9 Min Read | Last updated: August 15, 2024

‘Level Up’ Your Understanding of Amex Card Levels

American Express Card ‘levels’ are more like unique categories to match your spending style, from casual spender to luxury traveler – and everyone in between.

At-A-Glance

American Express offers three main Credit Card categories: travel and dining Cards, points Cards for everyday spending, and cash back Cards.

Each Card category has several unique variations with different benefits and ways to earn rewards.

The right Credit Card for you depends on your lifestyle and spending preferences.

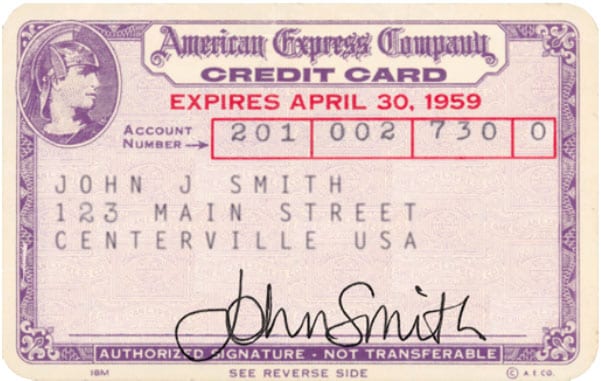

According to Encyclopaedia Britannica, American Express invented the “travel and entertainment Card” in 19581 after – according to the company’s own history – imagining a card combining “the security of Travelers Cheques with the added flexibility of credit.”2 American Express invented Travelers Cheques in 1891.

Fast forward to today: That simple credit card idea has evolved into a plethora of possibilities ready to suit the incredibly diverse lifestyles, tastes, and spending habits of a 21st Century generation. Today, American Express offers several categories of credit cards, each with unique card variations to suit any Card Member from the everyday shopper to the luxury traveler. While some people think of these card variations as “levels,” it’s more accurate to think of each as its own, special category with its own benefits and rewards so you can choose the card that matches your purchasing preferences:

- Entertainment and travel credit cards are still at the core, offering different benefits and rewards-earning opportunities for Card Members whose business or personal preferences have them spending on the go.

- Rewards points cards, for Card Members with more general spending habits.

- Cash back cards, for those who prefer to earn money by spending money, in the form of a statement credit.

Understanding the value and nuances of each American Express Card’s benefits can help you choose the right Card for you and your lifestyle. Terms apply to all benefits for the Credit Cards listed below and all offers listed are subject to change.

Green, Gold, and Platinum: Meeting Travel and Dining Needs Since Day One

If you’re an avid traveler and restaurant-goer, these three “classic” American Express Cards were designed to meet your needs. The Membership Rewards® points you earn with these credit cards – and other eligible American Express Cards – won’t expire as long as you have at least one active, enrolled Card, and there’s no cap to how many you can earn, so they’ll be waiting for whenever you’re ready to redeem them.

American Express® Green Card. Travel-oriented extras include no foreign transaction fees3 and up to $199 in statement credits per calendar year when using your Card to pay for a CLEAR® Plus membership (subject to auto-renewal). CLEAR uses unique attributes, such as eyes or fingerprints, to digitally verify identity to help its members move faster through security at select airports nationwide.

Consider the Green Card if: you’re a more casual traveler and diner, can pay an annual fee of $150,3 and you desire a fairly flexible repayment scheme.

American Express® Gold Card. With 4X points at restaurants worldwide (plus takeout and delivery in the U.S.) on up to $50,000 each year and 4X points on groceries at U.S. supermarkets on up to $25,000 each year – the Gold Card can maximize your love for dining, whether it’s at the newest restaurant in town or at home with your favorite recipe. And if you love to discover dining in new destinations, the Gold Card also comes with 3X points on flights booked directly with airlines or on AmexTravel.com.

The Gold Card has a $325 annual fee4 and comes with over $400 annually in benefits value across dining and travel, including a $120 Dining Credit, $120 Uber Cash, $100 Resy Credit, and $84 Dunkin’ Credit.5

Consider the Gold Card if: you find yourself frequently dining at restaurants, cooking home-cooked meals, traveling, and want to get rewarded for doing the things you already love.

