What Is Adjusted Gross Income?

7 Min Read | Last updated: January 29, 2024

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Adjusted gross income is simply all the money you made for a year minus special adjustments the IRS allows to help lower taxes.

At-A-Glance

- Your adjusted gross income plays a key role in determining how much taxes you’ll owe.

- It’s calculated by subtracting certain tax adjustments from your gross income.

- The lower your adjusted gross income, the more likely you’ll qualify for certain tax breaks.

The concept of “income” seems pretty simple on the surface. It’s the money you earn from work, savings interest, investments, and so on. But if you’ve ever found yourself scratching your head during tax season, wondering what your “adjusted gross income” is and how it relates to your gross income and taxable income, you’re not alone.

Adjusted gross income (AGI) is a crucial component of taxes. It’s the basis for determining your total tax bill, and plays a key role in determining which tax credits and deductions you’re eligible for. Thoroughly understanding what AGI is, how it’s used, and how to calculate it might help you lower your taxable income, thereby reducing your taxes – and saving you money.

What Is Adjusted Gross Income (AGI)?

AGI is defined as your gross income minus whichever tax adjustments you qualify for (AGI = gross income - any eligible tax adjustments).1 When filing your taxes, your AGI is used to determine your taxable income. Let’s break that down piece by piece:

- Gross income: Your total income – the starting point for filing your taxes – is the sum of everything you earn in a year, including wages, interest, investment gains, royalties, retirement distributions, rental income, alimony, and any other source of income not exempt from tax. For the 2022 tax year, it appears on line 9 of your tax return, aka 1040.2

- Tax adjustments: Next, tax adjustments are subtracted from your gross income (effectively lowering your gross income). In tax-speak, these adjustments are often called “above-the-line” deductions to differentiate them from the tax deductions most people are familiar with, which come “below-the-line” – in other words, after your AGI is calculated.3 For your 2022 tax year, your total adjustments to income appear on line 10 of your 1040.2

- Taxable income: Your AGI is then used to calculate your taxable income, or the portion of your income that will be taxed. For the 2022 tax year, your taxable income is shown on line 15 of your 1040.2 Specifically, your taxable income is calculated by subtracting any eligible “below-the-line” deductions from your AGI.3

How Your AGI Is Used

There are several important ways your AGI is used:

- Determining your federal (and state) tax liability. Your AGI is part of the equation to calculate your taxable income and your federal tax liability. If you live in a state that requires you pay state income taxes, your AGI may be used to determine your state taxes, too.4

- Determining your eligibility for tax credits and deductions. Your AGI directly affects the tax credits and below-the-line deductions you’re eligible for, especially if you plan to itemize deductions (instead of taking the standard deduction).5 But it can get a little tricky: Some tax credits and itemized deductions are dependent on your modified adjusted gross income (MAGI), not your AGI.6,7 No surprise: Your AGI is the starting point for determining your MAGI. To learn more about MAGI, read “What Is Modified Adjusted Gross Income?”

- To e-file your taxes. If you’re choosing to e-file your taxes, you may need to find your AGI from the previous year. If you’ve e-filed before, you should be able to import last year’s data if you’re using the same tax preparation software. If not, you can find it on line 11 of your 2021 1040.8 You can also contact the IRS.

Understanding AGI Can Help You Save Money on Taxes

When it comes to below-the-line deductions, you might be aware that you can lower your taxable income – and therefore, the taxes you owe – by taking the standard deduction or itemizing your deductions, depending on your specific tax circumstances.9 But you may also be able to lower your tax bill thanks to the above-the-line tax adjustments used to calculate your AGI.

There are a handful of above-the-line AGI adjustments, but people may not qualify for all of them.10 Some of the more common adjustments taxpayers use to lower their AGI include:

- IRA and other retirement plan contributions.

- Student loan interest.

- Self-employment taxes.

- Educator expenses.

- Health savings account (HSA) contributions.

In general, the lower your AGI, the greater the chance you’ll qualify for certain tax credits and itemized deductions.

It’s important to note that requirements for many below-the-line adjustments, tax credits, and itemized deductions can be very specific and are subject to income thresholds.11 This means that tax benefits might be reduced or limited if your AGI or MAGI (depending on the tax benefit) is above a certain level. When it comes to the medical and dental expense deduction, for example, the IRS will let you deduct a portion of qualifying medical expenses that exceed 7.5% of your AGI.12 So if your AGI is $50,000, you can only deduct medical expenses that exceed $3,750. This means that if you have $6,000 in medical expenses, $2,250 would be deductible.

Requirements are also subject to change each year, so be on the lookout for new laws before filing your taxes.

How to Calculate Your AGI

Most tax software will calculate your AGI for you, and the IRS suggests taxpayers consider filing electronically because it’s generally fast and accurate.13 But it’s usually better to understand what it’s doing. For the 2022 tax year, here’s what you would've needed:14

- Form 1040. If you’re 65 or older, form 1040-SR is an optional alternative.

