American Express @ Work1 Company Profile Page

User Guide

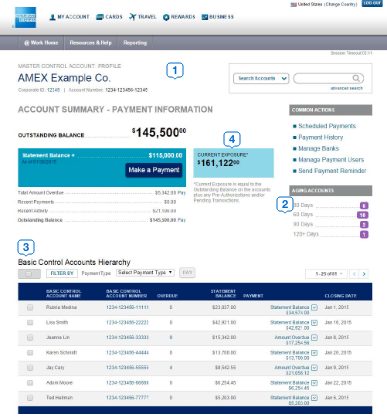

What is the Company Profile Page

Company Profile page is a consolidated view of your company’s American Express® accounts. If you have access to your Company’s profile page, you can review your company Main Control Account and access individual control accounts that you manage, all on one page. In addition, we have a feature called Company Level Exposure.

Key Features

- Account summary

- Company Level Exposure

- Account Hierarchy

- Card Member Accounts

- Aging Accounts

- Make Payments & Refresh Open to Buy

Benefits

- Increased Program Spending Visibility

- Stay in control

- Simplified Payment Experience

Authorized Banking Officer and Authorized Payer

To enable the separation of duties between authorization of payment and execution of payment, Corporate Online Payment provide 2 different roles:

- Authorized Banking Officer

- Authorized Payer

Person with access to the company bank account and provide payment permissions

This person MUST be a registered @ Work user to receive permission to make payments