The Platinum Card®. Platinum shines for avid travelers, with 5X points for flights booked directly with airlines or Amex Travel on up to $500,000 a year in purchases, and 5X points on hotels booked and paid in advance through Amex Travel. The Platinum Card and its $695 annual fee5 also offer many more valuable travel, airline, and hotel benefits that can make every trip more luxurious. For example, the American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 3/2023.

The Platinum Card also offers a suite of benefits that can help make life more rewarding at home. Treat yourself and discover new shows, news and recipes on Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Get up to $20 in statement credits each month when you make eligible purchases directly from one or more of our participating partners with your Platinum Card. Enrollment required.6 For more about the Card’s everyday benefits, read “Platinum’s Elevated Lifestyle Benefits Can Help Make Every Day an Adventure.”

Consider The Platinum Card if: you’re looking to get the most out of life, whether you want to stay inspired at home, enjoy luxurious travel benefits on the road, or both.

Amex Everyday® and Amex Everyday® Preferred: Membership Rewards for Everyday Use

Interested in earning Membership Rewards points for the purchases you make every day? These two American Express Cards – Amex EveryDay and Amex EveryDay Preferred – reward you for regular spending, from restocking the fridge to filling the gas tank and more. Your spending earns Membership Rewards points that can be redeemed in a variety of ways, such as travel, gift Cards, and statement credits.

Amex EveryDay Credit Card. This no annual fee Card will get you 2X points at U.S. supermarkets on up to $6,000 per year in purchases, 2X points for purchases made through Amex Travel, and 1X points on other eligible purchases. Plus, use your Card 20 or more times on purchases in a billing period and earn 20% extra points on those purchases less returns and credits. Terms apply.7

Consider the Amex EveryDay Card if: you’re interested in a Card that allows you to earn rewards for everyday purchases like groceries and don’t want to pay an annual fee.7

Amex EveryDay Preferred Credit Card. With a $95 annual fee, this Card offers 3X points at U.S. supermarkets up to $6,000 in per year in purchases, 2X points at U.S. gas stations and Amex Travel, and 1X points on other eligible purchases. Plus, use your Card 30 or more times on purchases in a billing period and earn 50% extra points on those purchases less returns and credits. Terms apply.8

Consider Amex EveryDay Preferred if: you’re interested in a Credit Card that offers more rewards for spending at supermarkets and gas stations.8

Cash Magnet®, Blue Cash Everyday® and Blue Cash Preferred®: Get Cash Back

If earning points isn’t for you – or you want to expand the ways you can earn Credit Card benefits – American Express offers three Cards that earn you cash back on all eligible purchases. Instead of earning points that you can then redeem for a number of options, cash back can be redeemed for statement credits – effectively earning you a discount on every purchase.

What’s more, all Cards – Cash Magnet, Blue Cash Everyday, and Blue Cash Preferred – allow new Card Members to enjoy $0 introductory Plan It® fees9,10,12 for plans set up during the first 12–15 months of Card Membership, depending on the Card. Plan It by American Express lets you make purchases of $100 or more on the Card and split them into fixed monthly installments. For each plan created after the introductory period ends, you’ll pay a fixed monthly Plan It fee, disclosed up front. Your plan fee will be up to 1.33% of each purchase moved into a plan, with the exact percentage determined by the plan duration, the APR that would otherwise apply to the purchase, and other factors. In other words, you’ll pay a fixed monthly Plan It fee for each new plan you create – instead of the annual percentage rate (APR) you’d typically pay when carrying a balance on your Card. Any purchases not included in a Plan will be subject to interest charges if the remaining monthly statement balance is not paid off on or before the payment due date.

