Limited-Time Welcome Offer

Rewards worth up to HK$4,420

- New Cardmembers* only

(Offer ends on March 1, 2026)

The Explorer Credit Card makes every journey smoother and more rewarding. Enjoy airport lounge access, earn and convert miles effortlessly, and travel with extra protection. It’s the smart way to travel, from departure to return.

First-year annual fee waiver of HK$2,200

^When Applicants successfully apply via designated APITA UNY physical stores, online channels, promotional mailing, email, Cardmembers will receive a total of HK$100 APITA UNY Shopping Vouchers.

^When Applicants successfully apply via designated Citistore physical stores, online channels, promotional mailing, email, Cardmembers will receive a total of HK$100 Citistore Shopping Vouchers.

*Applicants are currently not holding, or have not cancelled or held basic Card product issued by American Express Hong Kong within the past 12 months from the date of this application

~Including the 3 points earned under the American Express Membership Rewards program.

#On the basis of HK$100 cash voucher can be redeemed by 30,000 Membership Rewards points and HK$10 Pay with Points can be redeemed by 3,000 Membership Rewards points.

Welcome Offer Terms and Conditions apply.

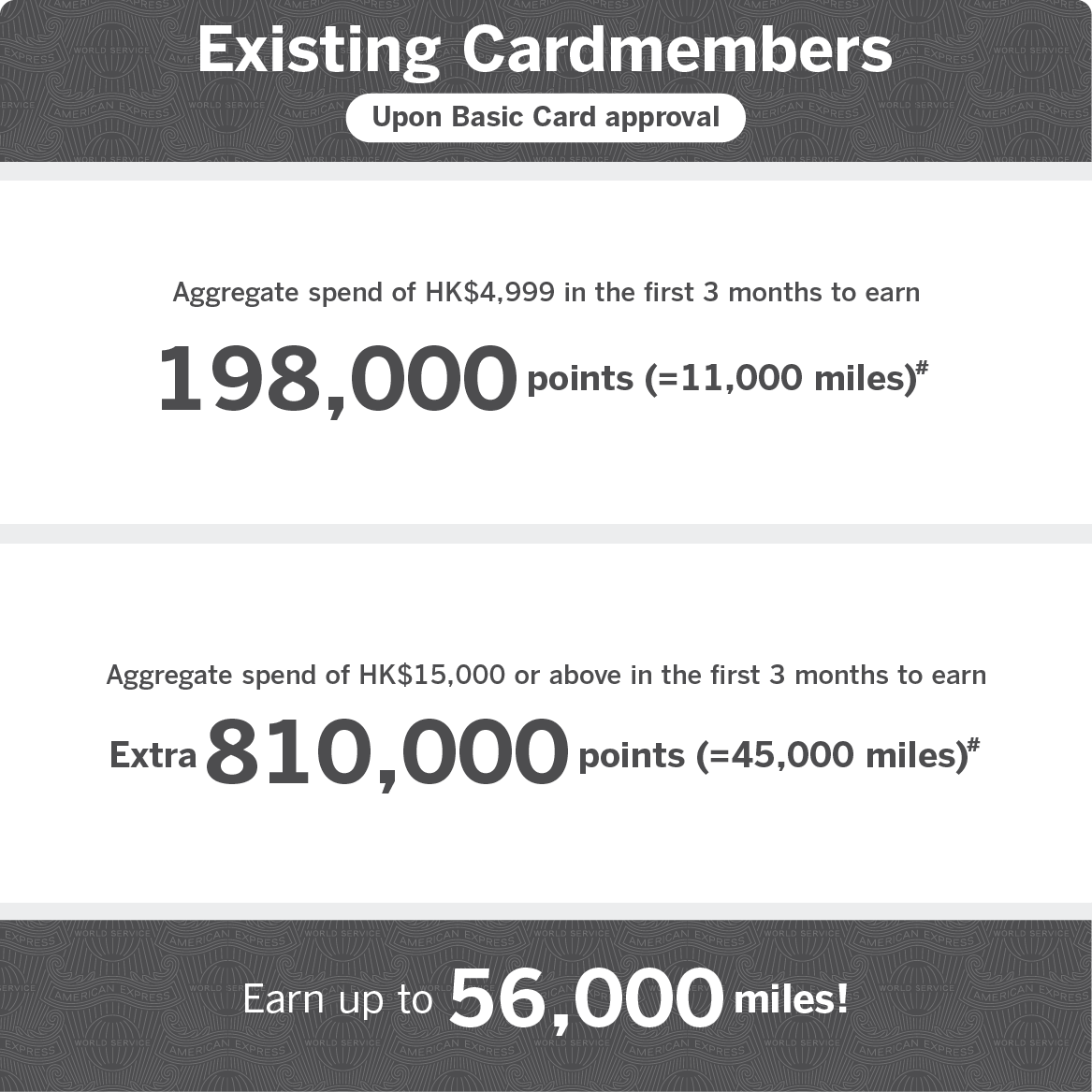

An existing Cardmember means you are:

- a Cardmember who are currently holding any approved Basic Credit Card or Charge Card issued by American Express Hong Kong within the past 12 months or

- an applicant who has held or cancelled any approved Basic Credit Card or Charge Card issued by American Express Hong Kong within the past 12 months.

