Overview

Enhanced Authorization is a free solution from American Express that better identifies who is on the other end of transactions in real-time. Merchants who use Enhanced Authorization typically see increased approval rates, reduced false positives, and reductions in fraud, while maintaining a seamless customer experience.

Enhanced Authorization enables Merchants to share additional transaction data with American Express, such as email address, IP address, shipping information, phone numbers, and more. American Express uses its best-in-class machine learning models to link together thousands of factors including customer spending patterns, merchant profiles and real-time transaction data to significantly improve our ability to assess risk and distinguish between a legitimate customer and a fraudster.

Increase approval rates

Merchants typically see higher approval rates with Enhanced Authorization. Legitimate customers are more easily identified through the sharing of additional transaction information.

Reduce false positives

A customer attempting a large purchase at a merchant for the first time might have been declined but may now be approved based on the additional data the merchant provides to American Express.

Reduce fraud

Because Enhanced Authorization makes it easy to validate a customer, we can also accurately decline fraudulent purchase attempts.

Capture & Send Data

Merchant captures customer data and sends it to American Express at the time of authorization

Authorization Decision

American Express compares data against positive & negative usage across the network and other data sources, and incorporates the data into the authorization decision

Improved Response

American Express provides a more accurate authorization result in real-time

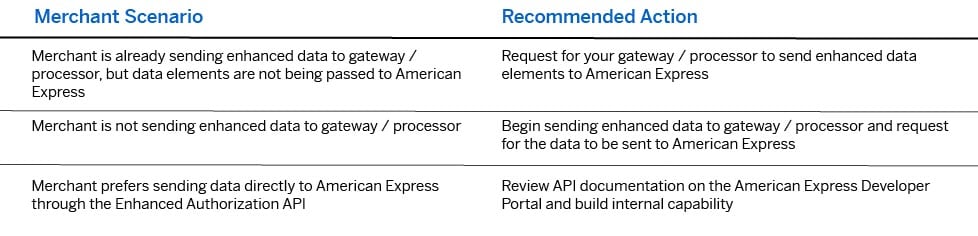

Option 1 (Recommended):

Authorization Request

Merchants populate optional data fields in the authorization request with data captured. American Express receives the data elements and uses them in real-time to provide a more accurate authorization response.

Option 2:

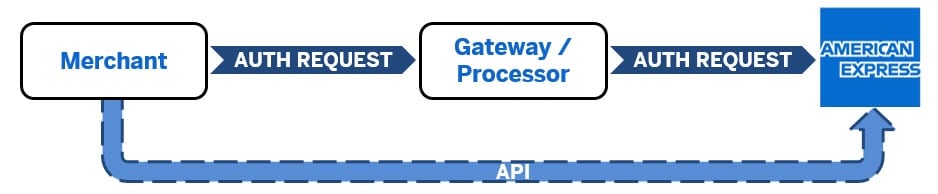

Enhanced Authorization API

Merchants capture data elements at the time of the transaction and sends an API message directly to American Express. When American Express receives the authorization request, it is combined with the data in the API message and used in real-time to provide a more accurate authorization response.

Click to access Enhanced Authorization API documentation on the American Express Developer Portal

For additional information after you have worked with your gateway / processor, please contact an American Express fraud representative: EnhancedAuth@aexp.com

All products and services may not be available to all merchants