninety) days from the date of purchase of the tangible goods by the Insured. Get a cover value of up to INR 5 Lacs.

3. Overseas Medical Insurance Terms and Conditions

Maximum of one claim can be filed in a year • Please note that your claims will be settled once you are back in India • Limit of 7 days per trip • Maximum 5 trips in a year • Hospitalisation should be for a minimum of 24 hours • Pre existing injuries/illness excluded • Maximum age 60 years deductible of US$ 100 per claim • ‘*Only hospitalisation cover’.• Insurance underwritten by ICICI Lombard General Insurance Company Ltd. and is a subject matter of solicitation.

American Express Platinum Card is only the mode of payment for this service. American Express does not take responsibility for the quality of service provided by the partner and is not liable for any direct, indirect, incidental, special, punitive, exemplary or consequential damages of any kind.

Get exclusive invitations to VIP-only events and unforgettable experiences.

Enjoy access to pre-sale tickets and secure some of the best seats in the house for world famous events like Concerts, Fashion Weeks, Grammy Awards, Wimbledon, Formula 1 Races and so much more.

Immerse yourself in experiences that expand your world-view and give you a vibrant social calendar.

To know more, please call your Platinum Concierge.

Important Update: Due to recent health and safety precautions stemming from the COVID-19 outbreak in the region, all Cardmember events have been put on hold till further notice. We apologize for any inconvenience this may cause.

Dining Experiences

Savour the finest spreads at some of the most celebrated restaurants in Delhi/NCR, Mumbai, Bengaluru, Chennai, Kolkata and other cities. Every meal turns special with exclusive discounts.

Continuing the surprise is the privilege of a guest dining complimentary when you celebrate in company.

To enjoy the benefit at these restaurants, please make the booking through Platinum Concierge Services.

EazyDiner Prime Membership

Get on a gastronmical discovery with a powerpacked dining programme from EazyDiner complimentary for our Platinum Cardmembers.

Guaranteed 25-50%* off at over 2,000+ premium restaurants in India, 2X* Eazy Points on dining , and a dedicated 24X7 VIP concierge.

* Terms and Conditions apply. Click on 'Know More' for details.

Premium Golf Access

Tee-off at over 30+ golf courses in India and 50+ international golf courses worldwide or take lessons from the professionals with our compliments that give you the edge.

Whether you are looking at simply enhancing your golfing skills or trying this sport for the first time, you and your Supplementary Card holders can enjoy this privilege anywhere in the country.

Your Cardmembership makes it easy for you to book your next trip to the greens with an online portal. Share your details to help us create your profile and start booking. You will receive your login credentials via email. Once your profile is ready, you can log in to your account anytime you want to make a golf booking.

If you have registered already, you can begin to make bookings using the Amex Experiences App. You can also view the status of your bookings or cancel a booking via the App.

Drive home stunning new wheels as you enjoy special offers on select models with your Metal.

₹1,00,000* off on Audi Q8 e-tron.

₹50,000* off on Audi A4.

Offer valid until 31 March 2024.

Stay at Sofitel Dubai Jumeirah Beach, a jewel of French sophistication overlooking the Arabian Gulf. This luxurious hotel blends art de vivre with Dubai's vibrant culture and invites you to indulge in lavish rooms, culinary delights, and exemplary amenities for a truly memorable experience.

Enjoy 25%* off on Best Available Rate with Metal.

Offer valid until 17 January 2025.

For more details, please reach out to Platinum Travel & Lifestyle Services.

Immerse yourself in an extraordinary dining experience and savour a menu of artfully crafted Indian flavours with a modern twist at Comorin, Gurugram.

Enjoy a complimentary* welcome drink and a delightful dessert when you dine-in.

Offer valid until 31 December 2024.

For reservations or to know more, please call Platinum Concierge Services.

Step into Hosa, a gastronomic haven nestled in Goa offering an exquisite menu that artfully combines traditional South Indian flavours with a contemporary twist.

Enjoy a complimentary* welcome drink and a delightful dessert when you dine-in.