Limited-Time Welcome Offer

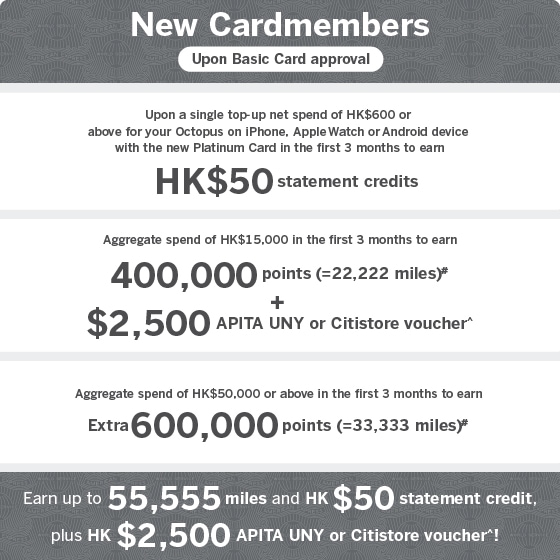

Worth up to HK$2,500 vouchers + 55,555 miles + HK$50 statement credit

- New Cardmembers* only

(Offer ends on March 1, 2026)

If you seek elite treatment at luxury hotels, unlimited lounge access, and exclusive dining experiences, The Platinum Card is made for you. Enjoy exceptional privileges, elevated service, and lasting value because every journey deserves the finest, and every benefit is worth more with Platinum.

Annual Fee: HK$9,500

^When Applicants successfully apply via designated APITA UNY physical stores, online channels, promotional mailing, email, Cardmembers will receive a Welcome Bonus and a total of HK$2,500 APITA UNY Shopping Vouchers.

^When Applicants successfully apply via designated Citistore physical stores, online channels, promotional mailing, email, Cardmembers will receive a Welcome Bonus and a total of HK$2,500 Citistore Shopping Vouchers.

*New Cardmembers refer to Basic Cardmembers who are NOT currently holding or who have NOT held or cancelled any approved Basic Credit Card or Charge Card issued by American Express Hong Kong within the past 12 months from the date of this application.

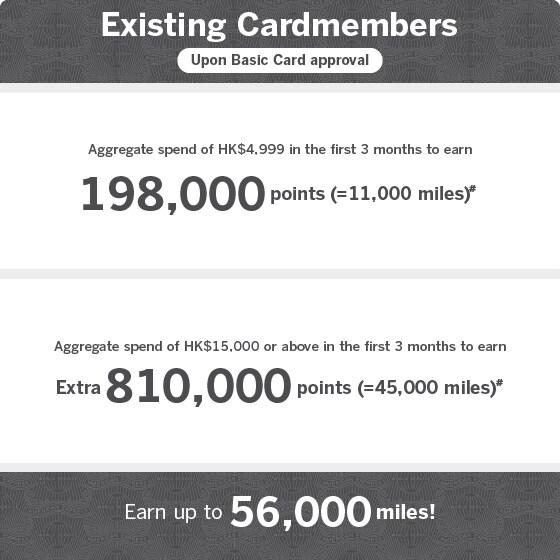

*Existing Cardmembers refer to Basic Cardmembers who are currently holding or who have held or cancelled any approved Basic Credit Card or Charge Card issued by American Express Hong Kong within the past 12 months from the date of this application.

Welcome Offer for new Cardmembers Terms and Conditions apply.

#The conversion rate is based on the January 2024 Asia Miles Standard Award Chart and is based on 1 airline mile = 18 Membership Rewards points.

Welcome Offer for existing Cardmembers Terms and Conditions apply.

