Membership Rewards® Points Calculator

See how your spending can earn you rewards

Take that trip you've been dreaming about. Use points towards all or part of your travel booking on AmexTravel.com.4

Want more flexibility? Transfer points to a participating loyalty program.5

Shop now for experiences and products ranging from the latest tech to home appliances.6

Use points at checkout online and offline to save on purchases at the places you love to shop.

Retail, restaurant, entertainment, travel, and American Express® gift cards. There's something for everyone.

Cover the cost of your recent Card purchases with points. From big-ticket items to your morning coffee, the choice is yours.7

TERMS AND CONDITIONS

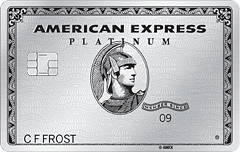

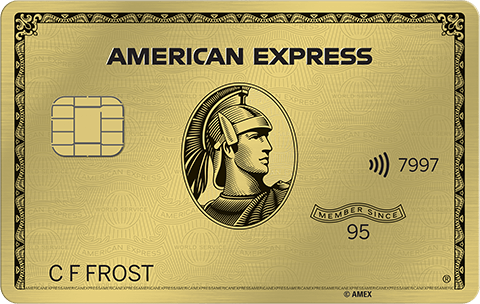

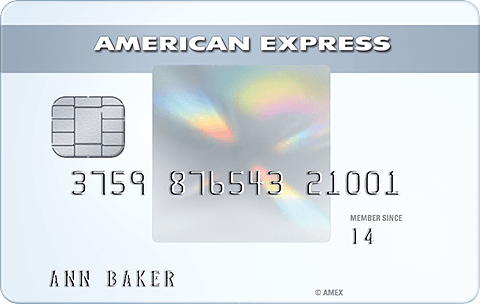

1. Amex EveryDay 2-1

For each dollar charged on an eligible purchase in each billing period on your Amex EveryDay® Credit Card from American Express, you earn one Membership Rewards® point. You earn: 1 additional point (for a total of 2 points) on the first $6,000 of eligible purchases in a calendar year at supermarkets located in the U.S. (superstores and warehouse clubs are not considered supermarkets). Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, balance transfers, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards; person-to-person payments or purchases of other cash equivalents. Additional terms and restrictions apply. Merchants are assigned codes based on what they primarily sell. A purchase will not earn additional points if the merchant’s code is not eligible. Purchases made through a third-party payment account or on an online marketplace (with multiple retailers) will not earn additional points. A purchase may not earn additional points if the merchant submits the purchase using a mobile or wireless card reader or if you use a mobile or digital wallet.

2. 20% Extra Points Benefit.

How the Benefit Works. If you make 20 or more separate purchases of goods or services in a billing period with your Amex EveryDay® Credit Card (“Card”), you earn 20% extra Membership Rewards points on those purchases less returns and credits with a date in that billing period. A transaction where you buy multiple items counts as one purchase. Purchases do not include fees or interest charges, balance transfers, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.

This benefit will not apply to any limited time promotions and offers (such as a Welcome Bonus).

Impact of Returns and Credits. Returns and credits do not reduce your purchase count. Returns and credits will reduce the number of Membership Rewards points and extra Membership Rewards points earned.

Example: Suppose in a billing period you make 20 purchases totaling $500 and you return a $200 item that you purchased in the same or a prior billing period. The return does not reduce your purchase count, but it does reduce the Membership Rewards points on those purchases from 500 to 300. So, in this example you would earn 20% extra on those 300 points.

When Purchases Count. To count purchases for this benefit, we use the date of the purchase. For example, if you make a purchase on the last day in your January billing period, it might not post to your account until your February billing period. If this happens, the purchase still counts towards your January billing period. In rare instances, a purchase may not post to your account for several billing periods. For example, extreme weather or other business disruptions may delay a merchant in submitting transactions to us. If a purchase posts to your account more than four billing periods after the purchase date, we count it for the billing period in which it posts, and not the purchase date.

Some merchants combine separate charges into a single transaction before submitting it to us. When this happens, the combined transaction will count as a single purchase for purposes of counting towards 20 separate purchases. For example, if you charge three items to your Card at the same online merchant at three separate times over one or more days, the merchant may combine those three charges and submit them as a single transaction. In that case, that combined transaction will count as one purchase.

