Navigating Your Savings Account

Follow these helpful guidelines to navigate your American Express® Savings account.

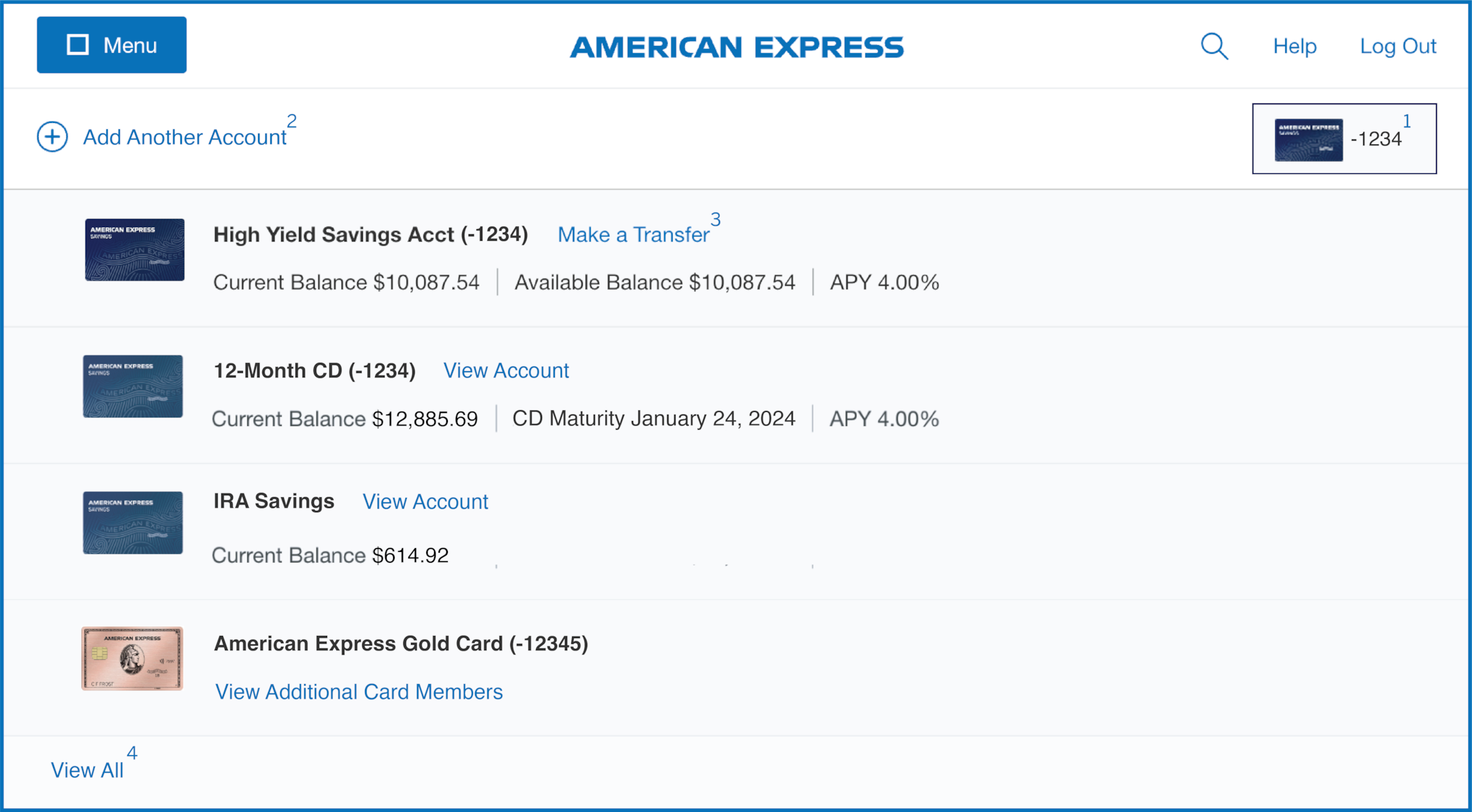

Viewing Your Account(s)

Welcome to the improved Savings experience! You can now manage your Savings account alongside your existing American Express accounts. To get acquainted with the new experience, first familarize yourself with the basics of switching your account view:

- To navigate between your accounts, click on the account button in the top right corner of the page. From here, a dropdown menu will appear that shows all your active accounts.

