Contact us and FAQs

American Express is always here to help with your business needs, big or small.

Need to talk to us?

Live Chat

Click the 'Chat' button once you login to your account to chat with a member of our service team. You can also access non logged in chat to help with registration or login difficulty.

Call us

Have your ten digit Merchant number on hand to help us serve you efficiently. In order to protect your Account, we will ask you some security questions to verify your identity when you call.

1300 363 614

8:00am - 6:00pm Monday - Friday AEST/AEDT

General Queries

Please visit here to read the latest American Express Card Acceptance Terms and Conditions.

Yes. The Merchant Regulations set forth the operational policies and procedures governing your acceptance of the American Express® Card. Please make sure to visit the Merchant Regulations website regularly as they are revised in April and October and may be updated in separate unscheduled releases.

We offer a variety of Marketing support to help bring our Card Members to your door and most of them are at no cost for you. Visit the Amex Benefits page for more details.

As American Express has a partnership with JCB, you are able to accept JCB Cards as long as you are accepting American Express Cards. If you are experiencing issues accepting JCB Cards, please contact your terminal provider in the first instance.

American Express partners with third party vendors to sign up businesses to become American Express Merchants as well as support new Merchants to onboard smoothly. Click here for more details.

Your Account and Terminal

You can update most details through your Online Merchant Account.

You can also call us on 1300 363 614 (Monday-Friday 8.00am-6.00pm AEST/AEDT).

Please fill in our short enquiry form and click 'submit'. One of our team members will call you back. Alternatively, you can call us on 1300 363 614 (Monday-Friday 8.00am-6.00pm AEST/AEDT).

Call us on 1300 363 614 (Monday-Friday, 8.00am-6.00pm AEST/AEDT). Please have your Merchant Number, the Card number and the amount of the transaction ready with you. Your Merchant Number can be found in emails from us or on the monthly statements (including e-statements).

Please email us at noreplyterminalsetups@aexp.com including your Merchant Number and a photo of the terminal that's showing a fault message. Alternatively, you can call us on 1300 363 614 (Monday-Friday 8.00am-6.00pm AEST/AEDT).

You can also contact us via Live Chat (8:00am - 6:00pm, AEST/AEDT). This service is available once you log in to your Online Merchant Account. If you don't have an Online Merchant Account yet, you can register here by following a few steps. Please have your Merchant Number and your payee bank account details ready.

Payments and Processing

In most cases, you'll be paid the full value of your American Express transactions first. Then we debit your Account for any Merchant Service fees on approximately the 7th of each month or each Friday. Alternatively you can be paid the American Express transaction value less any Merchant Service Fee for each submission you make.

If you're not sure of your payment type, please contact our Merchant Services Team to find out more.

If you bank with Westpac, NAB, CBA or ANZ and submit your transactions by the submission cut off times you may be eligible to receive your money in your account early the next business day. Please note that certain industries are not eligible for next day pay. Call our Merchant Services Team to confirm if you qualify for Next Day Pay.

If you submit transactions to American Express, we'll deduct what you owe us from the next payment(s) we make to your business. If those payments are not sufficient to clear the outstanding amount, we will debit your bank account.

View our Card Acceptance Terms and Conditions for full details.

You can view transaction details by logging in to your Online Merchant Account. We also have an API solution that provides summary data at submission and transaction level. Please reach out to your Client Manager for more details or contact us on 1300 363 614 (Monday to Friday, 8:00am - 6:00pm AEST/AEDT).

You can easily switch to online statements by registering for an Online Merchant Account. Please have your Merchant Number and your payee bank account details ready to verify your identity.

Chip & PIN and Contactless

A contactless payment is where customers simply hover their card, smart watch or mobile device over the terminal to process their payment. It's not only a faster way to pay but also keeps the checkout process cleaner reducing exposure to health risks for both customers and employees. The current limit is AU$200 (as of November 2020).

Ensure your terminal supports Chip and Contactless transactions. Your terminal provider can assist you with this. Also check that the customer's Card has a Contactless symbol. When the transaction amount is shown on the Contactless terminal, hold the Card against the reader. The terminal will indicate it has read the chip and the transaction should be approved.

A Chip Card contains a small embedded microchip, which encrypts Card Members' Account information, making it difficult to duplicate, copy or access. This technology is more advanced than magnetic stripe technology, and it will make an already safe payment system even more secure.

Managing Your Account Online

You can register for an Online Merchant Account here by following a few steps. Please have your Merchant Number and your payee bank account details ready to verify your identity.

Online Merchant Account offers a variety of tools for Merchants such as viewing summary and details of payments, managing Card Member disputes, updating your Account details 24/7 and more. You can register here with a few steps.

It depends on your payment type. If it's net payment, you will no longer receive paper statements from the next period. However, you will continue to receive them if it's gross payment. Please contact your Client Manager or call us on 1300 363 614 (Monday to Friday, 8:00am - 6:00pm AEST/AEDT) if you are not certain of your payment type.

Yes. To view payment data for multiple locations, simply register with the Merchant Account number of your head office.

Disputes and Chargebacks

A dispute occurs when a Card Member contacts American Express to question a charge on their statement. You will receive dispute notifications by mail. If you are enrolled for the online disputes management service within your Online Merchant Account, you will receive the dispute notifications by email.

Please respond to us within 20 calendar days with sufficient documentations to support your response. If you are enrolled with the online disputes management service, you can do this online by simply uploading the documents.

