Open Up Your Possibilities

with the American Express®

App*

Scan the QR code to download the Amex App on your mobile device.

Manage your Card and Banking accounts on the go.

MANAGE YOUR ACCOUNT

Keep information up to date across all your accounts in one place.

It's easier than ever to manage your profile with the latest Account experience in the Amex App.

MEMBERSHIP

Get the most out of your benefits with the improved Membership

experience.

Redeem rewards, enroll in benefits, use points for gift cards and more.

SEND & SPLIT ®

Send Money to any Venmo or PayPal user in the Amex App.

You spend with Amex and you can send with Amex. Pay any other Venmo or PayPal users with the flexibility of Amex, plus there's no standard Venmo PayPal credit card fee*.

AMEX OFFERS

Earn even more with monthly offers.

Add offers to your card with just one tap to get rewarded at the places you love to shop*.

AWARD-WINNING SERVICE

We’re here to chat 24/7.

Start a chat with us in seconds and revisit conversations any time in the app.

Spend and pay the way you want.

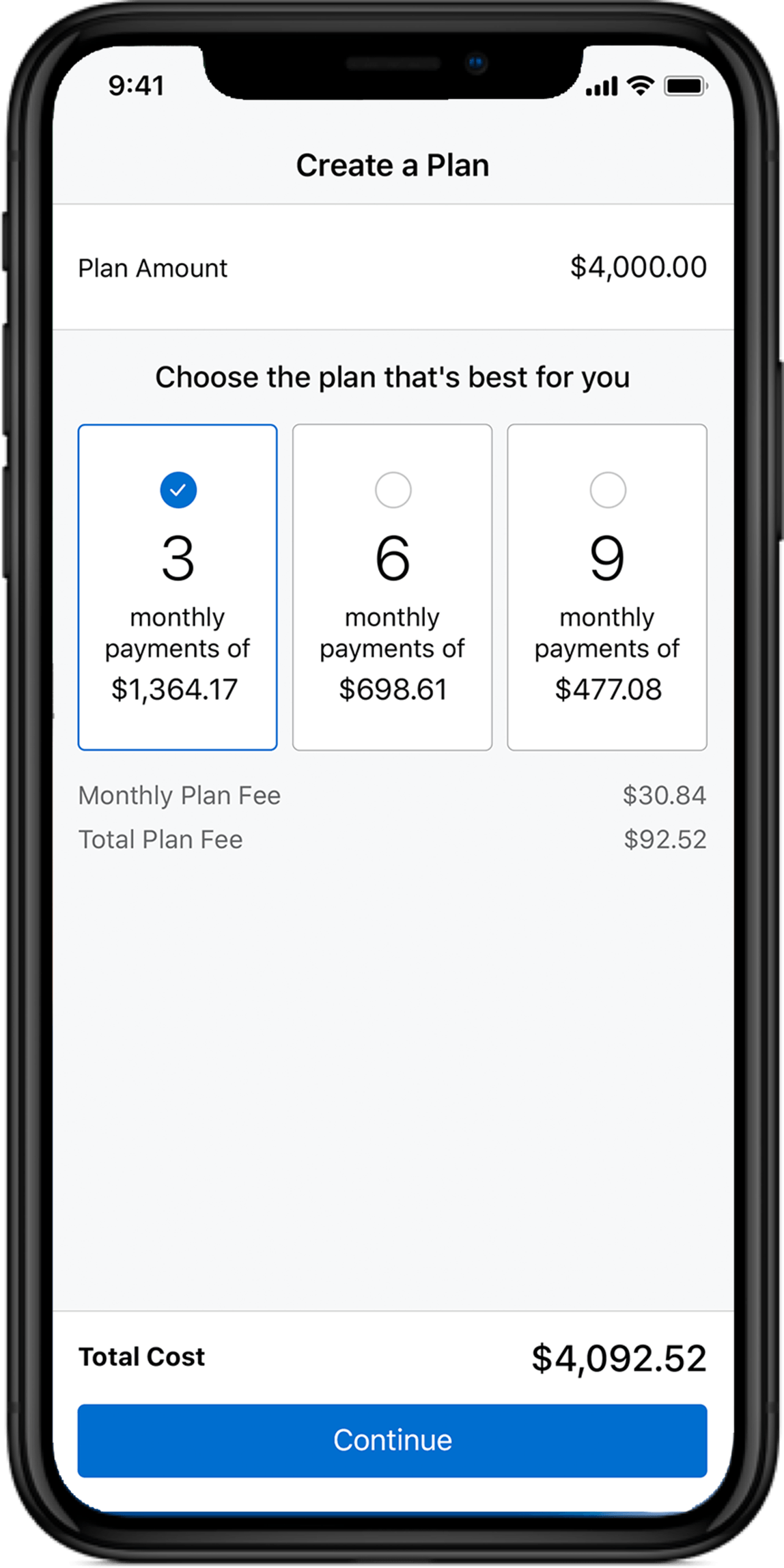

Plan it®

Build plans around your budget

Tap the eligible purchases you want to split up into monthly payments with a fixed fee*.

AUTOPAY

Put your payments on autopilot

Schedule monthly payments – and have one less thing to think about.