- To Add Another Account, click on the (+) button in the top left corner. This will allow you to add another American Express account to your account view.

- To Make a Transfer or View Account, click on the corresponding link next to the account. Note: Make a Transfer may not always be available depending on your account type.

- If you do not see all of your American Express accounts in the dropdown menu, click on View All in the bottom left corner.

Clicking any Savings account will take you to the Savings dashboard.

Savings Dashboard (Home)

The Savings Dashboard is your starting point when navigating within any High Yield Savings account (HYSA), Certificate of Deposit (CD), or Individual Retirement Account (IRA).

Whether you are viewing the details of your HYSA, CD, or IRA account, you will see the following information on your Dashboard:

- Current Balance

- Available Balance

- Interest YTD

- Account Number and Routing Number

By clicking on the View Account Details button, you will be taken to a more in-depth breakdown of your account.

You may also view your Account Activity by scrolling down on the page; here you can see any internal or external transfers to your account as well as Interest Payments.

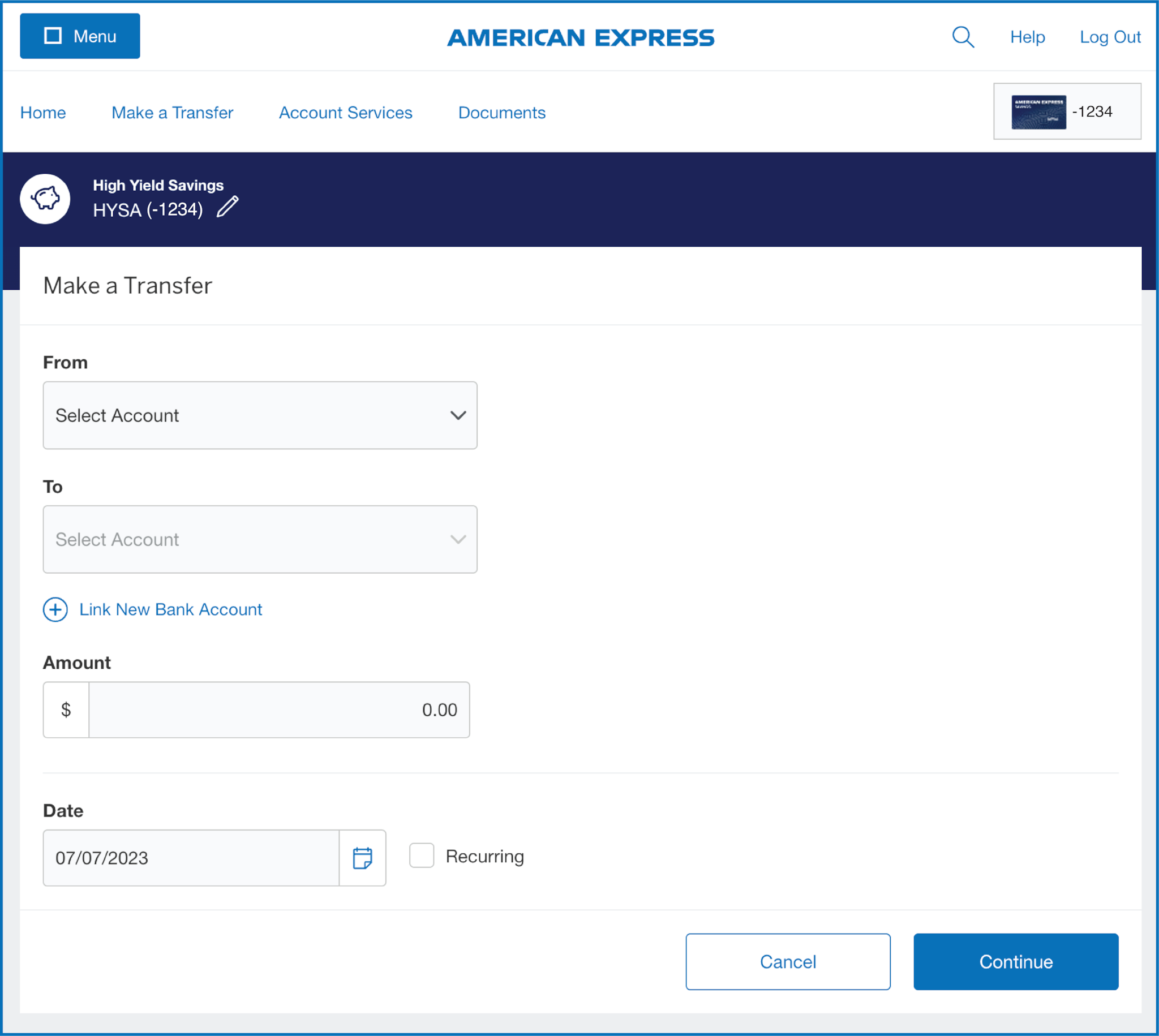

Make a Transfer

The Make a Transfer page allows you to transfer funds into or from your American Express Savings account.

For instructions on how to link an external bank account, visit our instruction page here.

For more information on how to Make a Transfer, click here.

The Make a Transfer page can be accessed via the top navigation menu within your Savings Dashboard.

