7 Min Read | Updated: January 19, 2024

Originally Published: December 20, 2019

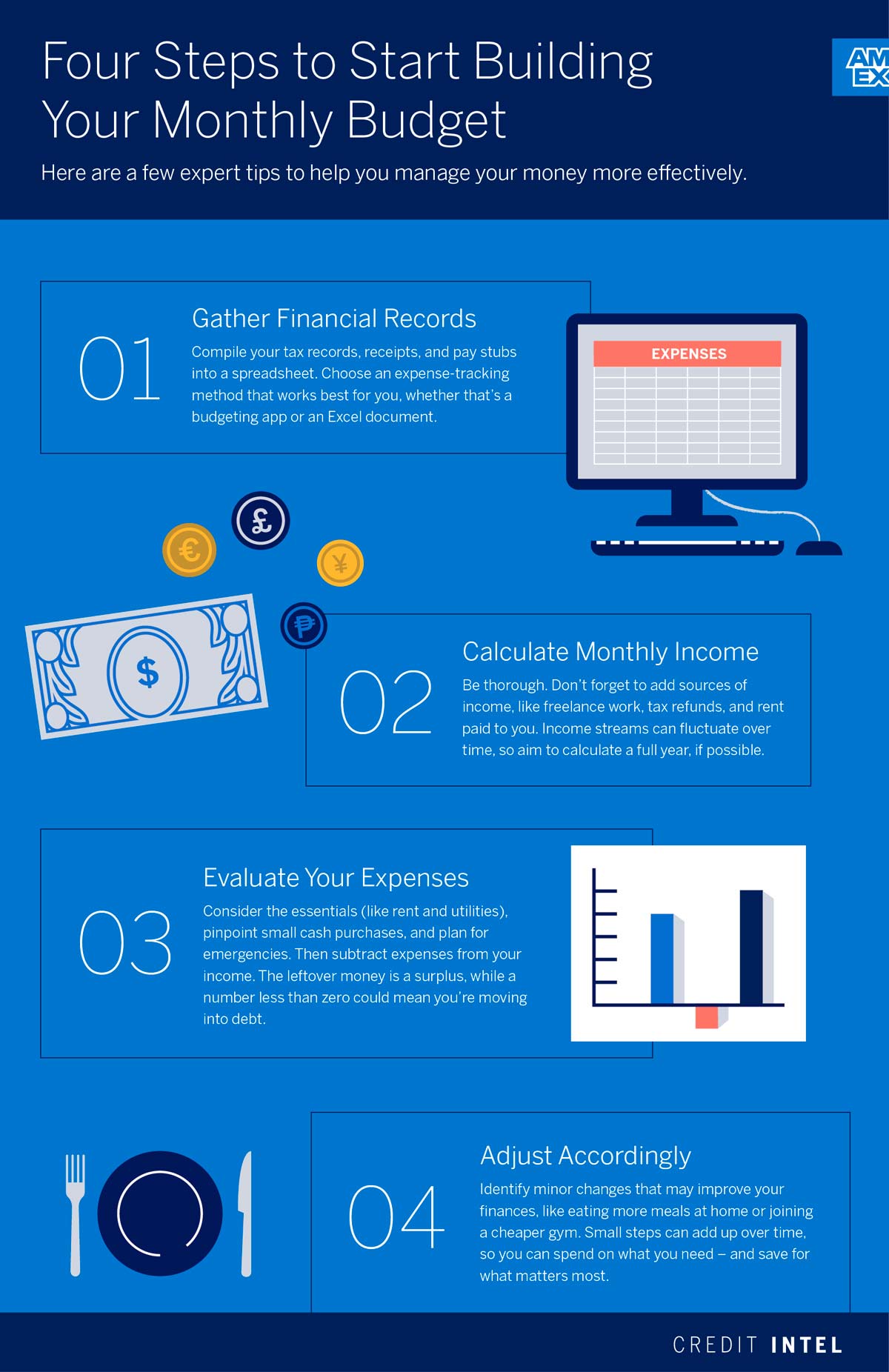

How to Make a Monthly Budget in 4 Steps

Take control of your personal finances: Here are some expert budget-building tips and a 4-step guide to help you achieve your budgeting goals.

