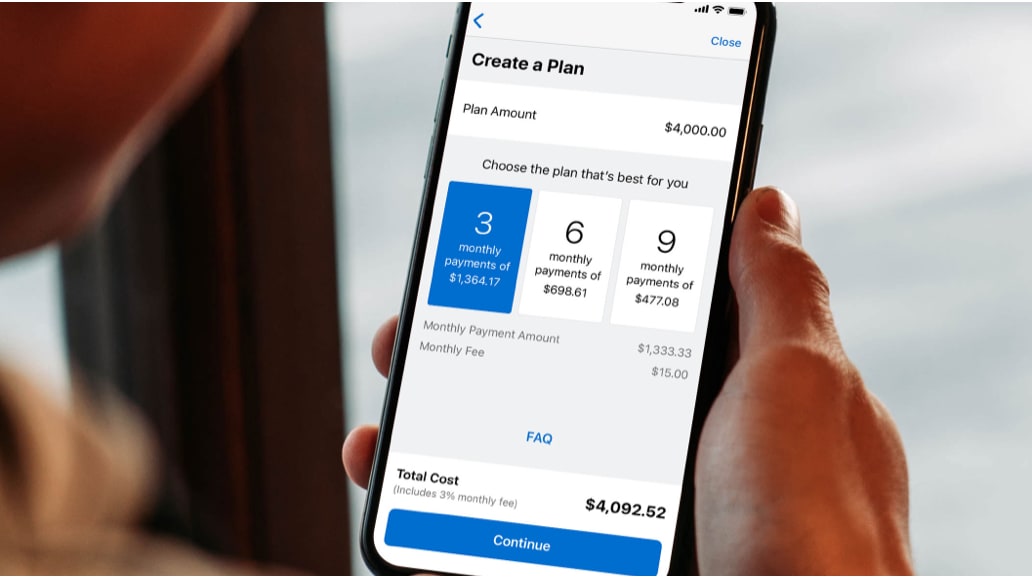

Split up large purchases into equal monthly installments with a fixed fee, plus still earn rewards on purchases the way you usually do. ‡

Plan It is a payment option that provides added flexibility and is built right into your Card.

A fixed monthly fee is shown upfront, so you’ll know exactly how much you’ll pay each month.

It’s easy to use– choose from one of the avaliable plan lengths.

See full Plan It terms below. ‡

Choose Plan It at checkout when booking your next trip.

Book your flight now and pay later when selecting Plan It at checkout on delta.com. You have the flexibility of paying for purchases of $100 or more in equal monthly payments with a fixed fee. You’ll still earn rewards the way you usually do on your American Express Card. Terms Apply.‡

You can choose Plan It at checkout on AmexTravel.com, making it easy for you to pace out your payments. Split the cost of your flight, pre-paid hotel, and pre-paid car rental bookings of $100 or more, when purchased separately, into equal monthly installments with a fixed fee — and still earn rewards the way you usually do on your American Express Card.‡

Three easy steps to use Plan It‡ in your online account or the American Express® App‡:

Select a purchase of $100 or more to put into a plan.

Select from one of the avaliable plan options and know how much you'll pay each month.

Review and confirm. The monthly plan payment is automatically included in the Minimum Payment Due each month.

Illustrative image only.

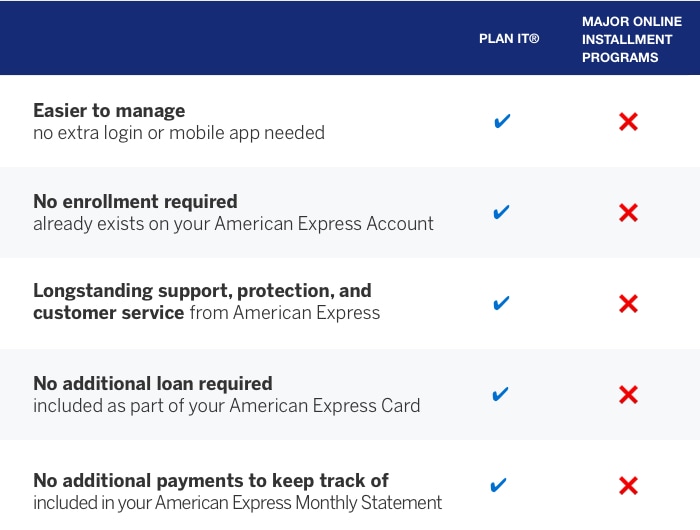

What makes Plan It different?