Offer valid until 31 December 2024.

For reservations or to know more, please call Platinum Concierge Services.

Discover a sanctuary of serenity at Roseate Hotels & Resorts in India as you enjoy special offers on tranquil stays and signature dining experiences with your Metal.

The Roseate, New Delhi

- 25%* off on Best Available Rate.

- 25%* off on food and beverages at Kiyan and Chi Ni

Roseate House, New Delhi

- 25%* off on Best Available Rate.

- 25%* off on food and beverages at Del, Kheer and Roasted by Roseate.

The Roseate Ganges, Rishikesh

- 25%* off on Best Available Rate.

- 25%* off on food and beverages at Chidiya Ghar.

Offer valid until 12 November 2024.

For queries or to make reservations, please reach out to Platinum Concierge Services.

Explore the path to your wellness crafted with profound care and expertise at Medanta with 15%* off on Executive Health Checkup Packages at participating hospitals

with your Metal.

Offer valid until 30 November 2024

0% for HPCL transaction less than INR 5,000,1% fee per transaction is applicable for all HPCL transactions on and above INR 5,000, 1% of the transaction value subject to a minimum of INR 10 + applicable taxes, will be charged as convenience fee at fuel stations operated by the Public Sector Oil Marketing Companies BPCL and IOCL, 2.5% of the transaction value subject to a minimum of INR 10 + applicable taxes, will be charged as convenience fee at fuel stations of all other Oil Marketing Companies (except HPCL, BPCL and IOCL)

Bespoke hospitality and lifestyle experiences reserved for you at Home Delhi, with your Metal.

Get 40%* off on annual membership fee of ₹60,000 + GST.

Enjoy special benefits with your membership like:

- 20%* off on Food and Beverages

- F&B vouchers worth INR 12,000*

- Up to 7 complimentary movie tickets*

- Up to 9 buy 1 get 1 complimentary movie ticket*

- Private party complimentary vouchers* and lots more.

A special getaway experience nestled in luxury awaits you at The Lalit with your American Express® Card.

STAY

1. 20%* off on Best Available Rates across The Lalit properties.

2. 25%* off on luxurious 3 & 4 BHK Villas at The Lalit Golf Spa & Resort Goa.

3. 25%* off on Lalit Legacy Suite across The Lalit properties.

Avail this offer on bookings made through The Lalit website.

DINING

20%* off on Food and Beverages across all The Lalit properties.

SPA

20%* off on all services at Rejuve- The Spa across all The Lalit properties.

For Dining and Spa bookings, Use Promo Code: AMEX20

Offer valid until 31 March 2024.

Click Here, for Terms & Conditions

Unravel international escapes with Metal at Oberoi Hotels & Resorts.

Explore special benefits curated for you at The Oberoi Beach Resort:

UAE, Egypt & Morocco

Third night complimentary* on 2 paid nights across applicable room and suite categories.

OR

20%* off on Best Available Rates, 15%* off on villas, in-villa breakfast and much more.

Mauritius

2 complimentary* nights on 5 paid nights with a floating breakfast experience.

OR

15%* off on villas with a floating breakfast experience, complimentary activities like water sports and more.

Bali and Lombok

20%* off on Best Available Rates of rooms, 15%* off on villas with breakfast and more.

OR

1 complimentary* night on 4 paid nights and other amenities.

For reservations or further queries, please reach out to Platinum Concierge Services.

Offer valid until 31 March 2025.

Experience a unique blend of nature's power and scientific brilliance at Potenza, a boutique wellness clinic backed by experts.

Discover a wide range of transformative treatments with complimentary wellness and beauty services worth ₹62,000* with your Metal that includes:

- 10 complimentary consultations at participating locations.

- 24 hours advance priority booking.

- Complimentary* Photobiomodulation treatment.

- 15%* off on all treatments.

- 1 complimentary* Body Balancer treatment.

- 50%* off on 5 sessions of Hyperbaric Oxygen Therapy.

- 1 complimentary* Collagen Bed treatment at Gurugram.

