The Difference Between a Hard Credit Check and a Soft Credit Check

5 Min Read | Last updated: June 16, 2025

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Understand the difference between a soft inquiry vs. hard inquiry before checking your credit report. See how they impact your credit score.

At-A-Glance

- When you apply for a loan or new credit, businesses may perform a hard credit check, or “hard pull,” of your credit report, which can cause your credit score to dip a few points.1

- A soft credit check or “soft pull” is recorded any time someone – you, a business you already have an account with, or one that is considering you for a preapproval deal – reviews your credit report.

- Shopping around for loans within a short time frame can minimize credit score damage, as multiple hard inquiries for certain loan types may be treated as one.

Whenever you apply for financing, like a Credit Card, personal loan, or mortgage, the lender will likely evaluate your financial status. Doing so helps them understand how risky you may be as a borrower.

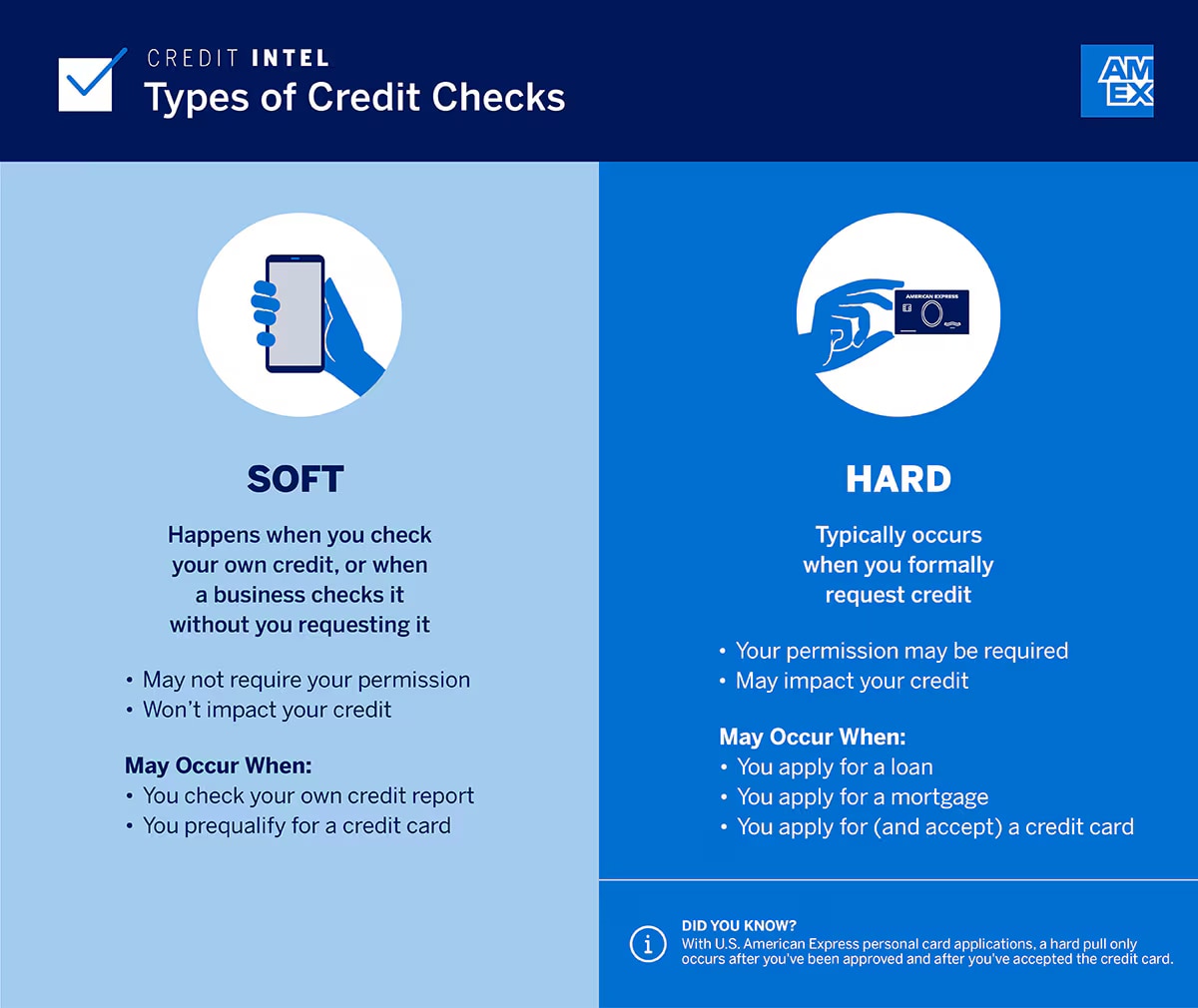

To get a sense of how you handle debt, lenders and businesses could make either a “soft” or “hard” credit check (also known as a “pull” or inquiry) of your credit report. Soft inquiries can be used to issue prequalification or preapproval offers, while a hard inquiry is done if you’re approved and choose to open an account.

Here’s what you need to know to differentiate between soft and hard credit checks so you can better manage your credit score.