Function

- Manage banking information online

- Authorized Banking Officer - Up to 5 banks

- Authorized Payer (@ Work User) - Not Applicable

- Authorize online payers

- Authorized Banking Officer - Up to 10 banks

- Authorized Payer (@ Work User) - Not Applicable

- Pay online

- Authorized Banking Officer - Optional

- Authorized Payer (@ Work User) - Yes

- Schedule payments

- Authorized Banking Officer - Optional

- Authorized Payer (@ Work User) - Yes

- View payment history

- Authorized Banking Officer - Optional

- Authorized Payer (@ Work User) - Yes

- Track payment status

- Authorized Banking Officer - Optional

- Authorized Payer (@ Work User) - Yes

New COP features

Company Profile

Offers Carousel

-

-

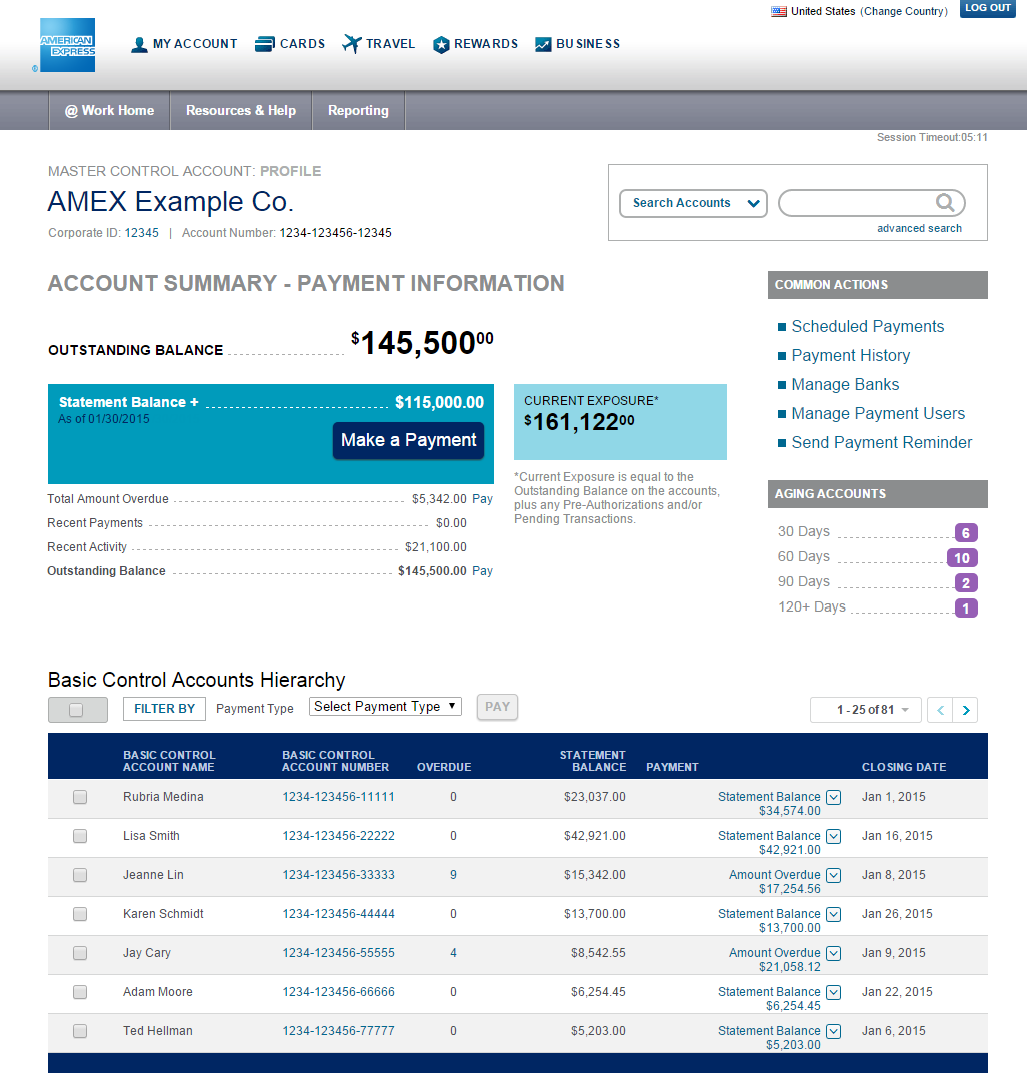

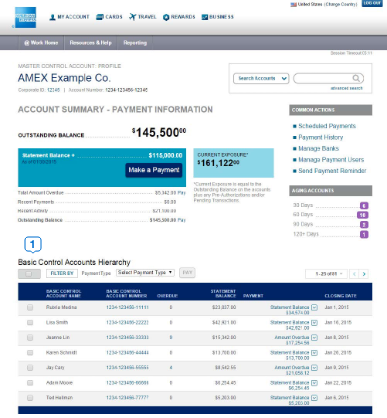

Account Summary - Snapshot of your Control Account payments and balances. Make a payment to any of the accounts under the control account hierarchy.

-

Aging Accounts - Identify Card Members that are delinquent in their payments.

-

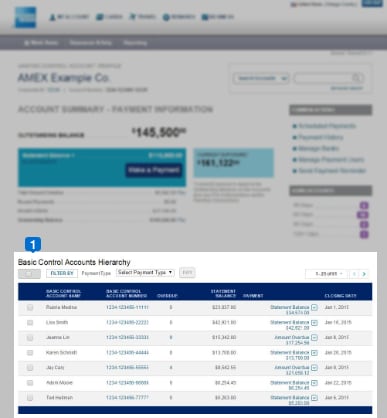

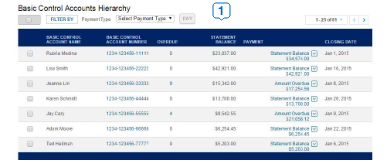

Account Hierarchy - One stop access to control accounts that you manage & to selected centrally billed online statements. Make payments to specific accounts selecting the balance to pay (statement balance, amount overdue or outstanding balance)

-

Company Level Exposure - Real-time access to view your Company’s consolidated balances & pending charges.