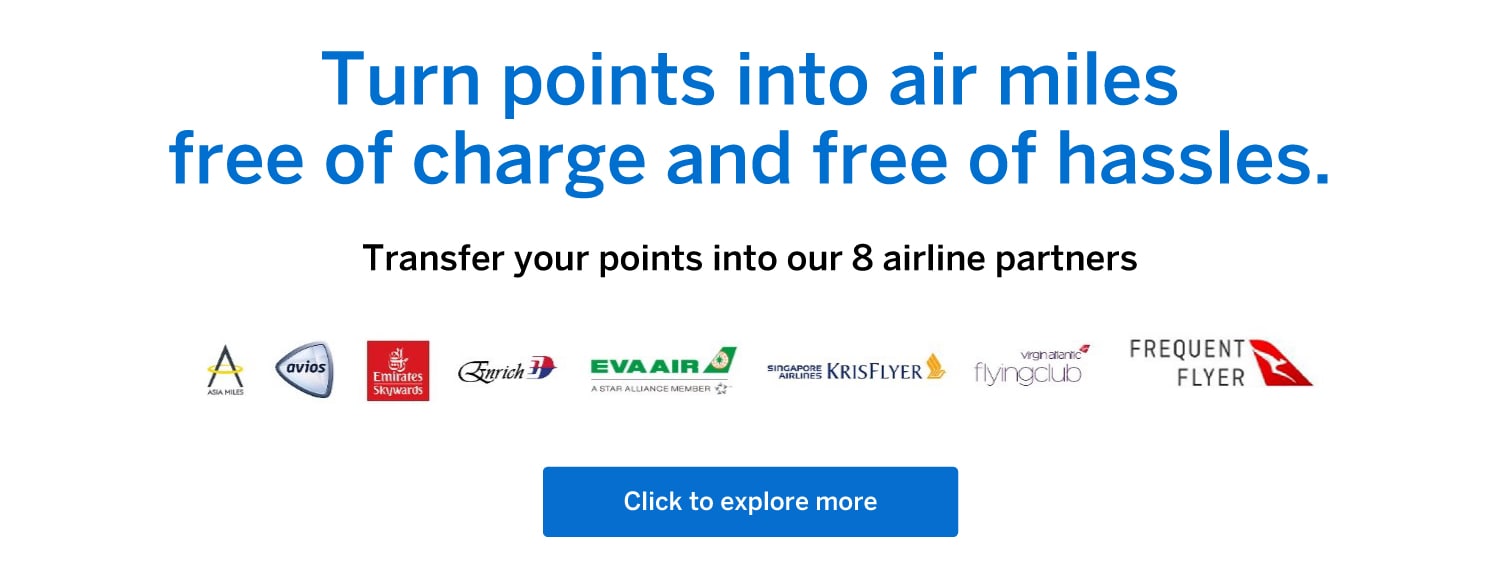

From daily rewards to travel, discover a Card that fits your needs.

Explorer Our Latest Benefits

An airport experience that turns wait times into good times

Start your journey at ease.

With effect from January 1, 2026, Basic and Supplementary Cardmember(s) of Explorer Credit Card can enjoy a total of up to 12 times complimentary lounge access or a complimentary meal set entitlement at designed airport dining outlets every calendar year, including the Intervals Bar located in Hong Kong International Airport1.

Terms and Conditions apply.

Treat yourself with our exclusive dining offers

Savor every moment with our seasonal and year-round dining offers.

Enjoy up to 25% savings upon purchase at designated restaurnats and enjoy complimentary canapés upon purchase of designated drinks at selected bars!

Stay tuned with our special offers to elevate your dining experience!

Blackout dates, Exclusions and Terms and Conditions apply.

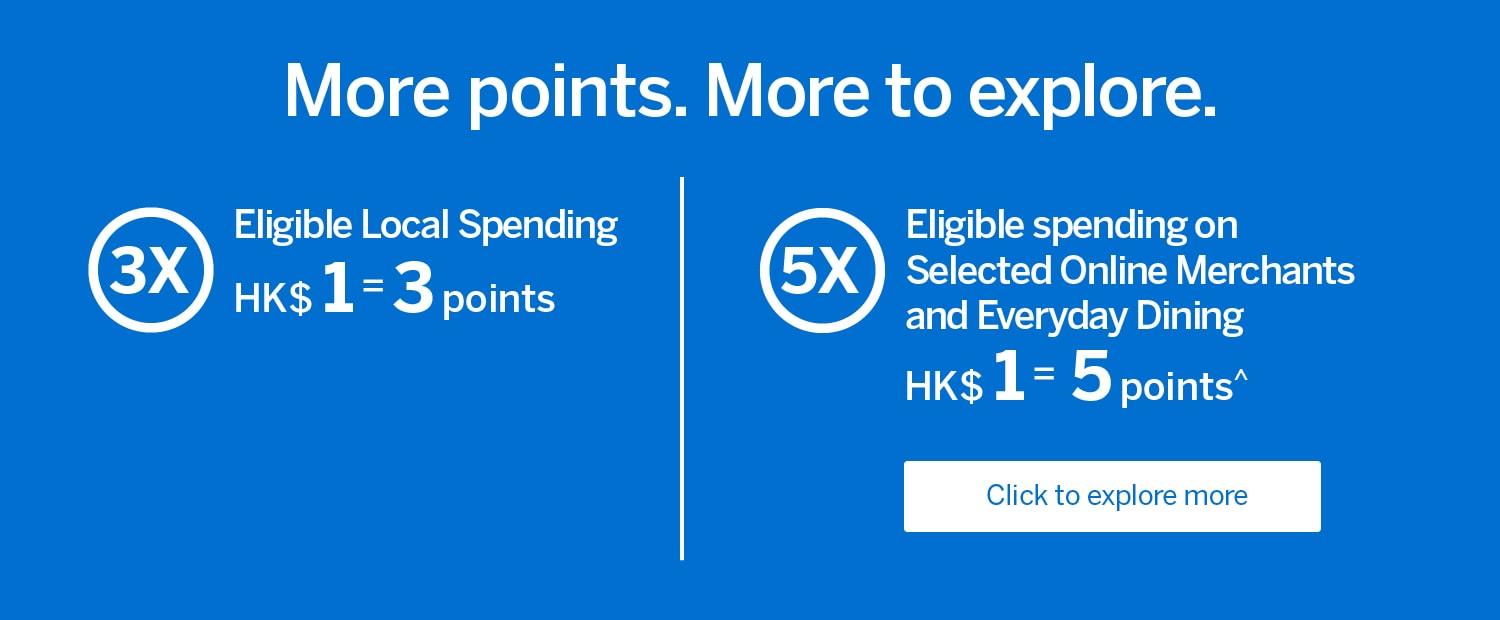

Enjoy 5X points^ at selected Online Merchants

Turn your online spending into even more bonus points.

