Buy Now, Pay Later with Plan It® by American Express

Pay in monthly installments to help stay in control for

whatever comes your way.

NO ENROLLMENT

EASY TO MANAGE

WORLD CLASS SERVICE + PROTECTION

Split up large purchases into monthly installments with a fixed fee, plus still earn rewards the way you usually do.

Plan It is a payment option that provides added flexibility and is built right into American Express® Personal Cards.

A fixed monthly fee is shown upfront, so you’ll know exactly how much you’ll pay each month.

It’s easy to use– select the plan length that works for you.

See full Plan It terms below.‡

Choose Plan It at checkout when booking your next trip.

Book your flight now and pay later when selecting Plan It at checkout on delta.com. Now, you have the flexibility of paying for purchases of $100 or more in equal monthly payments with a fixed fee. You’ll still earn rewards the way you usually do on your American Express Card. Terms Apply.‡

You can choose Plan It at checkout on AmexTravel.com, making it easy for you to pace out your payments. Split the cost of your flight, pre-paid hotel, and pre-paid car rental bookings of $100 or more, when purchased separately, into equal monthly installments with a fixed fee — and still earn rewards the way you usually do on your American Express Card.‡

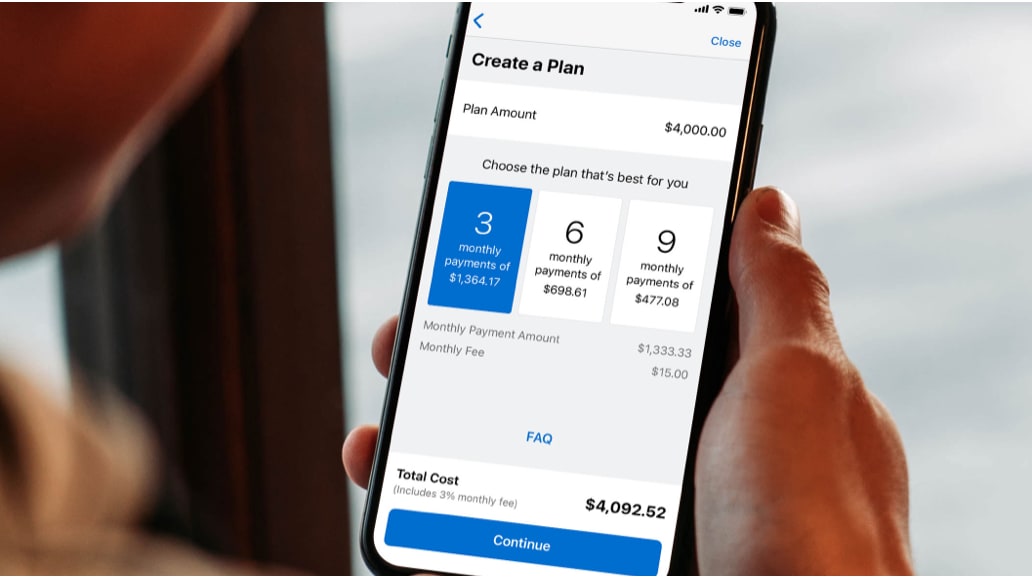

Three easy steps to use Plan It in your online account or the American Express® App‡:

Select a purchase of $100 or more to put into a plan.

Select a plan option that works for you, and see exactly how much you’ll pay each month.*

Review and confirm. The monthly plan payment is automatically included in the Minimum Payment Due each month.

*You will be offered 1-3 plan duration options. The plan duration options can vary based on a variety of factors such as the purchase amount, your account history, and your creditworthiness. If you are enrolled in an intro or promotional APR, you may see limited plan duration options during the intro or promotional period when you use Plan It on your account.

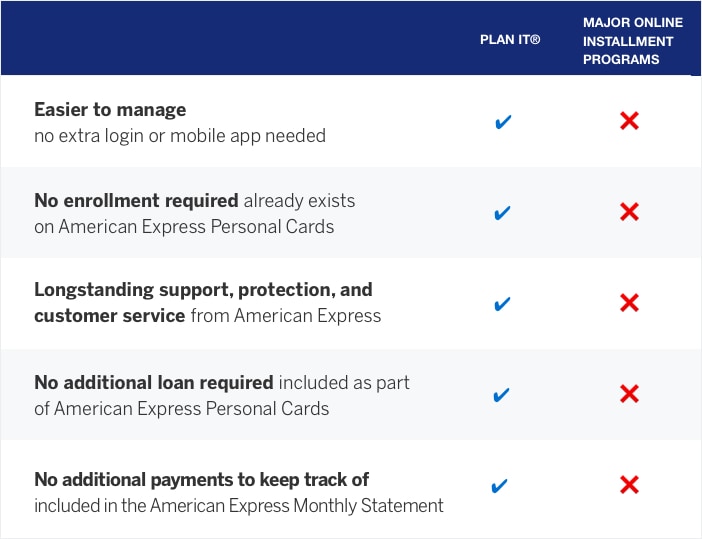

What makes Plan It different?

Unlike the major online installment programs, Plan It is built into American Express® Personal Cards.

See how the benefits of Plan It compare.

Join the millions of Card Members who have created a plan.