- 1 session of Superhuman Protocol (PEMF treatment, Photobiomodulation and 20 minutes on the Oxygen Bike).

To avail the offer, please contact Platinum Travel & Lifestyle Services.

Offer valid until 24 August 2024.

Shop at Aza Fashions, a multi-designer destination that offers a wide selection of Indian designer wear with your Metal.

Online:

Get 25%* off, up to ₹8,000 on eligible products. Minimum purchase value: ₹30,000.

In-Stores:

Get a Gift Voucher worth ₹4,000 on minimum purchase of ₹40,000. Only applicable on apparel.

Offer valid until 29 August 2024.

Immerse yourself in the world of exquisite fabrics, impeccable fit, and sensuous embellishments, all meticulously tailored at Tarun Tahiliani.

As a Platinum Cardmember:

- Enjoy 10%* off on all pieces from Pret Collection.

- Priority appointment with a senior stylist.

Offer valid until 31 December 2024 at all Tarun Tahiliani standalone stores.

Get Instant Discount of INR 2,500 on Minimum Transaction of worth INR 2,500 and above (Including purchase of membership).

Offer valid from 25th September 2023 until 10th May 2024 (both days included).

Discover beautiful ensembles from traditional Indian attires to modern separates by the couturier of flowers - Varun Bahl.

As a Platinum Cardmember, you enjoy 10%* off, up to ₹50,000 across new collections.

Use Promo Code: AMEXPL10

Offer applicable on shopping online or in-stores.

Offer valid until 31 December 2024.

*Click Here, for Terms & Conditions

Explore playful and experimental ensembles from the celebrated Indian designer label, House of Masaba, with your Metal.

Enjoy 15%* off, up to ₹10,000 on new collections, when shopping online or in-store.

Use Promo Code: MASABAXAMEX-PLA15-KV#DN

Offer is valid until 10 June 2024.

Click Here, To know more.

Embark on a culinary journey at Indian Accent with inventive Indian curated by Culinary Director, Chef Manish Mehrotra and headed by Chef Rijul Gulati and Executive Chef Shantanu Mehrotra in Mumbai and New Delhi.

Indulge with your friends and family with a special privilige:

Enjoy a complimentary bottle of wine* on reservations made through Platinum Concierge Services.

Offer valid until 31 December 2024.

Your metal brings you an escape from ordinary with offers on membership, and spa services at the ITC Hotels. You enjoy these benefits as a Club ITC member. In case you are not a member, "Enroll now" at no additional cost.

Offer 1 - ITC One

Buy two nights at ITC One or standard suite category and get the third night complimentary at participating ITC Hotels and WelcomHotels.

Offer 2 - ITC CLUB PRIVÉ

A) American Express Platinum Cardmembers can avail the ITC Club Prive Gold Membership Program of 5 years for 7 years.

B) American Express Platinum Cardmembers can avail the ITC Club Prive Silver membership/ Local Individual Membership Program of 12 months for 18 months.

Offer A and B are valid till 30 April 2024.

C) 3-Month complimentary membership to Club Prive with 15% off on meeting rooms, food, beverages and more.

Offer C is valid till 31 March 2024.

Offer 3 - KAYA KALP SPA

Indulge for 30 more minutes* when you book any spa treatment for 60 or 90 minutes.

Eligible Cards: American Express Platinum Card only.

Offer Period:

Offer - 1 & 4 are valid till 30 April 2024.

Click Here, to know more.

Indulge in the finest experiences at lebua Hotels and Resorts. Enjoy exclusive offers on luxurious stays, culinary journeys at celebrated restaurants and more with your metal.

lebua Bangkok, Tower Club

- Third night at a special price of THB 5,000* with complimentary benefits like Tower Club Lounge access and upgrade to Tower Club River View Suite.

- Complimentary* glass of champagne at Chef’s Table and Mezzaluna when you order The Chef’s Tasting Menu.

Offer valid until 30 April 2024.

Click Here, To Know More

Your Metal brings you experiential escapes with a special offer at Taj amã Stays & Trails by Indian Hotels Company Limited.