Shop effortlessly and earn extra rewards with a wide range of selected online merchants across various categories.

American Express Insurance e.Marketplace is a platform for Cardmembers to purchase insurance products. Receive 5 Membership Rewards Points for every HK$1 eligible spending, applicable to payments for new and existing policies purchased on the platform using American Express Explorer Credit Card and made on or after December 1, 2022. Extra Membership Rewards points cap, Exclusions and Terms and Conditions apply.

Terms and Conditions apply.

More Benefits

CARD PRIVILEGES

- Amex Experiences - Explore a series of local and oversea curated events that come with Amex! Including Hong Kong Wine & Dine Festival, Coachella, Formula 1® and more. For more details, please visit here.

- Movie Privileges2 - 10% savings on 4DX, 3D, 2D and IMAX regular priced movie tickets at Broadway Circuit in Hong Kong.

- Pay with Points3 - Enjoy complete flexibility with Pay with Points by American Express, you can use your Membership Rewards points to offset nearly all purchases you make with your American Express Card - including dining, everyday spending, travel, entertainment and more. For more details, please visit here.

- Year-round Offers - Click here to find out more attractive year-round offers with the American Express Explorer Credit Card.

- Annual fee waiver - Your Basic Card Annual Membership fee of HK$2,200 will be waived and you can continue using the first two Supplementary Cards without paying any annual membership fee for the following year simply by spending HK$150,000 annually.

- Supplementary Cards - 2 complimentary Supplementary Cards.

PEACE OF MIND

- Complimentary Travel Insurance4

When you pay for your entire fare for an overseas trip with American Express Explorer Credit Card, you'll always have someone to rely on when you travel.- Travel Accident Insurance with coverage up to HK$3.5 million

- Travel Inconvenience Protection with coverage up to HK$10,000 per year

- Shopping Protection

You can spend on your American Express Explorer Credit Card with total peace of mind. We'll protect you against fraud, faulty goods and even if you change your mind, we've got you covered.- Online Fraud Protection Guarantee5

Shop online with your Card and you won't be held responsible for any fraudulent charge. - No Worries Guarantee Program4

- Return Guarantee Protection Plan

- 45 Days Cover

- Extended Warranty Protection

- Price Protection Plan

- Online Fraud Protection Guarantee5

- World Class Service

Whatever you need, whenever the time, wherever you are, our world-class service stands by just for you. Call 2277 2005 and you'll have access to:- Manage your account online and get 24-hour secure access to monitor all your charges and payments

Eligibility

You qualify for this Card if:

- You are 18 years or older

- You have a minimum income of HK$300,000 p.a.

- You are a Hong Kong or Macau resident/citizen

How to apply

Click here to download the PDF on how to apply.

Welcome Offer Terms and Conditions apply.

Card Benefits Terms and Conditions apply.

Membership Rewards Program Terms and Conditions apply.

*Complimentary lounge access or a complimentary meal set entitlement at designed airport dining outlets: with effect from January 1, 2026, Basic Cardmembers and each Supplementary Cardmember can enjoy the Offer for 3 times and 1 time complimentary access respectively for each calendar year. After a cumulative net spending of HK$30,000 or more on the Cardmember’s account from eligible transactions within each calendar year, Basic Cardmembers and each Supplementary Cardmember can enjoy the Offer for additional 5 times and 1 time respectively, that is in total up to 8 times and 2 times complimentary access respectively. Based on the calculation of each Explorer Cardmember’s account can have a maximum of 2 complimentary Supplementary Cards, hence every Cardmember’s account can enjoy a total of up to 12 times complimentary accesses in each calendar year. For the avoidance of doubt, the accumulation of spending in each Cardmember’s account shall also include the spending of the Supplementary Cards.

American Express incurred fees (including, but not limited to Annual Fees, Foreign Currency Conversion fees and charges, cash advances, balance transfers), un-posted/cancelled/refunded transactions, and transactions that are found to be fraudulent or are eventually cancelled/refunded will not be considered as eligible purchases. Terms and Conditions apply, click here for more details.

^5X points at Selected Online Merchants: From January 2, 2026 to December 31, 2026, Eligible Cardmembers must successfully enroll with their Eligible Card. 5X including the 3 American Express Membership Rewards points earned under local spend and the additional 2 American Express Membership Rewards points earned under Selected Online Merchant Bonusing. The additional 2 American Express Membership Rewards points for every HK$1 spending incurred from 5X Offer are capped at extra 90,000 Membership Rewards points in total per Eligible Card Account for each calendar quarter. Terms and Conditions apply, click here for more details.

