The income statement is one of the ‘big three’ statements, which provide a valuable view of your company’s health. But these documents aren’t just for your accountant. This article provides SMEs with a useful reminder of what an income statement is, followed by tips on how you can use it to track profitability.

What is an income statement?

An income statement is one of the main financial documents you must produce by law at least once per year. It’s a historical record of your business’s trading over a specific period (usually one year). The income statement shows the profit and loss of the company, which is the difference between the total income and the total costs – this is why it’s also called a profit and loss statement (P&L).

What is an income statement used for?

An income statement records your company’s revenue and expenses over a specific time period. It shows your company’s profit and loss: the difference between the total income and the total costs.

The income statement is also known as the ‘profit and loss statement’ (P&L), ‘income and expenditure statement’, ‘statement of earnings’, or the ‘statement of operations’.

There are two main types of income statement:

A single-step income statement is a simplified version using one calculation:

Net income = (gains + revenue) – (losses + expenses)

A multi-step income statement is more complex. It uses multiple calculations, factoring in operating and non-operating costs, to work out the company’s profit or loss after tax. It often includes turnover, cost of sales, gross profit, operating costs, non-operating costs and tax to calculate overall profit or loss.

What is the purpose of an income statement?

The income statement allows directors to meet their legal obligation to report on the company’s financial activity. But there are other benefits beyond compliance. It shows the owners and shareholders how the business performed and whether it made a profit.

By looking at net profit (gross profit minus expenses), you can determine whether your profit is sustainable. Your income statement shows finance providers if your business is profitable enough to remain operational.

Importance of an income statement

This document shows the profit and loss of your business by measuring the performance over a month, quarter, or year. It therefore indicates the financial health of your business, highlighting your business’s turnover and profitability (or not).

What‘s the difference between an income statement, a cash flow statement, and a balance sheet?

The ‘big three’ financial reports used to summarise your company’s health are your income statement, balance sheet, and cash flow statement.

Income statement

The income statement shows the profit or loss of a business’s accounts in a specific period. It’s a useful snapshot of your business’s stability and financial condition. The income statement records revenue and expenses, usually monthly. It details the company’s income and subtracts costs to show gross profit, operating profit, and profit before tax.

Cash flow statement

The cash flow statement shows where the business’s money comes from and how it’s used. Unlike an income statement and balance sheet, it doesn’t include future income or outgoings but focuses on cash flow during a specific period. Some things that affect your cash flow won’t affect profit – for example, money taken out of a business for personal use.

If you need to take action that could affect your cash flow (such as taking money out of your business for personal use) the American Express® Business Gold Card can help to offset this. It gives you payment terms of up to 54 days, which gives you more time to better balance your incoming and outgoings¹.

Balance sheet

The balance sheet is a snapshot of where the business stands at a particular time, such as quarter- or year-end. Using it will help you keep track of your spending and earnings and avoid financial problems. It shows what assets the company owes and owns (e.g. property, furniture, equipment, stock for sale, cash, and money owed to you) and liabilities (e.g. bank overdrafts and loans).

Together, these three documents provide an insight into your business’s past, present and future financial situation. Financial models use the trends in these reports to forecast the company’s future performance.

What is an income statement formula?

These are the typical steps you would take when creating an income statement:

- Determine your reporting period

- Generate a trial balance report (this can be pulled from your accounting software provider and will detail the balance figures you need for your income statement)

- Work out your turnover (i.e. your total sales revenue)

- Work out your cost of sales

- Calculate your gross profit (sales revenue minus cost of sales)

- Work out your operating costs (this might include things like utilities, wages, and insurance)

- Calculate your operating income (gross profit minus operating costs)

- Work out non-operating costs (this might include interest payable on credit agreements)

- Calculate your profit/loss before tax (operating income minus non-operating costs)

- Include tax

- Calculate your profit/loss after tax (income before tax minus tax)