Unlike the major online installment programs, Plan It is built into your American Express® Card.

See how the benefits of Plan It compare.

Join the millions of Card Members who have created a plan.

Explore your options before making a purchase using our Plan It Calculator.

Pay It®‡ lets you tap in the American Express® App‡ to quickly pay for small purchase amounts throughout the month and still earn rewards on purchases the way you usually do.

See full Pay It terms below. ‡

Frequently asked questions

No. Instead, you’ll pay a fixed monthly plan fee for the duration of your plan that will be disclosed upfront.

If you have an eligible Card with the Plan It feature, you can use the Plan It Pre-Purchase Calculator to view the plan duration and plan fee options that could be available for a specific dollar amount prior to making a large purchase. To access the calculator, visit the Plan It hub on your online account.

If you don't have an eligible Card with the Plan It feature, you can visit the public Pre-Purchase Calculator here to view the monthly payment plan options that could be available on the Card.

The calculator is an illustrative tool only and does not provide the actual plan options that may be available to you when creating a plan. Your ability to make a purchase or create a plan equal to the amount you enter in this tool will be based on your account status, your Amount Available to Plan, and / or your credit limit. Your actual plan options with the monthly plan payment and plan fees will be presented to you if you choose to create a plan.

You can’t cancel a plan after it’s been set up, but you can pay a billed plan early by paying the New Balance shown on your most recent billing statement in full. If you pay off a billed plan early, you won’t incur any future plan fees on that plan.

If you pay the updated Total Balance on your account in full, you will pay off your entire balance including any newly created plans in your current billing period. You can view your updated Total Balance by logging into your online account, or by calling us at the number on the back of your Card.

Please keep in mind it takes 24-48 hours for your balances to update after creating a plan.

You’ll see an Adjusted Balance on your account whenever you have active plans. Any amount you pay above your Adjusted Balance will be applied towards your remaining plan balance.

If you have a Consumer Card product with a Credit Limit, your Adjusted Balance includes your billed, non-plan portion of your Remaining Statement Balance and monthly Plan Payment Due. If you pay the Adjusted Balance by your Payment Due Date each month, you’ll avoid being charged interest on purchases.

If you have a Consumer Card product with Pay Over Time, your Adjusted Balance includes your Pay In Full New Balance, Pay Over Time and/or Cash Advance New Balance, and monthly Plan Payment Due. If you pay the Adjusted Balance by your Payment Due Date each month, you’ll avoid being charged interest on charges automatically added to a Pay Over Time balance.

A qualifying purchase for Plan It is at least $100 (or qualifying amounts of $100 or more, if you have a Consumer Card with a Credit Limit) and does not include a purchase of cash or cash equivalent, balance transfers (if offered), a purchase subject to foreign transaction fees, or any fees owed to us (including annual membership fees); as long as it remains within your Amount Available to Plan and does not exceed your Pay Over Time Limit or 95% of your Credit Limit, as applicable.

Qualifying purchases include recent purchases posted to your account and purchases shown on your most recent billing statement.

Qualifying amounts include purchases shown on your most recent billing statement.

Plan It is available on Consumer Card Accounts issued by a U.S. banking subsidiary of American Express, excluding Accounts that do not have a Credit Limit and do not have the Pay Over Time feature.

Certain accounts are not enrolled due to account status, Card type, or the date of the account opening. If your account is enrolled at a later date, you will receive a communication.

Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or account numbers issued by other financial institutions are not eligible for Plan It. Only Basic Card Members or Authorized Account Managers with Full Access can set up plans on the account.

You can't change the duration of a plan after it's been set up, but you can pay a billed plan early by paying the New Balance shown on your most recent billing statement in full. If you pay off a billed plan early, you won't incur any future plan fees on that plan.

If you pay the updated Total Balance on your account in full, you will pay off your entire balance including any newly created plans in your current billing period. You can view your updated Total Balance by logging into your online account, or by calling us at the number on the back of your Card.

Please keep in mind it takes 24-48 hours for your balance to update after creating a plan.

You will be offered 1-3 plan duration options for a qualifying purchase or qualifying amount. The plan duration options can vary based on a variety of factors such as your creditworthiness, the purchase amount, and your Account history. The duration can't be changed or modified.