Soft Inquiry vs Hard Inquiry

Credit checks happen when someone takes a look at your credit. When you officially apply for credit, a lender may run a hard check, which could cause your score to dip slightly. Soft checks, however, happen with prequalification, preapprovals, or when you check your credit report for yourself, which you should do from time to time to keep an eye out for mistakes or identity theft. Soft credit checks don’t impact your credit score. Here’s what causes a soft vs hard credit check:

Hard Inquiries

Hard inquiries may only happen when you formally request a form of credit, whether you’re borrowing money or opening a new utility service, for example. Hard pulls can cause a small temporary ding to your credit score.2

Soft Inquiries

A soft inquiry can happen when you check your own credit report or when a business checks it without you requesting credit, like if they’re mailing you a preapproval offer for a credit card. A soft pull has no impact on your credit score.3

Did you know?

With U.S. American Express personal card applications, a hard pull only occurs after you’ve been approved and after you’ve accepted a credit card, not during the application process itself. Get matched with a personalized set of Credit Cards, with no impact to your credit score.

What Is a Hard Credit Check?

Besides applying for a loan or a new credit card, there are other financial moves that can create a hard credit pull.

Examples of Hard Credit Checks Include:

- Landlords or leasing managers may make a hard or soft pull when you apply to rent a place, so check before you apply.

- Requesting a credit limit increase for an existing credit card can trigger a hard pull to see if you’re eligible.

- Buying or leasing a car might trigger a hard inquiry credit check.4

Each hard inquiry stays on your credit report for two years, but when FICO® calculates your credit score, it only considers credit inquiries made during the last 12 months. And even during that first year, the impact may be about five points, depending on your credit history.5 That’s a minor ding compared to other financial moves that can trigger a big credit score drop.

Hard inquiries also serve as a heads-up to businesses checking your credit. If they see multiple hard inquiries popping up over a few weeks or months, that can be a sign that you may become financially overextended.

American Express’ application process means that you can apply for a U.S. personal credit card with confidence, knowing that simply submitting an application may not impact your credit file. A hard check may only happen once you’ve been approved and have formally accepted the card. If you apply for an American Express business card, however, a hard credit check may happen regardless of the application decision.

How to Reduce Hard Credit Checks

There is a way to minimize the impact of hard credit checks on your credit score when shopping around for a loan. The two main credit scoring models, FICO and VantageScore®, don’t penalize you for being a smart comparison shopper when it comes to mortgages, auto loans, and student loans. You may be able to submit loan applications to a few different lenders for the same type of credit as long as you do it over a relatively short time span, 14 days being common.6

Say you’re shopping for a car loan. You’re allowed a window of time where all hard inquiries related to a similar type of loan will be bunched together and count as just one hard inquiry. This shopping window can range from 14 days to 45 days, depending on which version of a credit scoring model is being used.7 A safe move is to try and get all your loan applications submitted within a two-week period.

In addition to rate shopping in a short time span, you may also be able to reduce hard credit checks by getting preapproved for credit cards or loans before you formally apply. The preapproval process can tell you which credit cards or loans you’re likely to qualify for without impacting your credit score or triggering a hard credit inquiry.

What Is a Soft Credit Check?

When you or a business wants to check your credit report without any formal request for money or credit, it counts as a soft credit pull. You can think of soft credit inquiries as non-events, as they have no impact on your credit score.

Examples of a soft credit check include:

- Preapproval offers many people receive for new credit cards, car lease deals, or mortgage refinancing can be the result of a business doing a soft pull to find good candidates.

- Setting up utilities at a new residence may trigger a soft credit pull to decide if a deposit is required.

- An employer might do a background check as part of the hiring process, which can trigger a soft pull on your credit.8

Once you have a loan or account with a business, they might check your credit report from time to time just to make sure everything remains in good standing. These are also considered soft checks.

Checking Your Report for Identity Theft or Other Fraud

It can be smart to check your credit report periodically for suspicious hard inquiries that you didn’t authorize.9 That can be a tip-off that an identity thief may have used your personal information to apply for a loan or credit while posing as you. If you ever find a hard pull you don’t remember requesting, you’ll want to take steps to alert the credit bureaus, consider a credit freeze, close down any unauthorized accounts you discover, and then file a dispute to have the unauthorized hard pull removed from your credit report.

The Takeaway

The main difference between what triggers a hard vs soft credit check is whether you formally asked for credit. Only hard credit checks can impact your credit score, but even a hard pull may only cause a small, temporary dip in your score. You can take steps to manage the impact on your score by being strategic about applying for credit.

1,2,5,9 “What Is a Hard Inquiry and How Does It Affect Credit?,” Experian

3,4,8 “Hard Inquiry vs. Soft Inquiry: What’s the Difference?,” Experian

6,7 “How to Rate Shop and Minimize the Impact to Your FICO® Scores,” myFICO

SHARE

Related Articles

Can You Remove Unauthorized Hard Inquiries From Your Credit Report?

Unauthorized hard inquiries can negatively affect your credit score. Learn the steps you can take to remove hard inquiries from your credit report.

How Long Do Hard Inquiries Stay On Your Credit Report?

Gain insights into how long hard credit inquiries typically stay on your credit report and discover their potential impact on your credit score.

How Many Hard Inquiries Are Too Many?

See how many hard inquiries are too many and how they can affect your credit score. See tips to manage hard inquiries to help protect your credit.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.