Transaction Dates. A date of a purchase, return or credit may sometimes be different from the date you made the transaction. For example, if you buy goods online, the purchase date may be the date the goods are shipped. Also, if you use your Card while traveling (on a hotel, car rental, or while on a cruise), the purchase date may be the date you complete that travel.

General Terms. You will typically earn the 20% extra Membership Rewards points 8-12 weeks after the billing period in which you make the 20 or more eligible purchases.

3. Membership Rewards® Program

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

4. Shop with Membership Rewards® Points

To use Pay with Points, you must charge your eligible purchase through American Express Travel to a Membership Rewards® program-enrolled American Express® Card. Eligible purchases through American Express Travel exclude car reservations and non-prepaid hotels. Points will be debited from your Membership Rewards account, and credit for corresponding dollar amount will be issued to the American Express Card account used. If points redeemed do not cover entire amount, the balance of purchase price will remain on the American Express Card account. Minimum redemption 5,000 points.

See membershiprewards.com/terms for the Membership Rewards program terms and conditions.

If a charge for a purchase is included in a Pay Over Time balance on your Linked Account the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead the statement credit may be applied to your Pay in Full balance. If you believe this has occurred, please contact us by calling the number on the back of your Card.

5. Membership Rewards® Program-Transfer Points

Enrollment in a participating Frequent Flyer or Frequent Guest program is required. Airline tickets and guest rooms are subject to availability. For each conversion of points into the Frequent Flyer program of a U.S. airline, a fee of $0.0006 per point, with a maximum fee of $99, will be charged to your Card account. We charge this fee to offset the federal excise tax we must pay on such conversions. The fee may be more or less than the actual amount of the excise tax we pay on any individual conversion. We may offer you the option to redeem points to cover this fee.

6. Shop with Membership Rewards® Points

When using points for products through membershiprewards.com you are purchasing directly from a merchant, not from American Express. Participating merchants determine (i) product prices and availability, (ii) offers, promotions and applicable restrictions, (iii) estimated shipping and (iv) estimated tax, all of which are subject to change at any time without notice and are only confirmed in the order confirmation email sent by the merchant.

For accounts that qualify, Membership Rewards® points will be deducted for the purchase, including estimated shipping/handling and applicable taxes. A debit for the purchase will be issued by the merchant, and a credit for the purchase, including estimated shipping/handling and applicable taxes, will be issued by American Express to the Card account that you have designated for purchasing products through membershiprewards.com. Please note: The debit and credit may not appear on the same billing statement. Card Members enrolled in the Membership Rewards program with any account that is canceled, past due or have a return payment outstanding are not eligible to redeem points.

7. Using Points for Charges

Using Points for Your Charges is only available to Basic Consumer and OPEN Card Members enrolled in the U.S. Membership Rewards® program. Additional Card Members, Authorized Additional Card Members, and Corporate Card Members are not eligible. Account managers and Rewards managers may be eligible to use points by calling the number on the back of your Card but are not eligible to use points online. All Linked Card Accounts must not be canceled, past due or have a returned payment outstanding. A minimum of 1,000 Membership Rewards points in your program Account is required and you may use Membership Rewards points only toward the entire amount of an eligible charge. American Express will present the eligible charges you can use points towards, and we may change which charges are eligible at any time without notice. American Express is under no obligation to make charges available for redemption using Membership Rewards points. For each transaction, points will be debited immediately from your Membership Rewards program Account and a credit will be issued to your Linked Card Account for the corresponding dollar amount within 48 hours. Credits processed after the Card Account’s statement closing date will appear in the following billing period. You are responsible for payment of the amount due on your Card Account by the due date even after using this feature. To learn about this feature and redeem points online, visit membershiprewards.com/yourcharges.

American Express Travel Related Services Company, Inc.,when acting solely as a sales agent for travel suppliers, is not responsible for the actions or inactions of such suppliers. We want you to be aware that certain suppliers pay us commissions and other incentives for reaching sales targets or other goals, and may also provide incentives to our travel counselors. For more information please visit americanexpress.com/travelterms

California CST#1022318, Washington UBI#600-469-694, Iowa TA#669.