If your account is in an introductory or promotional period with a promotional APR, you may see limited duration options.

Yes. You may not be able to create a plan if it would cause:

- your plan balance to exceed 95% of your Account Total New Balance on your last billing statement. This limit only applies if you're using the Plan It feature to plan purchase amounts shown on your last billing statement. Plans you create for recent purchases that have posted to your account but have not yet been billed don't count against this limit

- your plan balance to exceed 95% of your Credit Limit

- you to exceed your Pay Over Time Limit.

Since your Amount Available to Plan is based on a portion of your balance, it can vary from month to month. Overall, your ability to create plans will be based on a variety of factors such as your creditworthiness, and your Credit Limit or Pay Over Time Limit, as applicable.

Note, the Pay Over Time Limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances.

Qualifying purchases on AmexTravel.com for Plan It include flight and pre-paid hotel bookings when purchased seperately. You cannot use Plan It on flight + hotel combined bookings or other similar packages.

Pay It®

Pay It® is only available in the American Express App® for your eligible Account. With the Pay It feature, you can make a payment equal to the amount of a billed purchase less than $100. Payments made with Pay It are not applied to that billed purchase but to your outstanding balance in accordance with how we apply payments.

Your Account is eligible for Pay It if you are a Basic Card Member or Additional Card Member of a Card account issued by a U.S. banking subsidiary of American Express that is not canceled, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or account numbers issued by other financial institutions are not eligible.

Plan It®

With Plan It®, you can create up to 10 active payment plans, each subject to a plan fee. The plan fee is a fixed finance charge that will be charged each month that the corresponding plan is active. You will be offered 1-3 plan duration options for the qualifying purchase. The plan duration options can vary based on a variety of factors such as the purchase amount, your Account history and your creditworthiness. If you are enrolled in an intro or promotional APR, you may see limited plan duration options during the intro or promotional period when you use Plan It on your Account. If you create a plan during an introductory or promotional APR period, your plan fee will be based on the introductory or promotional APR as long as the plan is created before 11:59pm MST on the last day of the introductory or promotional period.

To create a plan, select qualifying purchases of $100 or more and a plan duration. If you have a Card with a Credit Limit, you may also be able to select a qualifying amount of $100 or more and a plan duration. When creating a plan for purchases, you may select up to 10 qualifying purchases for each plan that you create in your American Express online Account. However, you may select only one qualifying purchase for each plan that you create in the American Express App. Qualifying purchases will be identified in your American Express online Account and American Express App. Qualifying purchases (or a qualifying amount, if you have a Card with a Credit Limit) do not include purchases of cash or cash equivalents, balance transfers (if offered), purchases subject to Foreign Transaction Fees, or any fee owed to us, including Annual Membership fees. Unless you are creating a plan at checkout, please allow 2-3 days for your purchase to post to your Account. Once your purchase posts and is no longer pending, you can create a plan for that purchase.

Your ability to create plans will be based on a variety of factors such as your creditworthiness, and your Credit Limit or Pay Over Time Limit, as applicable. The Pay Over Time Limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances. You may not be able to create a plan if it would cause you to exceed your Pay Over Time Limit or cause your Plan balance to exceed 95% of your Account Total New Balance on your last billing statement. You will not be able to create plans if your Pay Over Time feature is suspended or your Account is canceled. You will also not be able to create plans if one or more of your American Express Accounts is enrolled in a payment program, has a payment that is returned unpaid, or is past due. The number and length of plan duration options offered to you, the number of active plans you can have at a time, and your ability to include multiple qualifying purchases in a single plan, will be at our discretion and will be based on a variety of factors such as your creditworthiness, the purchase amount(s), and your Account history. After a plan is paid in full, it will be removed from your Account in the next billing period.

Plan It is available on Card Accounts issued by a U.S. banking subsidiary of American Express, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Only the Basic Card Member or Authorized Account Managers on the Account can create a plan. Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or Account numbers issued by other financial institutions are not eligible.

American Express App

iOS and Android only. See app store listings for operating system info.

Apple, the Apple logo, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.

iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license.App Store is a service mark of Apple Inc. Android, Google Play, and the Google Play logo are trademarks of Google LLC.

Seller of Travel

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our travel consultants. For more information visit www.americanexpress.com/travelterms.

California CST#1022318; Washington UBI#600-469-694.