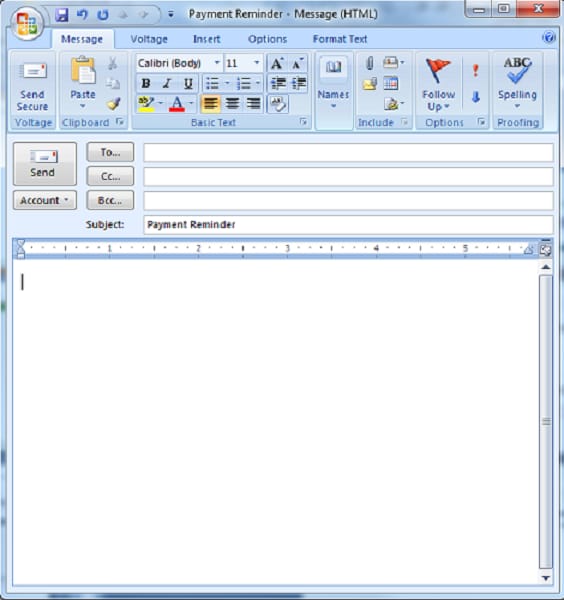

Payment Reminder Email

Send Payment Reminder - Open your email service within the system to send a note regarding your payments.

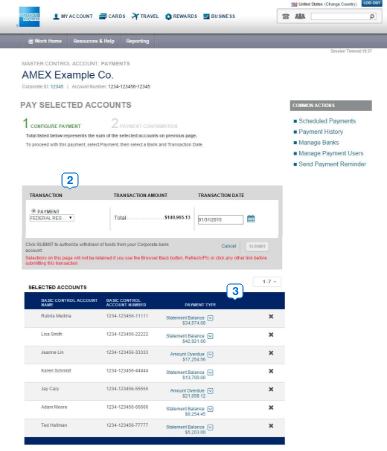

Payment Process

Configure Payment – From the Account Summary section

Offers Carousel

-

-

Start your payment - When you click on a balance from the Account summary

-

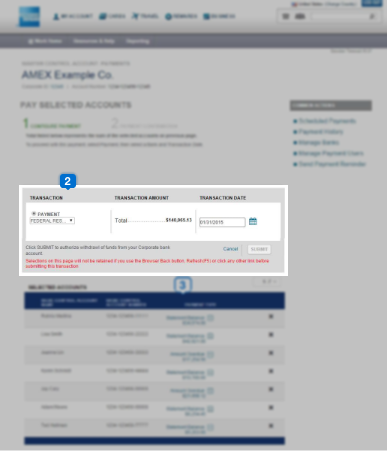

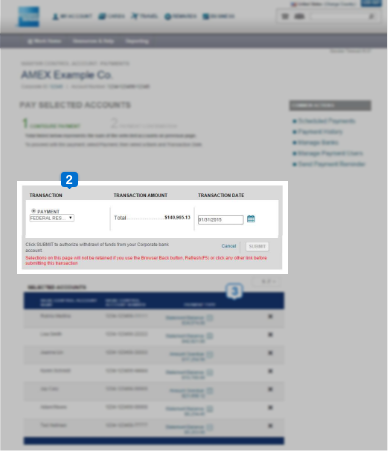

Set payment details -

a.Choose the bank account from which your payment will be debited

b.Confirm the payment amountc.Define a payment date

-

Review Payment Details - Review the accounts and amounts selected in your payment instructions

