What is Financial Planning and How Does it Work?

5 Min Read | Published: January 29, 2024

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Personal financial planning can help protect you from life’s unpredictability. Find tips to improve your financial planning process and learn to build a budget.

At-A-Glance

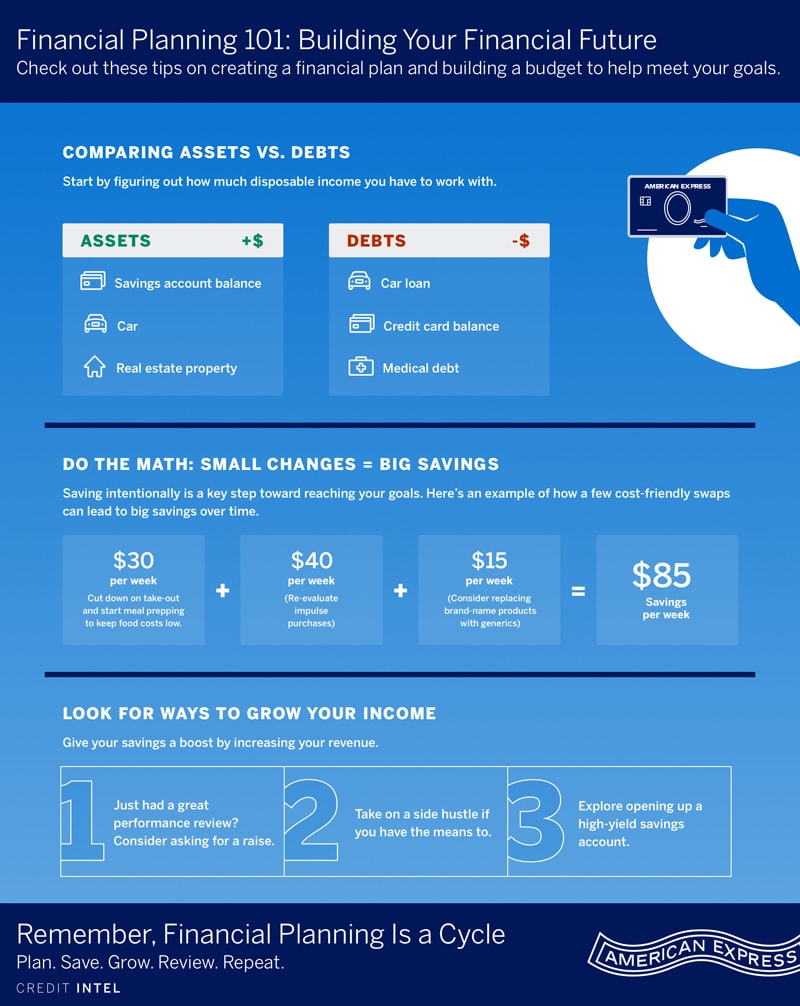

- You can start improving your financial planning process by getting clarity on income, assets, debts, and expenses.

- Build a realistic budget you can actually use and learn from.

- Learn to spend less, save more—and automate savings, if possible.

Careful financial planning can help protect you from life’s unpredictability, which always seems to be lurking, ready to pounce. The sooner you start, the better off you may be—especially if you haven’t focused much yet on your financial status and goals.

Even if you’ve done financial planning before, things change—often while you’re not looking—and course corrections might be needed. For many people, relatively small changes can make a big difference in the long run. And financial planning is a long game.

Below are some practical tips that can help you develop and manage a comprehensive financial plan.

First Things First: What is the Definition of Financial Planning?

Financial planning is all about developing a savings and investment plan to help you achieve your goals in life. Some parts of that plan-building process can be tedious—like detailing out your income, assets, and liabilities. And some might be emotional—like figuring out what your life goals really are.

Financial Planning Starts with Knowing Where You Stand

To get your financial planning process started, it’s good to know your personal “free cash flow”—the disposable income and other assets you have to work with. You can start with your statements and pay stubs, and tally your income, assets, and debts. Here’s one way to get started:

- Assets inventory: This can include bank accounts, investments, home or other property, car, etc.

- Retirement accounts: These include 401(k)s, 403(b)s, Roth or standard IRAs, or even old-fashioned defined employer pensions.

- Social Security: Get a personalized projection of your future Social Security benefits at ssa.gov—though this could change depending on changes to your income and the system itself.

- Debts: These can include student, car, home, and personal loans; outstanding credit card balances.

It’s worth noting that online financial planning tools could simplify this process and streamline future updates.

Assess Regular Expenses and Build a Realistic Budget

Next comes identifying your expenses—including your best guesses about surprises. You don’t know what unexpected event will happen, but something probably will.1

You can start by assembling credit card and checking account statements, adding up what you’ve spent in each of the past few months. If you use ATMs, drill down to estimate where the withdrawn cash went. Tracking might be easier if you pay more expenses through a credit card instead of bills and coins, since many card issuers automatically categorize expenses for you.2 Remember expenses you only pay occasionally, like:

- Car, home, and health insurance

- Estimated income or property taxes

- Gifts for weddings and other events

- Healthcare checkups

Understanding your health insurance deductibles can help you begin to plan for out-of-pocket health expenses. Don’t forget dental or vision costs insurance might not cover.

Homeowners know boilers, refrigerators, and roofs don’t last forever. The Standard Estimated Life Expectancy Chart for Homes published by the International Association of Certified Home Inspectors can be a useful planning resource to tell you how much to set aside.3 Or, you could keep it simple: Some planners suggest budgeting between 1% and 4% of your home’s value each year for potential repairs.4,5

Finally, include other major expenses you want or need: vacations, college, a home purchase or upgrade, a new car. Consider establishing separate accounts to save for these.