- Complimentary lounge access or a complimentary meal set entitlement at designed airport dining outlets: with effect from January 1, 2026, Basic Cardmembers and each Supplementary Cardmember can enjoy the Offer for 3 times and 1 time complimentary access respectively for each calendar year. After a cumulative net spending of HK$30,000 or more on the Cardmember’s account from eligible transactions within each calendar year, Basic Cardmembers and each Supplementary Cardmember can enjoy the Offer for additional 5 times and 1 time respectively, that is in total up to 8 times and 2 times complimentary access respectively. Based on the calculation of each Explorer Cardmember’s account can have a maximum of 2 complimentary Supplementary Cards, hence every Cardmember’s account can enjoy a total of up to 12 times complimentary accesses in each calendar year. For the avoidance of doubt, the accumulation of spending in each Cardmember’s account shall also include the spending of the Supplementary Cards. American Express incurred fees (including, but not limited to Annual Fees, Foreign Currency Conversion fees and charges, cash advances, balance transfers), un-posted/cancelled/refunded transactions, and transactions that are found to be fraudulent or are eventually cancelled/refunded will not be considered as eligible purchases. Terms and Conditions apply, click here for more details.

- Movie privileges Terms and Conditions apply.

- Cover it with Points Terms and Conditions, Shop with Points Terms and Conditions, Travel with Points Terms and Conditions and American Express Membership Rewards Program Terms and Conditions apply.

- Complimentary Travel Insurance and No Worries Guarantee Program (collectively "Plans") are underwritten by Chubb Insurance Hong Kong Limited ("Chubb"), Chubb is authorized and regulated by the Insurance Authority of the Hong Kong SAR and is solely responsible for all coverage and compensation under the Plans. American Express International, Inc. ("we/ us") does not act as an agent or fiduciary for you, and we may act on behalf of the insurance provider, as permitted by law. The Plans are subject to relevant Travel Insurance Terms and Conditions and No Worries Guarantee Program Terms and Conditions.

- Online Fraud Protection Guarantee Terms and Conditions apply. Provided that you notify us immediately upon discovery of any fraudulent transactions on your statement and you have complied with the Card conditions. "Immediately" means on or before the due date of the statement in which the fraudulent transaction appears.

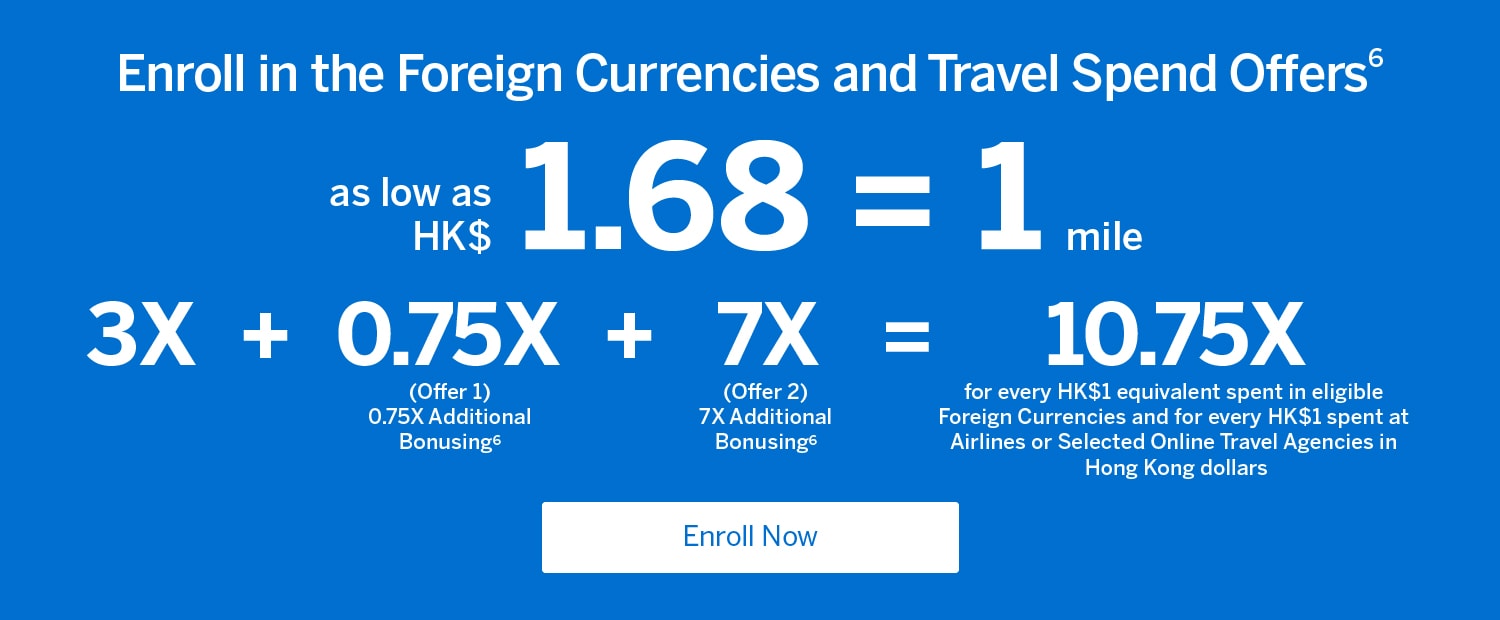

- Upon successful enrollment in and fulfillment of the below Foreign Currencies and Travel Spend Offer, Cardmembers may earn up to 10.75 American Express Membership Rewards points for every HK$1 equivalent spent on eligible foreign currencies transactions, and for every HK$1 spent at Airlines or Selected Online Travel Agencies in Hong Kong dollars.