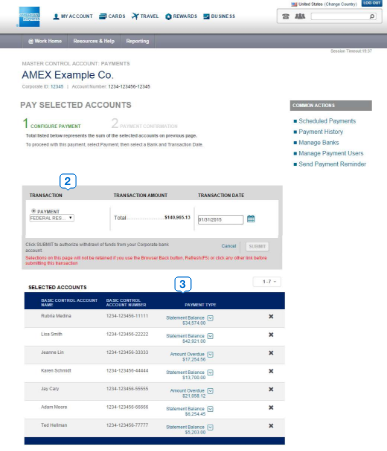

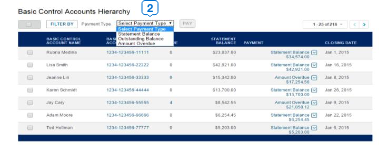

Configure Payment – From the Account Hierarchy section

Offers Carousel

-

-

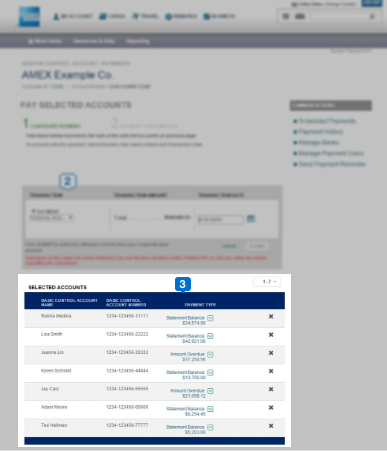

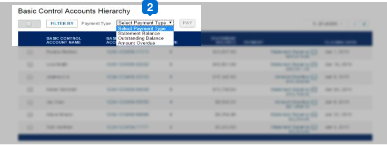

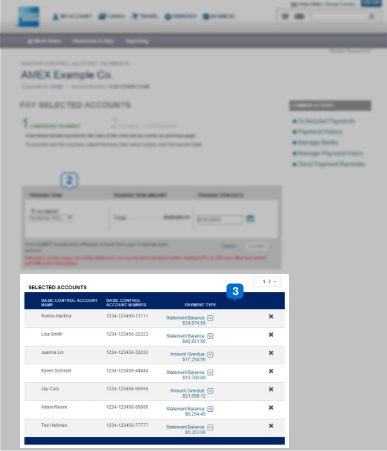

Select Payment Details - Select the accounts and amounts to include in your payment.

-

Apply changes to all accounts -

a. Check the top left box

b. Select the applicable balance (this selection will be applied to all accounts)c. Click PAY

Configure Payment – From the Account Hierarchy section

Offers Carousel

-

-

Start your payment - Select the accounts and amount to pay individually

-

Set payment details

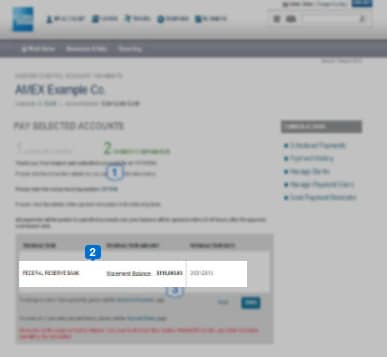

a.Choose the bank account from which your payment will be debited

b.Confirm the payment amountc.Define a payment date

-

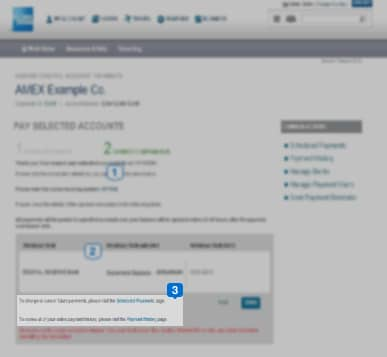

Edit Payment Details - Review and edit the accounts and amounts selected in your payment instructions

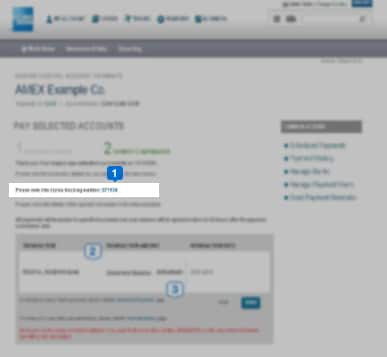

Payment Confirmation

Offers Carousel

-

-

Tracking Number - Keep track of your payment and use the status tracking number to review the status of the payment.

-

Payment Details - View the payment instructions submitted.

-

Access to Scheduled Payments and Payment History - Short cut to review your past and scheduled payments.