Explore your options before making a purchase using our Plan It Calculator.

American Express also helps you manage your everyday expenses by quickly paying small purchase amounts and still earn rewards the way you usually do with Pay It in the American Express® App.‡

See full Pay It terms below.

Explore the many ways we have your back.

Rewards

Choose a Card with rewards that match your lifestyle. Earn points, cash back or partner rewards.

Card Acceptance

American Express can now be accepted at 99% of places in the US that accept credit cards. Based on Feb 2021 Nilson Report.

Amex Offers

Amex Offers rewards you at places you like to shop, dine, travel, and more.‡

Intro Offer

Blue Cash Everyday® Card

Buy Now, Pay Later Intro Plan It Fee Offer

Enjoy $0 Introductory Plan It fees on plans created during the first 15 months after account opening. For plans created after that, a plan fee up to 1.33% of each purchase amount moved into a plan based on the plan duration, the APR that would otherwise apply to the purchase, and other factors will apply.¤1

Plus, enjoy the following Card benefits:

No annual fee¤

0% intro APR on purchases for 15 months from the date of account opening, then a variable APR, 13.99% to 23.99%¤

Unlimited 1% cash back on purchases in the form of Reward Dollars that can be redeemed as a statement credit.+

Earn $200 back after you spend $2,000 in purchases on your new Card in your first 6 months. You will receive the $200 back in the form of a statement credit.†

Want to know more about Plan It?

Plan It

With Plan It, you can create up to 10 active payment plans, each subject to a plan fee. The plan fee is a fixed finance charge that will be charged each month that the corresponding plan is active.

To create a plan, select qualifying purchases of $100 or more and a plan duration. If you have a Card with a Credit Limit, you may also be able to select a qualifying amount of $100 or more and a plan duration. When creating a plan for purchases, you may select up to 10 qualifying purchases for each plan that you create in your American Express online Account. However, you may select only one qualifying purchase for each plan that you create in the American Express App. Plan duration options may vary depending on the total dollar amount of the qualifying purchases (or qualifying amount, if you have a Card with a Credit Limit) you move into a Plan. Qualifying purchases will be identified in your American Express online Account and American Express App. Qualifying purchases (or a qualifying amount, if you have a Card with a Credit Limit) do not include purchases of cash or cash equivalents, purchases subject to Foreign Transaction Fees, or any fee owed to us, including Annual Membership fees. Unless you are creating a plan at checkout, please allow 2-3 days for your purchase to post to your account. Once your purchase posts and is no longer pending, you can create a plan for that purchase.

Your ability to create plans will be based on a variety of factors such as your creditworthiness, and your Credit Limit or Pay Over Time Limit, as applicable. The Pay Over Time Limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances. You may not be able to create a plan if it would cause you to exceed your Pay Over Time Limit or cause your Plan balance to exceed 95% of your Account Total New Balance on your last billing statement. You will not be able to create plans if your Pay Over Time feature is suspended or your Account is canceled. You will also not be able to create plans if one or more of your American Express Accounts is enrolled in a payment program, has a payment that is returned unpaid, or is past due. The number and length of plan duration options offered to you, the number of active plans you can have at a time, and your ability to include multiple qualifying purchases in a single plan, will be at our discretion and will be based on a variety of factors such as your creditworthiness, the purchase amount(s), and your Account history. After a plan is paid in full, it will be removed from your Account in the next billing period.

Plan It is available on Card Accounts issued by a U.S. banking subsidiary of American Express, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Only the Basic Card Member or Authorized Account Managers on the Account can create a plan. Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or Account numbers issued by other financial institutions are not eligible.

Pay It

Pay It® is only available in the American Express App® for your eligible Account. With the Pay It feature, you can make a payment equal to the amount of a billed purchase less than $100. Payments made with Pay It are not applied to that billed purchase but to your outstanding balance in accordance with how we apply payments.

Your account is eligible for Pay It if you are a Basic Card Member or Additional Card Member of a Card account issued by a U.S. banking subsidiary of American Express that is not canceled, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or account numbers issued by other financial institutions are not eligible.

American Express App

The American Express® App and app features are available only for eligible Card accounts in the United States. American Express® prepaid Cards and Cards issued by non-American Express issuers are not eligible. To log in, Card Members must have an American Express user ID and password or create one in the app.

iOS and Android only. See app store listings for operating system info. Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trademarks of Google Inc.

Amex Offers

Eligible Card Members can redeem an Amex Offer by first enrolling in the offer in their online account or in the American Express® App and then using their enrolled Card to pay. Only U.S.-issued American Express Consumer and Business Cards and registered American Express Serve® and Bluebird cards may be eligible. We may consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your eligibility to access Amex Offers. You may not be eligible to access Amex Offers if we, in our sole discretion, determine that you have previously engaged in abuse, misuse or gaming of the Amex Offers program, or any other Amex program. Available offers may vary for each eligible Card Member. Please review the terms of each offer for details on how to redeem. For full Program Terms, visit https://www.amexoffers.com/partnerterms

Seller of Travel

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our travel consultants. For more information visit www.americanexpress.com/travelterms.

California CST#1022318; Washington UBI#600-469-694.