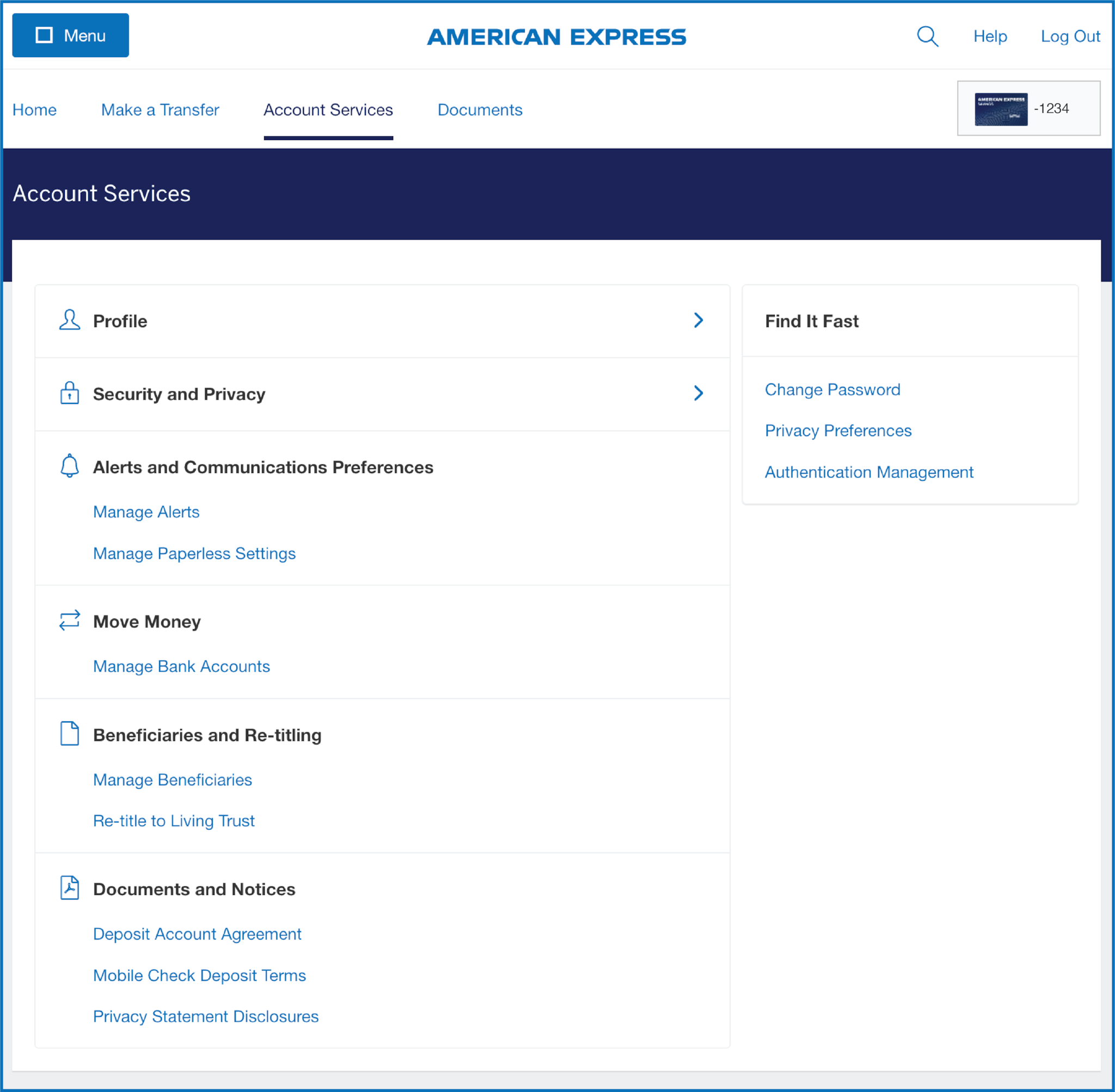

Account Services

The Account Services page allows you to manage your account in different ways:

- Profile includes your personal information, such as name, address, phone number, and email.

- Security and Privacy allow you to set your preferences regarding how you log in to your account, including authentication management.

- You can also review services such as your Alerts and Communications Preferences, Beneficiaries and Re-titling, and Documents and Notices.

The Account Services page can be the accessed via the top navigation menu within your Savings Dashboard.