- "3X on Local and Foreign Currencies Spend" : Eligible Cardmembers will accrue 3 American Express Membership Rewards points for (i) every eligible HK$1 equivalent billed to the Eligible Card in foreign currencies; (ii) every eligible HK$1 equivalent spent in Airlines and Selected Online Travel Agencies billed to the Eligible Card in Hong Kong dollars. Enrollment is not required.

- "0.75X Additional Bonusing (Offer 1)" : During the Foreign Currencies and Travel Spend Offer Promotion Period (as defined below) and after successfully completing the enrollment to Offer 1, the Enrolled Cardmembers (as defined below) will start earning an additional 0.75 American Express Membership Rewards points for (i) every HK$1 equivalent spent in foreign currencies from Eligible Transactions (as defined below); and (ii) every eligible HK$1 spent on eligible airfare transactions for scheduled flights made directly with a passenger airline merchant ("Airline Bonusing") or at Selected Online Travel Agencies ("Selected Online Travel Agencies Bonusing") in Hong Kong dollars.

- "7X Additional Bonusing (Offer 2)": During the Foreign Currencies and Travel Spend Offer Promotion Period (as defined below) and after successfully completing the enrollment to Offer 2, the Enrolled Cardmembers (as defined below) will start earning an additional 7 American Express Membership Rewards points for (i) every HK$1 equivalent spent in the first HK$10,000 (or equivalent) in foreign currencies from Eligible Transactions (as defined below); and (ii) Every eligible HK$1 spent in the first HK$10,000 on eligible airfare transactions for scheduled flights made directly with a passenger airline merchant ("Airline Bonusing") or at Selected Online Travel Agencies ("Selected Online Travel Agencies Bonusing") in Hong Kong dollars billed to the Eligible Card during each calendar quarter (i.e. January 2 - June 30, 2026).

Above Offer 1 and Offer 2 are collectively "Foreign Currencies and Travel Spend Offer", which are valid from January 2 to June 30, 2026, both dates inclusive ("Foreign Currencies and Travel Spend Offer Promotion Period"). - This program is applicable to Cardmembers of American Express Explorer Credit Card issued by American Express International, Inc. ("American Express") in Hong Kong ("Eligible Card" such holder, "Eligible Cardmember").

Eligible Cardmembers must successfully enroll in the Foreign Currencies and Travel Spend Offer with the Eligible Card during the Foreign Currencies and Travel Spend Offer Promotion Period ("Enrolled Cardmembers"), then spend in foreign currencies, airlines under Airline Bonusing or Selected Online Travel Agencies with the Eligible Card to enjoy the Foreign Currencies and Travel Spend Offer ("Eligible Transaction"), which shall be subject to any exclusions outlined in the American Express Membership Rewards Terms and Conditions or herein. For the avoidance of doubt, any spending/transaction that occurs prior to the successful enrollment is not counted as qualified/eligible transactions under the Foreign Currencies and Travel Spend Offer.

Foreign currency means any currency other than Hong Kong dollars. If a transaction is converted into Hong Kong dollars prior to being submitted to American Express International, Inc., foreign currency spend earn rate will not be applied on that spend. Payments for online transactions made in Hong Kong Dollars will also not be considered foreign currency spend. Foreign currency spend excludes charges and other fees. A Currency Conversion Fee applies when payment is charged in a currency other than Hong Kong dollars. For more information regarding charges made in foreign currencies, please refer to the relevant Cardmember Agreement.

For Airline Bonusing and Selected Online Travel Agencies Bonusing, exclusion and Terms & Conditions apply. Please refer to Membership Rewards Program Terms and Conditions for details.

Unlock Platinum privileges

All year round, The Platinum Card brings you travel and lifestyle benefits that add real value to every occasion.

NEW! "Two-For-One” Dining Experience8

Enjoy buy-one-get-one special dinner menus at designated Michelin-starred and fine dining restaurants in town.

Selected top Michelin-starred restaurants:

Selected customer favourites:

Access 1,550 Airport Lounges in 140+ countries

HK$1,100

Travel Credit

As a Basic Platinum Card Member, you are eligible for an annual statement credit of up to HK$1,100 for pre-paid hotel and car rental bookings made through Amex Travel Online.