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

At-A-Glance

A monthly personal budget can help reduce stress, and building one is easier than you might think.

We’ll help you capture the information you need, including spending that’s unexpected or easy to forget.

Then you can make changes that de-stress and put you in control.

Maybe you feel you should create a personal monthly budget, but find the task intimidating —or just boring. But it shouldn’t have to be. We can walk you through the process, but first, why bother? Simple: A monthly budget gives you control—and, with it, less stress.1

When you don’t know where you stand financially, it can be brutally stressful. You don’t know what’s coming at you next. But when you look the personal finance monster in the face, it may not be as scary—and if it is, you can do something about it.

What can you do? You can prioritize spending you really care about, versus spending that doesn’t matter to you. Your monthly budget can help you build better money habits, because it gently reminds you when you’re tempted to stray.1 Plus, it can include a goal—whether that’s travel, a home, college, paying off loans, or retirement.1 Goals are empowering—especially for withstanding inevitable setbacks.

To get you started on your own monthly budget, we overview the process in four steps:

- Start by gathering the information you’ll need from many sources;

- Calculate your average monthly income;

- Find and tally all your expenses;

- Compare, evaluate, and take action.

Let’s take a closer look at each step.

Step 1: Collect Your Monthly Budget Information

Plan to set aside a quiet time to concentrate on budgeting. If you need to schedule an appointment with yourself (and/or your partner) a few weeks in advance, that’s fine: Everyone knows quiet time is often scarcer than money.

To create your budget, you’ll need to collect and categorize information about all your income and expenses.2 To get an accurate picture of average monthly income and spending, you’ll need to gather information covering at least several months—ideally a year or more. There are several ways to do this:

- Online tools. Use an online budgeting or money management tool that pulls information from your financial accounts and automatically categorizes it.

- Personal spreadsheet. Download the information from your financial accounts and analyze it using a spreadsheet or desktop financial management tool.

- Old school: pen and paper. Use a notepad and shoeboxes full of recent bills, statements, pay stubs, tax returns and other information.

You may need to combine several of these methods to collect all the required information. Initially, you may not think of everything, and that’s OK. Just make a list of missing items. Then, you can find (or guesstimate) them all at once, rather than constantly interrupting your budgeting session to track down individual pieces of information.

Whichever method you use, it’s a good idea to set up a system that lets you continue doing this on an ongoing basis with minimum effort. Some online tools, for example, continuously gather information from your financial accounts, so you can see how your spending or income changes over time and adjust your monthly budget if necessary.

Step 2: Begin Your Monthly Budgeting with Income

Focus on income first: that can be easier. Maybe you already organized last year’s when you did your taxes—though certain untaxed income, such as your employer’s pension contributions, might not be immediately visible.

For the current year, categorize your online deposits or work from pay stubs and other paper records. Income from side gigs or freelance work, overtime, and bonuses can bounce up and down, so track a full year if you can.2 If you earn quarterly or annual interest or dividends, track those, too. Don’t forget other income sources, such as:

- Rent paid to you

- Alimony or child support

- Government benefit checks

- Tax refunds

With this information, you can calculate average monthly income over a year (or whatever period you’re using). If income changes significantly each month, reduce your estimate to reflect lower-income months. That way, you’ll be less likely to be caught short. (Tip: You may be able to adjust some bills to arrive later in the month, after income arrives.)

Step 3: Expenses: Essential, Discretionary, “In Between,” and Emergency

Start with expenses that must be paid. Some essential expenses are fairly predictable, such as:

- Monthly rent or mortgage payments

- Student and/or car loans

- Quarterly or semi-annual car insurance

- If you commute, transportation costs (fares, tolls, gasoline, parking).

Other costs change significantly in timing and amount, but you know they’ll exist:

- Groceries—you gotta eat.

- Electricity, water, gas (could vary seasonally).

- Internet and phone

- Taxes—income, property, etc.