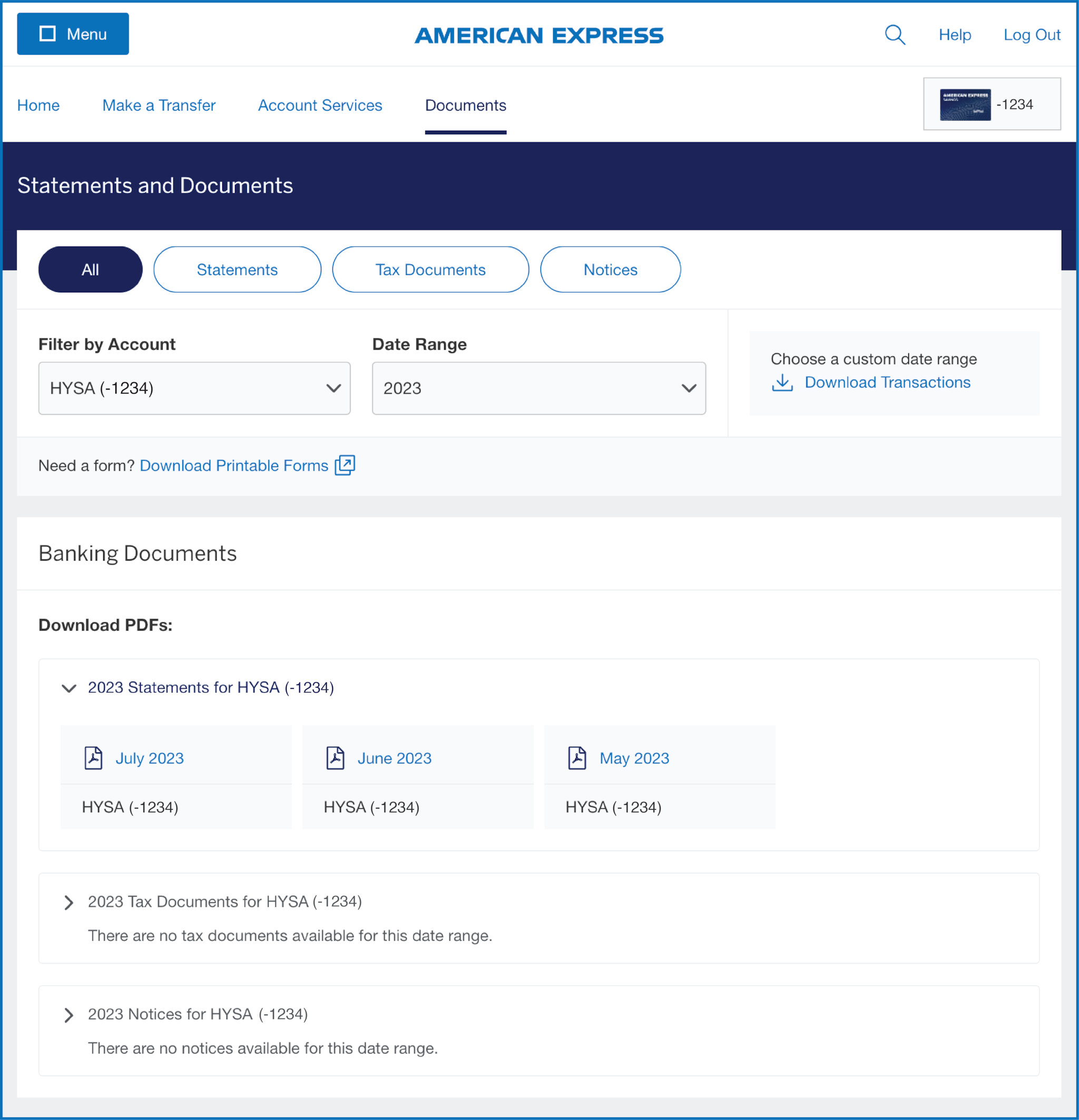

Documents

In the Documents page, you may view Statements, Tax Documents, and Notices. You may filter statements and documents by account as well as a specific date range.

You may download transactions here, so you can add them to a personal accounting software like Quicken or Mint.

The Documents page can be accessed via the top navigation menu and the PDF Statements link next to Account Services from the Savings Dashboard.