Tally all these potential annual costs, and divide by 12. The result becomes your basic monthly expense budget. Experts recommend you don’t just file away your budget—use it to track your actual performance.2 Then, do an end-of-year post mortem to see where you succeeded and failed. Refine next year’s budget to reflect what you’ve learned.

Plan to Save—Automatically, if Possible

All this budgeting shows what it’ll take to just stay even with expenses. But your financial planning process depends on doing better than that. How much to save depends on your goals and situation, but planners often recommend saving at least 10% of your income.6 Many recommend saving 20%.7,8

Automate money transfers from checking to savings or other accounts, so the money isn’t available to spend without an extra step—which gives you time for second thoughts.9,10

Grab Free Money Wherever You Can

It’s easier to save when you grab “free money.” Two quintessential examples are retirement savings in tax deferred accounts and employer-matched 401(k) contributions.11,12 They encourage you to start saving for retirement earlier and benefit from compound interest, dividends, or other investment growth.13

You can also explore:

- Employer-offered flexible spending accounts that let you budget for some out-of-pocket healthcare expenses with pre-tax dollars, thus reducing your taxes14,15

- Cash back credit cards—especially if they offer bonus cash back on expenses you often incur, such as supermarket purchases

Grab Free Money Wherever You Can

Simply tallying income and expenses won’t grow your assets: experts say for financial planning to get you all the way to your goals, you’ll probably need to control spending.16

Here are some ways:

- Reduce monthly interest payments by cutting debt and refinancing what’s left.17

- Consider buying a certified pre-owned car with a warranty, and keep it for a decade instead of leasing a new one every three years.18

- Have home-brewed coffee instead of going to coffee shops, and use filtered tap water instead of bottled.

- If you’re a smoker, you might save thousands if you can quit—not to mention potential savings on future healthcare costs.19

- Remove insurance coverage you may not need, like collision coverage on older cars.20

- Reduce monthly subscriptions you rarely use.21,22

- Consider stopping that wireline phone or cable connection.23

- Comparison-shop on any expenses left on autopilot.

- Consider replacing brand-name products with generics.24,25

- Adjust the thermostat up a few degrees in summer and down in winter.26

Work on Your Upside, Too

As you cut costs, perhaps you can increase revenue, too.

- In an employee-friendly job market, you may be able to earn more by upskilling, moving to a higher-paying job, or asking for a raise.

- Consider whetherIs adding a side hustle is practical

- If you shop around, you might find better returns on your savings and investments without taking risks you’re not comfortable with—for example, by moving money from an ordinary checking account into a high-yield savings account or CD.

Elements of a Financial Planning Process

Set goals Identify income Identify expenses Calculate net income Plan savings (short- and long-term) Plan expense reduction Plan income growth Execute the plan Review & repeat

The Takeaway

Financial planning can help you take—and keep—control of your money and your life. There are many practical ways to plan, budget, cut costs, increase income, and save. It may take work, but these practical tips can help you get there.

1 “Making a Budget,” Consumer.gov

2 “Looking to hop into the financial empowerment journey? Start with Expense tracking the right way,” Pittsburgh Financial Empowerment Center

3 “InterNACHI's Standard Estimated Life Expectancy Chart for Homes,” International Association of Certified Home Inspectors

4 “How much to budget for home maintenance,” State Farm

5 “How to Budget for Home Maintenance Costs,” HGTV

6 “Teenagers and saving,” Consumer Financial Protection Bureau

7 “Learning about budgets,” Consumer Financial Protection Bureau

8 “Financial Goals,” CreditUnion.gov

9 “Find Money to Save,” FDIC

10 “Save and Invest,” MyMoney.gov

11 “Tax-Advantaged Savings Accounts: Overview and Policy Considerations,” Congressional Research Service

12 “Matching Contributions Help You Save More for Retirement,” IRS

13 “Retirement,” Robert Sprague Ohio Treasurer

14 “Using a Flexible Spending Account (FSA),” HealthCare.gov

15 “Flexible Spending Accounts (FSAs),” National Institutes of Health

16 “Developing a Savings and Spending Plan,” Michigan.gov

17 “What do I need to know about consolidating my credit card debt?,” Consumer Financial Protection Bureau

18 “Leasing vs. Buying a New Car,” Consumer Reports

19 “What You Need to Know About Quitting Smoking,” U.S. Department of Health and Human Services

20 “Do I Need Collision Insurance on an Older Car?,” Kelly Blue Book

21 “Tips On Cutting Costs,” Washington State Department of Financial Institutions

22 “5 Tips on How to Stick to Your Budget,” Social Security Administration

23 “Is It Safe to Get Rid of Your Landline?,” AARP

24 “6 Tips for Eating Healthy on a Budget,” Centers for Disease Control and Prevention

25 “Generic Drugs: Questions & Answers,” U.S. Food and Drug Administration

26 “How To Save Money on Heating and Cooling Your Home,” Federal Trade Commission

SHARE

Related Articles

4 Tips for Better Financial Habits

Good financial habits can help you improve your overall financial well-being. Learn how these four tips can help jumpstart your journey to financial success.

Tips on How to Use Credit Cards for Financial Flexibility

Want to know how to use credit cards to increase your financial flexibility? Here’s how one credit card user has done it over the years.

What Is Personal Finance?

Personal finance refers to managing money in a way that works for you, while at the same time planning for your future goals. Learn more about how it works.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.