Then, there are discretionary expenses: money you (mostly) choose to spend.3 Here’s a list to start with:

- Cable/satellite TV (including optional movie packages and streaming services)

- Dining out (including coffee and other drinks)

- Donations and gifts

- Clothing

- Gym memberships

- Hobbies

- Movies and concerts

- Sporting events

- Subscriptions

- Travel

Of course, some expenses are partially discretionary. Some jobs have high expectations for dress. Or you might have a cable/internet bundle where internet’s a must but premium movie channels aren’t. But for now, you’re figuring out what you actually spend.

Don’t forget expenses paid in cash. Track withdrawals by ATM or check, then reflect on where they went:

- Morning coffee?

- Special events?

- Businesses paid in cash?

I actually gamify this. The more obscure expenses I remember, the bigger the win I give myself—even if it’s just that little extra mental kick that comes from remembering an oddball expense as if it were an obscure answer at our local pub’s trivia contest.

If you know a significant expense is coming—say, a sizable repair—try to build it into your budget so you can start saving for it.3 So, too, build in monthly savings for short- and medium-term goals.1 For example, if next year’s vacation will cost $3,000, plan to save $250 per month for the next 12 months.

Finally, consider emergencies. Maybe you’ve already tracked some—e.g., an unexpected health expense from a few months ago. Since they’re “unexpected” (as opposed to merely “overlooked”), you can’t predict exactly how much the next one will cost. But some experts suggest building a $1,000 emergency fund ASAP, and then gradually growing it to 3-6 months of expenses.4 So if you want to build a basic emergency fund in four months, you’d add $250 of emergency savings to your monthly budget.

Step 4: Now Compare—and Adjust

You should now have averages for both monthly income and expenses. Subtract expenses from monthly income: If there’s some left over, that’s your monthly surplus. If the resulting number is less than zero, the shortfall tells you how far into debt you’re moving.1

Did you wind up where you expected? If you haven’t been getting ahead, now you know why. If you’re doing OK, can you do better?

If you need or want to make adjustments, you may have more flexibility to work on discretionary expenditures. Here are some small lifestyle changes that could make a big impact on your budget:

- Eat more meals at home.

- Spend less at coffee shops.

- Give up some non-essential subscriptions.

- Choose a cheaper gym membership or exercise on your own.

- Delay updating your wardrobe or cellphone.

- Comparison shop to cut insurance costs.

- Adjust the thermostat.

- Replace brand names with generics.

Over time, you can work on medium-to-longer-term expenses too. Can you:

- Consolidate high-interest debt onto a lower-interest loan that’s easier to pay off?

- Choose a less expensive car when your lease is up?

- Cut or defer taxes by funding a retirement account (especially if your employer will also contribute)?

- Reconfigure that vacation to cost $2,000 instead of $3,000?

Some changes might hurt in the short term. But some may not hurt at all. And you’ll feel more virtuous, more confident, more in control of your future. That’ll never be a line item in your budget—but it’s worth a lot.

The Takeaway

Building a monthly budget helps you de-stress, because it puts you in control. You know where you’re really at, and you have more clarity about how to achieve your goals.

1 “Not sure how to handle your finances and student aid (grants, scholarships, loans, work-study) while you’re in school?,” U.S. Department of Education

2 “Making a Budget,” Consumer.gov

3 “Budgeting,” B.U. Medical Campus Student Financial Services

4 “Saving for emergencies,” Washington Department of Financial Institutions

Bill Camarda has more than 30 years’ experience writing about business, technology, and finance. He is author or co-author of 19 books on information technology.

All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Related Articles

8 Ways to Account for Inflation in Your Travel Budget

Travel inflation may be more likely to turn an upcoming trip into a budget buster. The good news is that there are plenty of ways to help cushion the impact.

What, Exactly, is “Personal Finance”?

Understand what personal finance is, why it is important and how you too can do personal finance to help you manage your money.

How Much Should You Save Each Month?

How much you should save each month depends on your income, expenses, and savings goals. Many financial experts recommend the 50/30/20 budget rule as a good start.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.