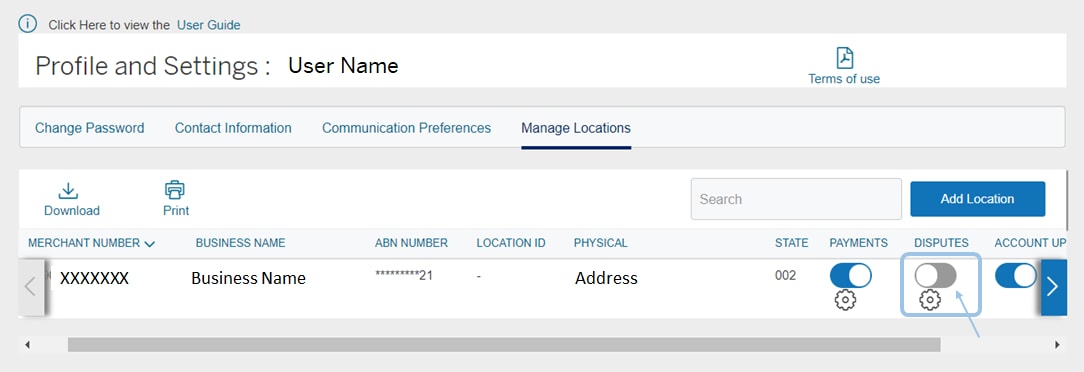

If you are already registered for Online Merchant Account but not enrolled for disputes management, please visit Manage Location tab on Profile page and click on the switch icon to activate online disputes management service.

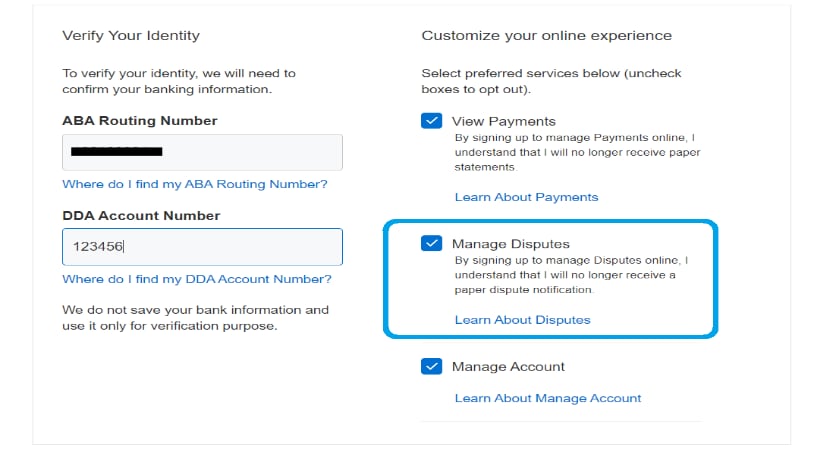

If not, register now with a few steps and make sure you have ticked the 'Manage Disputes' box to confirm the type of services you are registering for.

The supporting documents you will need to send vary by case type. Refer to the dispute letter sent to you, or the 'Supporting Documentation Required' field under the ‘Reason for a Dispute’ section in the disputes detail page if you are responding via your Online Merchant Account for the most acceptable examples.

Apple Pay

To accept Apple Pay in your store, you just need to have an American Express contactless-enabled terminal. Contact your terminal provider if you have any questions about your current capability of if you would like to set up contactless terminal capability.

No, there are no additional fees, just your one flat Merchant rate for all American Express transactions.

Yes, Apple Pay transactions will process like any other contactless American Express transaction you accept today. You will need to check with your terminal provider to determine if you can process Contactless transactions.

For Apple Pay Contactless payments (e.g. in-store), the transaction is treated as Card Present. For Apple Pay payments within apps (those that come directly through the participating Merchant's mobile app), the transaction is treated as Card Not Present but you will not be liable for any fraud that may occur.

Security and privacy are at the core of American Express and Apple Pay. When Card Members add a credit or debit card to Apple Pay, the actual Card numbers are not stored on the device or on Apple servers. Instead, a unique Device Account Number is assigned, encrypted and securely stored in the Secure Element on your device. Each transaction is authorised with a one-time unique dynamic security key, instead of using the security code from the back of the Card. And on iPhone and iPad every payment requires Face/Touch ID or a passcode, and Apple Watch must be unlocked — so only the Card Member can make payments from their device.

Other Topics

We offer a suite of tools to help Merchants mitigate fraud risk. Please visit Fraud Protection page where we share tips to avoid fraud and introduce the tools we offer.

It's an American Express policy with which all Merchants, Processors, and Service Providers that store, process or transmit American Express Card Member information must comply. It aligns with the Payment Card Industry Data Security Standard (PCI Standard), which sets out a common set of technical requirements for safeguarding sensitive payment data. It applies to all entities, equipment, systems and networks that process, store or transmit Card Member information.

By accepting American Express Cards, you agree to be bound to Terms and Conditions of our Card Acceptance Agreement.

It applies to you even if you do not store any Card Member Information. To find out more about American Express Data Security, click here.

VAN is a unique 15-digit number that looks much the same as an American Express Card number. Digitally generated for each transaction, a VAN allows spend limits and restrictions to be applied, reducing the chance of someone misusing it. You can accept VAN payments, per your current American Express acceptance contract.

Talk to us

LIVE CHAT

You must be registered for an Online Merchant Account to use live chat.

CALL US

Have your ten digit Merchant number on hand to help us serve you efficiently

1300 363 614

8:00am - 6:00pm Monday - Friday

AEST/AEDT

ENQUIRE NOW

Fill out your details for a callback from our sales representative team.