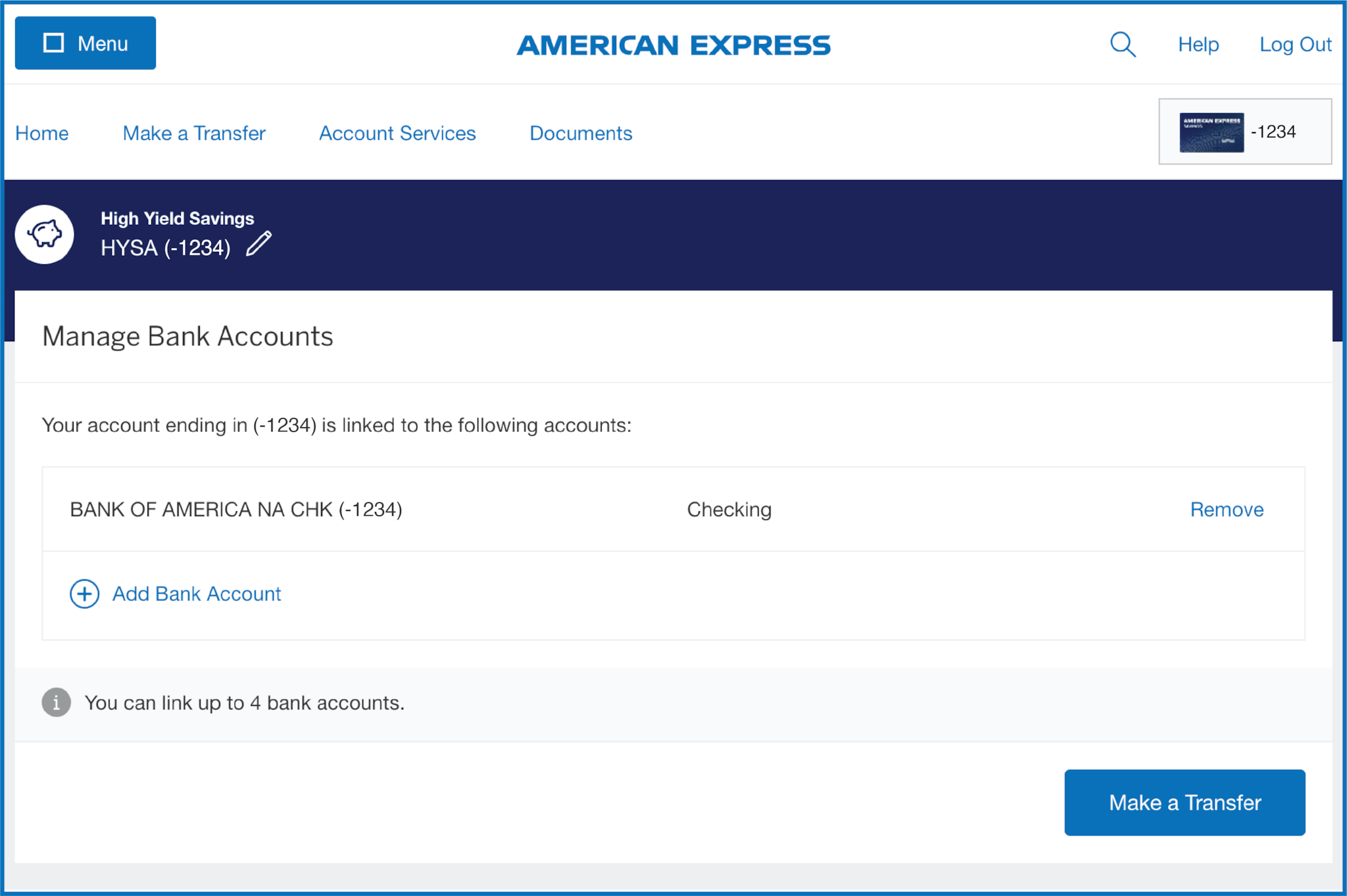

Manage Bank Accounts

In the Manage Bank Accounts page, you can link a new external bank account by selecting (+) Add Bank Account and remove a linked bank account by clicking Remove next to the bank account you wish to unlink.

This page can be accessed via the Manage Banks link on the Savings Dashboard under Useful Links, as well as the Manage Bank Accounts under the Move Money section on the Account Services page.

Log In To Your Savings Account

Accounts offered by American

Express National Bank. Member FDIC. Each depositor is insured to at least $250,000 per depositor, per insured bank, per ownership category.

* The Annual Percentage Yield (APY) as advertised is accurate as of . Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is opened. Interest Rate and APY of a Certificate of Deposit account is fixed once the account is funded.

** The national rate referenced is from the FDIC's published Monthly Rate Cap Information for Savings deposit products. Visit the FDIC website for details.

1 There is no minimum balance required to open your Account, to avoid being charged a fee, or obtain the Annual Percentage Yield (APY) disclosed to you.

2 For a CD account, rates are subject to change at any time without notice before the account is funded. The rate received will either be (i) the rate reflected during your application process or (ii) the rate being offered when your CD is funded, whichever is higher. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after completing your account-opening deposit. After a CD is opened, additional deposits to the account are not permitted. Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. Please see the Consumer Deposit Account Agreement and Savings Schedules for additional terms and conditions and Truth-in-Savings disclosures.

3 For purposes of transferring funds to or from an external bank, business days are Monday through Friday, excluding holidays. Transfers can be initiated 24/7 via the website or phone, but any transfers initiated after 7:00 PM Eastern Time or on non-business days will begin processing on the next business day. Funds deposited into your account may be subject to holds. See the Funds Availability section of your Consumer Deposit Account Agreement and Savings Schedules for more information.

4 Calculations are estimates of expected interest earned. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates. The first recurring deposit is assumed to begin in the second period after any initial deposit.

5 IRA Contributions are subject to aggregate annual limits across all IRA plans held at American Express or other institutions. IRA distributions may be taxed and subject to penalties based on IRS guidelines. Required minimum distribution, if applicable, is only relevant to this IRA plan and does not take into consideration other IRA plans held at American Express or other institutions. Please see IRS.gov for more information. We recommend you consult with a financial or tax advisor when making contributions to and distributions from an IRA plan account.