HK$2,000

Global Dining Credit

- Up to HK$1,000 statement credit for local dining annually

- Up to HK$1,000 statement credit for overseas dining annually

- Over 1,400 restaurants at 20 locations around the world

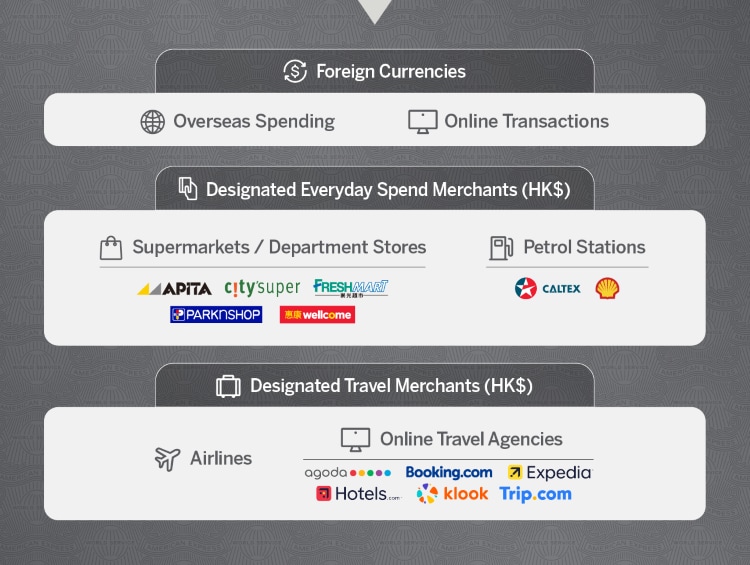

NEW Spend Program to earn as low as HK$2 = 1 Mile

From January 1 to June 30, 2026, enroll your Platinum Card to enjoy as low as HK$2 = 1 Mile7 when you spend in foreign currencies, airlines, and at designated travel & everyday spend merchants.

Card benefits at a glance

US$100 Credit

Enjoy a complimentary credit valued at $100 to use towards eligible charges, such as food and beverage, spa, or other on-property charges during your stay1

Daily Breakfast

Enjoy daily breakfast for two people

Room Upgrade

Receive a room upgrade upon arrival, when available2

260 points : HK$1

Enjoy a special conversion rate at 260 points : HK$1 when booking Fine Hotel & Resorts with the Amex Travel Online platform.

Early Check-in & Late Check-out

Guaranteed 4pm late checkout and noon check-in when available

Complimentary 3rd/4th Night at selected hotels

Enjoy a complimentary 3rd/4th night at selected hotels. Please click here for details.

1Certain room categories are not eligible for upgrade.

2Eligible charges vary by property.

Fine Hotels + Resorts

Receive complimentary benefits with an average total value of HK$4,6801 when you book with Fine Hotels + Resorts through American Express Travel Online. With over 1,300 world-class properties worldwide for you to explore:

- Noon check-in when available and guaranteed 4pm late checkout

- Complimentary room upgrade upon arrival, when available2 , and daily breakfast for two people

- Additional special amenity at each property, such as a US$100 food and beverage credit or a spa for two people3

For details, please click here

The Hotel Collection

Platinum Card Members will receive access to the following at over 700 participating hotels and resorts when staying a minimum of two consecutive nights:

- US$100 hotel credit on hotel amenities such as dining, spa or other leisure facilities

- Room upgrade upon arrival, if available

For details, please click here

International Airline Program

A world of privileges opens before you. Travel individually or with your loved one and receive unparalleled savings on individual and companion fares when purchasing with your Platinum Card for a full fare First Class, Business Class or Premium Economy Class ticket of selected routes with our airline partners.

For details, please click here

Elite partner programs

We give you complimentary memberships to many of the world's leading hotels and car rental companies' loyalty programs.

- Hilton Honors – Gold status

- Marriott Bonvoy™ – Gold Elite Status

- Radisson Rewards – Premium status

- Avis – Avis President’s Club

- Hertz – Hertz Gold Plus Rewards®

3X overseas spending

Earn 3 Membership Rewards points for every HK$1 you spend with The Platinum Card while overseas or for online purchases if the transaction is in a foreign currency5.

Up to 40% savings Dining Offers

AMEX GOURMET CLUB - Prestige Dining Privileges

- Whether you’re looking to enjoy a leisurely meal after work or an impressive setting for someone special, you can find the perfect venue from our selection of dining partners and enjoy up to 40% off your total food bill, including designated Maxim’s restaurants, selected restaurants of Aqua Restaurant Group, Cafe Deco Group, JIA Group, S&S Hospitality and etc.

W Hong Kong Wellness

Go for a few laps at WET® Swimming Pool, break a sweat at FIT® Gym, or chill in the Luxury Heat & Water Facilities (valued at HK$1,100 per visit). A 10% discount is also available on spa and products.

- WET® Swimming Pool

Take a dip or take a sip at Hong Kong’s highest outdoor pool, perched on the 76th floor, complete with refreshing pool bar. - FIT® Gym

Melt the stress away on the 73rd floor where you can maximize your workout with the latest Technogym equipment. - Luxury Heat & Water Facilities

Replenish, rejuvenate, and relax with the vitality pool, aroma steam room, and dry sauna experiences on the 73rd floor.

For details, please click here

Hotel Year-Round Offers

Complement your new year celebrations with indulgent dining and spa treatments at Hong Kong’s most prestigious hotels.

Movie Privileges5

Buy-1-Get-1-Free offer on Fridays, and 20% savings on other days for 3D, 2D and IMAX regular priced movie tickets at Broadway Circuit in Hong Kong.

Complimentary travel insurance6

Your Platinum Card provides you and your family with global travel insurance while you are away from home, when you book and pay for the trip with The Platinum Card.

- Travel Accidents coverage of up to HK$3,000,000

- Medical Assistance and expense up to HK$1,000,000

- Canceling and cutting your trip short

- Lost, stolen and damaged baggage

- Delayed flights and missed departures

No worries guarantee6

- Return Guarantee – if you are unhappy with a purchase made with The Platinum Card in Hong Kong, bring the new item to us within 30 days of purchase and we will give you a refund.