- Schedule 1 for Form 1040. If your taxes are more complicated, you may need additional relevant schedule forms.

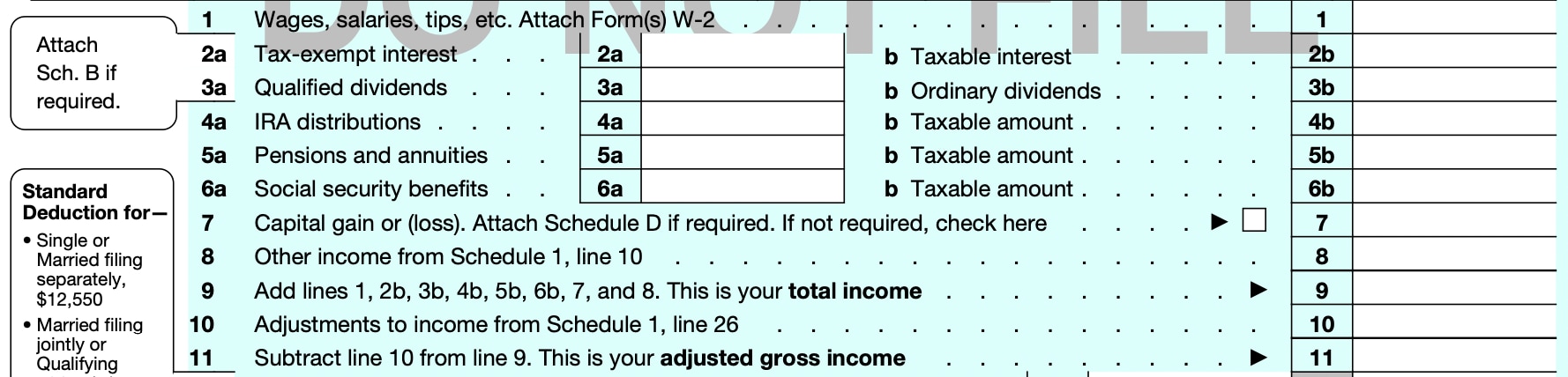

To calculate your AGI, refer to the accompanying excerpt of Form 1040 for the 2022 tax year (below) and follow these instructions:15

- Fill out lines 1-7 of your 1040. This will tally your reported income for the year.

- Fill out Schedule 1, which is essentially a worksheet for determining your various positive and negative income adjustments.

- On line 8, fill in other income from line 10 of Schedule 1 (if applicable).

- On line 9 of your 1040, add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income.

- On line 10, fill in your total adjustments to income from line 26 of Schedule 1 (if applicable).

- On line 11 of your 1040, subtract line 10, your total adjustments to income, from line 9, your total income. This is your AGI.

Image for example purposes only.

Your AGI will never be more than your total income, and it’s possible for your AGI and total income to be the same.

Take note: When filling out your 1040, some types of additional income and adjustments to income require that you fill out and attach additional forms and schedules. These help you correctly calculate income and adjustments. For more information, see the IRS instructions for Form 1040.

The Takeaway

Your adjusted gross income is your gross income minus certain above-the-line tax adjustments. These adjustments effectively lower your taxable income and increase your chances of qualifying for certain tax breaks. If you’re eligible, taking advantage of above-the-line tax adjustments can help you save money by lowering your tax bill.

1 “Definition of Adjusted Gross Income,” IRS

2 “2022 Form 1040,” IRS

3 “Itemized deductions,” Cornell Law School

4 “Briefing Book,” Tax Policy Center

5 “Itemized Deductions vs. Above-the-Line Deductions,” TaxAct

6 “Don't Wait: Plan Now to Reap Tax Benefits Later,” Office of Financial Readiness

7 “The Use of Modified Adjusted Gross Income (MAGI) in Federal Health Programs,” Congressional Research Service

8 “Validating Your Electronically Filed Tax Return,” IRS

10 “26 U.S. Code § 62 - Adjusted gross income defined,” Cornell Law School

11 “Tax credits for individuals: What they mean and how they can help refunds,” IRS

12 “Topic No. 502, Medical and Dental Expenses,” IRS

13 “How to file your federal income tax return,” USA.gov

14 “About Form 1040, U.S. Individual Income Tax Return,” IRS

15 “1040 (and 1040-SR),” IRS

SHARE

Related Articles

How to Calculate Interest Rates

Calculating interest rate can be complicated and confusing. Here are a few simple steps to calculate interest rate and credit card interest.

What Is APR and How to Calculate It

Comparing Annual Percentage Rates (APRs) can help you find the right loans. Learn how to calculate APR on a credit card and get tips to lower costs.

What Is Gross Income?

Understanding the definition of gross income can be important because gross income is the starting point for calculating many other types of income.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.