Uncover a collection of handpicked private and fully serviced luxury villas, from charming residences to mesmerizing forest trails as you plan your next serene getaway.

Enjoy 20%* savings on the 4D rate (best available rate) at ama Stays & Trails.

To avail the offer kindly contact Taj Ama reservations team at book@amastaysandtrails.com I 080 - 23570761.

Blackout dates will apply.

This offer is valid until 31 December 2024.

Click Here, To Know More.

Find your nest of luxury on your next vacation with Lohono Stays, handpicked holiday homes in Goa, Jim Corbett, Srinagar and many more with your Metal.

Book 2 nights stay and enjoy special benefits:

- 20%* off on villas.

- Enjoy any one exclusive experience* like floating breakfast, barbecue, candlelight dinner setup and more during your stay.

- Complimentary bottle of wine or a gift hamper.

- 10%* off on Food and Soft Beverage (In-villa menu).

Use Promocode: LOHONOPLATINUM20

By clicking on book now you will be redirected to a 3rd party website.

Offer is valid until 27 May 2024.

Experience the ultimate paradise in Gulmarg with your Metal at The Khyber Himalayan Resort & Spa.

Plan a mesmerising holiday as you enjoy exclusive offers on stays, dining experiences and therapeutic spas:

20%* off on Food and Beverages.

10%* off on Best Available Rates.

10%* off on wellness experiences at The Khyber Spa by L'Occitane.

10%* off on transfers from Airport to The Khyber. *Subject to availability*.

To avail the offer cardmembers are advised to contact Platinum travel and lifestyle services.

Offers are valid until 28th May 2024. T&Cs apply.*

Nurture your family's health as your Metal brings you special benefits on healthcare services at Max Healthcare.

Get specialized rates on Gold and Titanium preventive health check packages.

Offer valid until 30 June 2024.

Click Here, for Terms and Conditions.

Earn 5X Membership Rewards® points on every purchase through Reward Multiplier.

A fabulous new destination to earn rewards when you shop across an array of brands.

Click Here, to explore more

Offer valid until 30 June 2024, at participating merchants.

Shop Now.

For Terms & Conditions, Click Here

Your American Express®️ Platinum Card brings you exclusive dining experiences for you to savor from the comfort of your home.

Now get up to 25%* off on food delivery from your favorite restaurants like The Lodhi and Qmin.

To check offer validities for restaurants please check full terms and conditions.

Click Here, for Terms & Conditions

Get 20%* off on minimum transaction of INR 7,000 per visit.

Offer is applicable only at The Spa at Four Seasons, 1, 136, DR. E Moses Marg, Gandhi Nagar, Upper Worli, Worli, Mumbai, Maharashtra 400018

Offer valid 15th June 2023 to 31st May 2024 (both days included)

Enjoy 25%* savings on Suites and more at select Taj Hotels, Palaces, Resorts and Safaris. Also enjoy special benefits on the Offer like:

- Complimentary airport transfer on arrival

- Complimentary daily breakfast for 2 guests

- Complimentary welcome drink on arrival

- Complimentary bottle of house wine

- One specially curated meal experience for 2 during the stay

- 20% discount on Spa and Salon services; Taj Club Benefits in hotels with Taj Club facilities

- Free wi-fi upto 4 devices

Offer applicable on stays from 1 June 2023 until 31 December 2024.

Go on rejuvenating vacations with Premium Getaways, our collection of luxury and wellness retreats in India with up to 25%* off on your Card.

Explore properties like Ananda, Raas, Coorg Wellness Resort, Kumarkom Lake Resort, Sujan and Aramness Gir.

To know more, kindly click here.

For offer details and validity, please refer to the detailed terms and conditions.

Your metal brings you elevated dining experience at your favourite restaurants.

Enjoy up to 50% off on your total bill at select restaurants

To know more, Click Here

Click Here, for terms & conditions

You don’t need a reason to indulge when there are so many exciting offers, cashbacks and rewards your Cardmembership brings you.From travel, dining and shopping, be spoilt for choice with offers in every category.