- Extend Warranty – when you make a purchase with The Platinum Card, we will extend the original manufacturer's warranty of 1 to 3 years by up to 1 year.

- Price Protection – if within 14 days of purchase, you see an identical item for purchase at a lower original purchase price at another retail outlet in Hong Kong, we will refund you the difference.

Home assistance

- Electrical Assistance to fix failure of the main switch

- Plumbing Assistance for clogged water supplies or water draining system, or leaking water pipes (excluding taps)

- Locksmith Assistance if you accidentally lock yourself out from your residence

- Repair of air conditioning units in the event of failure (excluding freezing agent or leakage)

Roadside assistance

- Towing to your selected garage and full coverage for all expenses beyond first HK$750 (excluding parts and accessories)

- Arrange a taxi and reimburse fares for you

- Pay for you to return to collect your vehicle

Receive up to 55,555 miles + HK$2,500 vouchers + HK$50 statement credit for New Cardmembers

Eligibility

You qualify for this Card if:

- You are 18 years or older

- You are a Hong Kong or Macau resident / citizen

Terms and conditions apply for New Cardmembers Welcome Offer.

Terms and conditions apply for Existing Cardmembers Welcome Offer.

*New Cardmembers refer to Basic Cardmembers who are NOT currently holding or who have NOT held or cancelled any approved Basic Credit Card or Charge Card issued by American Express Hong Kong within the past 12 months from the date of this application. Existing Cardmembers refer to Basic Cardmembers who are currently holding or who have held or cancelled any approved Basic Credit Card or Charge Card issued by American Express Hong Kong within the past 12 months from the date of this application. American Express reserves the right to debit the original price of the Welcome Offer from ineligible Cardmembers’ accounts without prior notice.

- Average value based on Fine Hotels + Resorts bookings in 2021 for stays of two nights. Actual value will vary based on property, room rate, upgrade availability, and use of benefits.

- Certain room categories are not eligible for upgrade.

- All benefits mentioned vary by property.

- Foreign currency spend has to be settled in a foreign currency. Foreign currency means any currency other than Hong Kong Dollars. If a transaction is converted into Hong Kong Dollars prior to being submitted to American Express International, Inc. (for example, if the merchant gives you the option of converting the transaction to Hong Kong Dollars at point of sale), the foreign currency spend earn rate will not be applied on that spend. Payments for online transactions made in Hong Kong Dollars will also not be considered foreign currency spend. The following types of charges are not eligible for Membership Rewards points: charges processed and billed prior to the Enrollment Date, American Express Card annual fee, American Express Travelers Cheque purchases, American Express Gift Cheque or Travel Gift Certificate purchases, charges for dishonored cheques, finance charges-including Credit Card account finance charges, late payment and referral charges, tax refunds from overseas purchases, tax Bill payment and payment portion under 'Points + $' redemption items.

- Movie privileges blackout dates and Terms and Conditions apply.

- The plan is underwritten by Chubb Insurance Hong Kong Limited, American Express International, Inc. does not act as an agent or fiduciary for you, and American Express International, Inc. may act on behalf of the insurance provider, as permitted by law.

- From January 1 to June 30, 2026, after successfully completing the enrollment for the Accelerator Program, Cardmembers can get up to 9 Membership Rewards points for below categories during each calendar quarter (i.e. January 1 – March 31, 2026 or April 1 – June 30, 2026). Conversion rate accurate as of November 2025 and on the basis of 1 mile can be redeemed by 18 Membership Rewards Points. Terms and Conditions apply and for enrollment details, please visit go.amex/cbb9C7.

- (i) Eligible Cardmembers who spend with the enrolled Eligible Card, can earn 3 points from Membership Rewards Basic Program; 1 point from Turbo program and additional 5 points for every HK$1 equivalent spent in foreign currencies, up to the first HK$15,000 billed to enrolled Eligible Card Account per calendar quarter.

- (ii) Eligible Cardmembers who spend with the enrolled Eligible Card, can earn 1 point from Membership Rewards Basic Program; 1 point from Turbo program and additional 7 points for every HK$1 equivalent spent in “Designated Travel Merchants” Expenses billed to the Enrolled Eligible Card in Hong Kong dollar, up to the first HK$15,000 billed to enrolled Eligible Card Account per calendar quarter.

- (iii) Eligible Cardmembers who spend with the enrolled Eligible Card, can earn 1 point from Membership Rewards Basic Program; 1 point from Turbo program and additional 7 points for every HK$1 equivalent spent in “Designated Everyday Spend Merchants” Expenses billed to the Enrolled Eligible Card in Hong Kong dollar, up to the first HK$15,000 billed to enrolled Eligible Card Account per calendar quarter.

8. The Offer is valid for reservations made via designated website within the period from now to February 28, 2026 (both dates inclusive), The Offer is applicable to two (2) guests only, including the Eligible Cardmember. Each Eligible Cardmember can only enjoy a maximum of one (1) complimentary designated dinner menu per reservation, and can make up to four (4) reservations per month. Blackout dates and Terms and Conditions apply.

Click here for full details of the The Platinum Card benefits.

Year-Round Offers Terms and Conditions apply.