*Terms and Conditions

Membership Rewards ® Program

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

Send & Split®

Send & Split® is only available in the American Express® App (“Amex App”) to Card Members with an eligible Card. Eligible Cards are US-issued Basic Consumer Cards that are issued by American Express National Bank and are not cancelled. Prepaid Cards, American Express Corporate Cards, American Express Small Business Cards, American Express-branded cards or account numbers issued by other financial institutions and American Express Cards issued outside of the United States are not eligible Cards. To use Send & Split, you must first have an email address on file, enroll in Send & Split® in your American Express Online Account (“Online Account”) and open an Amex Send® stored balance account in the Amex App (“Send Account”). Send & Split allows you to: (i) send a person-to-person payment from your Send Account to Venmo and PayPal users (“Send”) and (ii) split a Card purchase (“Split”) and receive funds to your Card account as a statement credit or to your linked Venmo or PayPal account. You may use Send & Split® with an Additional consumer Card that is issued in the US by American Express National Bank and is not cancelled if you also have an eligible Card in the same Online Account and that Online Account is enrolled in Send & Split. You must have or create an account with Venmo or PayPal and link your Online Account to your PayPal or Venmo account to use Send & Split. You must add money to your Send Account from your eligible Card(s) to Send to a Venmo or PayPal recipient. The money you add will be reflected in your Send Account balance. The charge on your Card for an Add Money transaction does not earn rewards and is subject to the Card’s purchase APR. Once the Send from your Send Account is available in the recipient’s Venmo or PayPal account, you do not have the ability to cancel the transaction. There is no fee to Send to US recipients. PayPal charges a fee to Send to non-US recipients. With Split, you can split pending or posted purchases that are made with your eligible Card in your Amex App. Once you select a purchase to Split, select the contacts you want to request to Split with. You can choose to get paid back as a statement credit to your Card account (a Split credit) or to your linked Venmo or PayPal account. Split credits to your Card account apply when we receive confirmation that the Split request was completed but may take 24-36 hours to post to your Card account. You are still responsible to pay the full purchase amount charged to your Card, regardless of whether you are paid back via Split. You earn rewards for purchases that you split in the same way that you earn rewards for other purchases. Other eligibility and restrictions apply.

Amex Offers

Eligible Card Members can redeem an Amex Offer by first enrolling in the offer in their online account or in the American Express® App and then using their enrolled Card to pay. Only U.S.-issued American Express Consumer and Business Cards and registered American Express Serve® and Bluebird cards may be eligible. We may consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your eligibility to access Amex Offers. You may not be eligible to access Amex Offers if we, in our sole discretion, determine that you have previously engaged in abuse, misuse or gaming of the Amex Offers program, or any other Amex program. Offers are also available to Additional Card Members and available offers may vary for each eligible Card Member. Please review the terms of each offer for details on how to redeem. For full Program Terms, visit www.americanexpress.com/us/amexoffersterms/.

Plan It ®

With Plan It®, you can create up to 10 active payment plans, each subject to a plan fee. The plan fee is a fixed finance charge that will be charged each month that the corresponding plan is active. You will be offered 1-3 plan duration options for the qualifying purchase. The plan duration options can vary based on a variety of factors such as the purchase amount, your Account history and your creditworthiness. If you are enrolled in an intro or promotional APR, you may see limited plan duration options during the intro or promotional period when you use Plan It on your Account. If you create a plan during an introductory or promotional APR period, your plan fee will be based on the introductory or promotional APR as long as the plan is created before 11:59pm MST on the last day of the introductory or promotional period.

To create a plan, select qualifying purchases of $100 or more and a plan duration. If you have a Card with a Credit Limit, you may also be able to select a qualifying amount of $100 or more and a plan duration. When creating a plan for purchases, you may select up to 10 qualifying purchases for each plan that you create in your American Express online Account. However, you may select only one qualifying purchase for each plan that you create in the American Express App. Qualifying purchases will be identified in your American Express online Account and American Express App. Qualifying purchases (or a qualifying amount, if you have a Card with a Credit Limit) do not include purchases of cash or cash equivalents, balance transfers (if offered), purchases subject to Foreign Transaction Fees, or any fee owed to us, including Annual Membership fees. Unless you are creating a plan at checkout, please allow 2-3 days for your purchase to post to your Account. Once your purchase posts and is no longer pending, you can create a plan for that purchase.

Your ability to create plans will be based on a variety of factors such as your creditworthiness, and your Credit Limit or Pay Over Time Limit, as applicable. The Pay Over Time Limit applies to the total of your Pay Over Time, Cash Advance, and Plan balances. You may not be able to create a plan if it would cause you to exceed your Pay Over Time Limit or cause your Plan balance to exceed 95% of your Account Total New Balance on your last billing statement. You will not be able to create plans if your Pay Over Time feature is suspended or your Account is canceled. You will also not be able to create plans if one or more of your American Express Accounts is enrolled in a payment program, has a payment that is returned unpaid, or is past due. The number and length of plan duration options offered to you, the number of active plans you can have at a time, and your ability to include multiple qualifying purchases in a single plan, will be at our discretion and will be based on a variety of factors such as your creditworthiness, the purchase amount(s), and your Account history. After a plan is paid in full, it will be removed from your Account in the next billing period.

Plan It is available on Card Accounts issued by a U.S. banking subsidiary of American Express, excluding Accounts that do not have either a Credit Limit or the Pay Over Time feature. Only the Basic Card Member or Authorized Account Managers on the Account can create a plan. Prepaid Cards and products, American Express Corporate Cards, American Express Small Business Cards and American Express-branded Cards or Account numbers issued by other financial institutions are not eligible.

American Express ® App

The American Express® App and app features are available only for eligible accounts in the United States. American Express® prepaid Cards and Cards issued by non-American Express issuers are not eligible.

To log in, customers must have an American Express user ID and password or create one in the app.

Apple, the Apple logo, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.

iOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license.

App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trademarks of Google LLC.