Cash Magnet Card. Perhaps the most straightforward of American Express’ cash back Cards is the Cash Magnet, with unlimited 1.5% cash back on all eligible purchases. There’s no annual fee.9

Consider the Cash Magnet Card if: you want to earn rewards in the form of cash back instead of points, you like simplicity, and don’t want to pay an annual fee.9

Blue Cash Everyday Card. This is a no annual fee10 cash back Card that aims to help you earn rewards for everyday essentials. For example, the Card offers:

- $84 Disney Bundle Credit, which allows you to get a $7 monthly statement credit (up to $84 back annually) after using your enrolled Blue Cash Everyday Card to spend $9.99 or more each month on a subscription (subject to auto-renewal) to the Disney Bundle. Valid only at DisneyPlus.com, Hulu.com, or Plus.espn.com in the U.S.11

- $180 Home Chef Credit, which allows you to get up to $15 in statement credits monthly for online purchases made with meal kit delivery service, Home Chef, on your Blue Cash Everyday Card (up to $180 in statement credits annually). Enrollment required. Shipping available in the contiguous U.S. only. Subscription subject to auto-renewal.11

- 3% cash back at U.S. supermarkets, on up to $6,000 in yearly purchases.

- 3% cash back at U.S. online retailers, on up to $6,000 in yearly purchases.

- 3% cash back at U.S. gas stations, on up to $6,000 in yearly purchases.

- 1% cash back on all other eligible purchases.

Consider the Blue Cash Everyday Card if: you want a no-annual-fee grocery, gas, and online retail rewards Card that earns you cash back instead of points, in addition to select streaming and meal-kit credits.

Blue Cash Preferred Card. Blue Cash Preferred offers cash back opportunities on additional spending categories like streaming subscriptions and transit. With the Card’s $95 annual fee12 come a variety of reward opportunities that can be especially valuable for families and those who use a lot of streaming services, tend to cook at home, or even commute to work. For example, with this Card you can get:

- 6% cash back at U.S. supermarkets, on up to $6,000 in purchases per year.

- 6% cash back on select U.S. streaming subscriptions.

- 3% cash back at U.S. gas stations.

- 3% cash back on transit, including tolls, parking, trains, buses, and more.

- 1% cash back on all other eligible purchases.13

Consider the Blue Cash Preferred Card if: you tend to spend a lot at grocery stores and gas stations and love using your streaming services.

The Takeaway

The best American Express Card for you depends on where you spend your money, how much you typically spend, and how you like to earn your rewards. American Express offers multiple Card types – travel and dining, everyday spending, and cash back – each with a unique mix of rewards and benefits so you can find the best match for your purchasing preferences.

1 “Credit Card,” Encyclopaedia Britannica

2 “Our History,” American Express

3 For more on Rates and Fees for the American Express® Green Card, click here.

4 For more on Rates and Fees for The American Express® Gold Card, click here.

5 For more on Offer and Benefit Terms for The American Express® Gold Card, click here.

6 For more on Offer & Benefit Terms for The Platinum Card®, click here.

7 For more on Rates and Fees for Amex EveryDay® Credit Card, click here.

8 For more on Rates and Fees for Amex EveryDay® Preferred, click here.

9 For more on Rates and Fees for the Cash Magnet® Card, click here.

10 For more on Rates and Fees for the Blue Cash Everyday® Card, click here.

11 For more on Offer & Benefit Terms for the Blue Cash Everyday® Card, click here.

12 For more on Rates and Fees for the Blue Cash Preferred® Card, click here.

13 For more on Offer & Benefit Terms for the Blue Cash Preferred® Card from American Express, click here.

Megan Doyle is a business technology writer and researcher whose work focuses on financial services and cross-cultural diversity and inclusion.

All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

How to Use a Balance Transfer Credit Card

The best way to use credit cards with no balance transfer fee is by paying off your debt in the first 12-18 months. Learn more about 0% balance transfer credit cards.

What Credit Card is Best for You in 2022?

Before choosing a credit card, make sure to do some research around what credit card is best fit for your needs. Here’s how to choose one today.

Everything You Need to Know to Get Your First Credit Card

Want to know how to get a credit card for the first time? Here are a few expert tips to help you with your search.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.