Income statement format

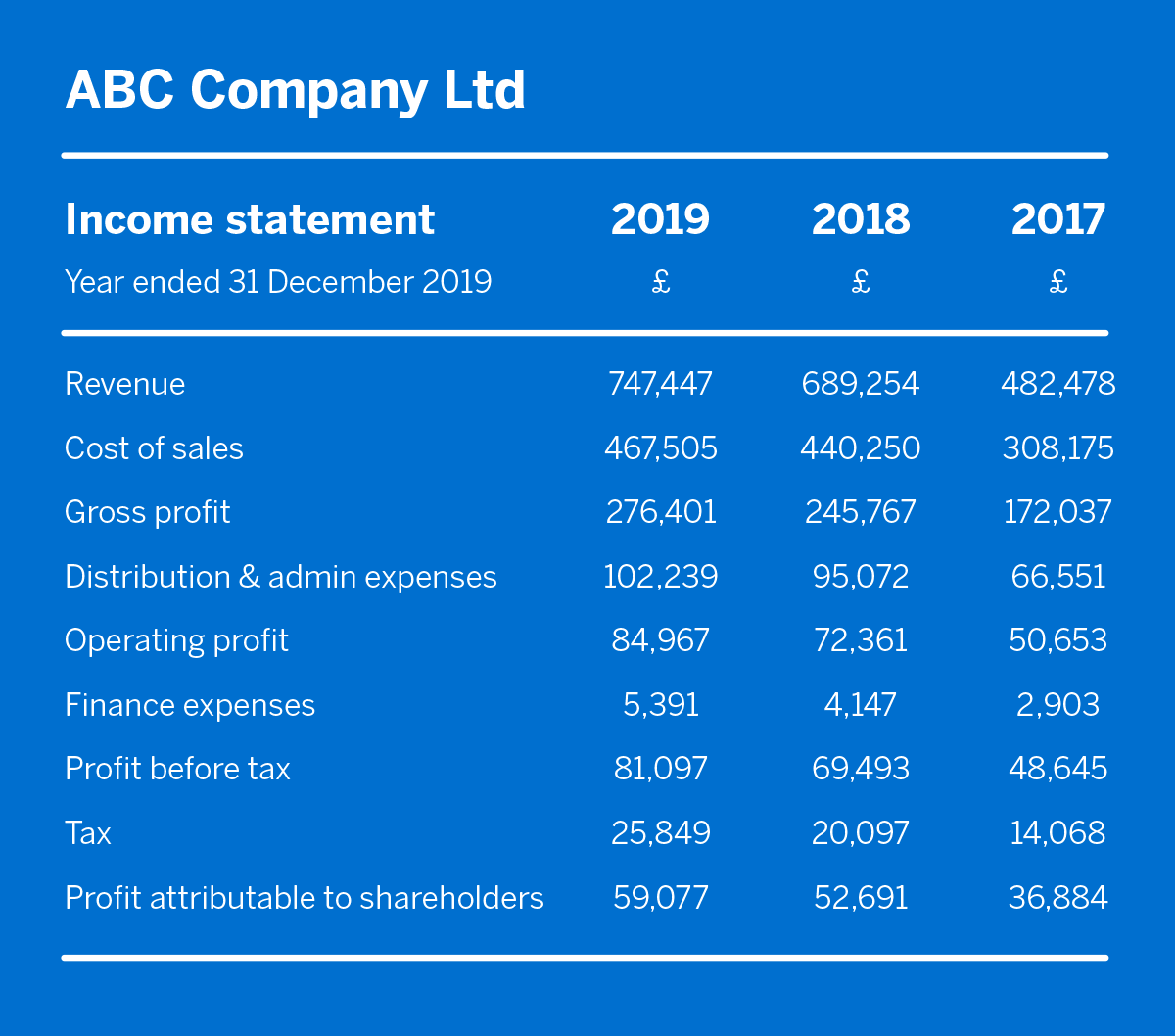

This income statement example shows how a business’s profit and loss have changed over time and how the information is formatted.

Main elements of an income statement

The main elements can be seen in our income statement example. The individual terms are explained below:

Revenue

The sales revenue or total value of sales made in the relevant period.

Cost of sales

Direct costs of making the above revenue. For example, the cost of goods sold (COGS) like raw materials, and direct labour production costs.

Gross profit

The difference between cost of sales and revenue. Used to calculate the gross profit margin, which is expressed as a percentage.

Distribution and administrative expenses

Operating costs not directly related to producing goods/services, such as advertising and marketing, transport, administrative costs, and rent.

Operating profit

The profit from the normal operating activities of the business (usually income from sales, minus the cost of goods, services, and salaries).

Finance expenses

Interest paid on borrowed money; less interest income received on cash balances (helps shareholders see how much profit is used by the company’s funding structure).

Profit before tax

Operating profit minus finance expenses.

Tax

An estimate of the amount of corporation tax that will be due on the profit before tax.

Profit attributable to shareholders

The amount of profit remaining after tax. Shareholders decide how much of this is paid out to them versus kept in the business.

How can analysing income statements help the business?

Calculating business profit with an income statement provides clarity about your business performance.

It also gives a topline overview of money going out of the business before you arrive at a profit or loss. You can then identify potential savings, e.g. if your interest payable figure is much higher than other expenses, you might need to look at refinancing options. Alternatively, the cost of sales might be prohibitively high, and you should review how products are sourced and manufactured.

Taking a close look at an income statement gives you lots of useful insights. For example, you can determine your best-performing months and work out what contributed to this success. Perhaps you invested more in marketing, which increased sales. You can assess expenses, and work out ways to reduce your largest ones.

You can compare annual income statements to look for drastic changes. The profit attributable to shareholders or the ‘bottom line’ of your income statement is one of the clearest indicators of your business’s health.

1. The maximum payment period on purchases is 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date. If you’d prefer a Card with no annual fee, rewards or other features, an alternative option is available – the Basic Card.