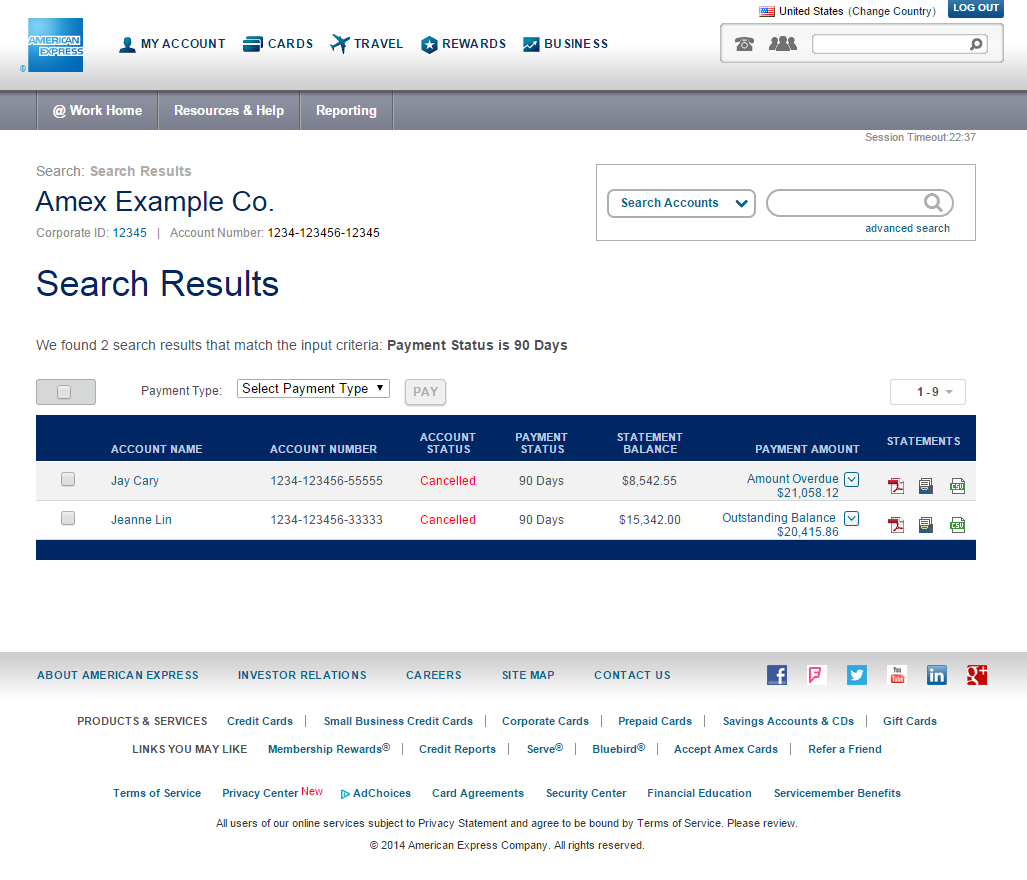

Search Results

Search Results - Select the filter criteria and access your results.

Past & Scheduled Payments

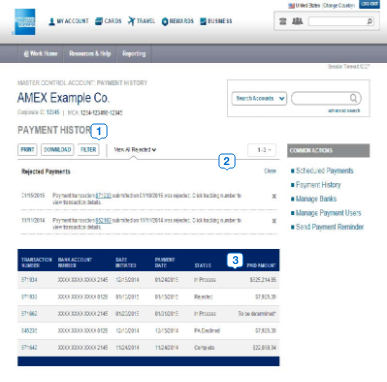

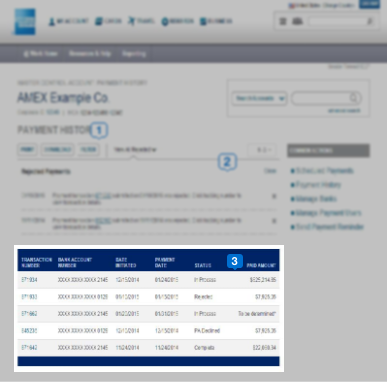

Payment History

Offers Carousel

-

-

Keep records of your payment history - Print or download your payment history. Filter by date or status.

-

Rejected Payments - Review your rejected payment notifications and take action accordingly.

-

Review Payment Details - Review the accounts and amounts selected in your payment instructions

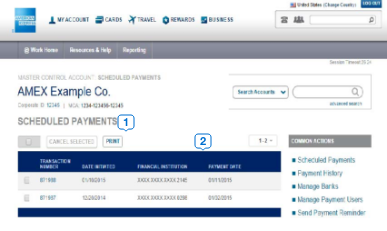

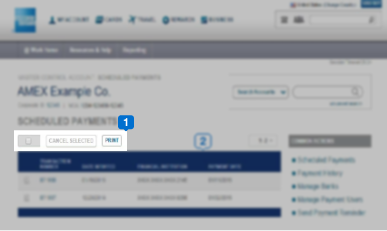

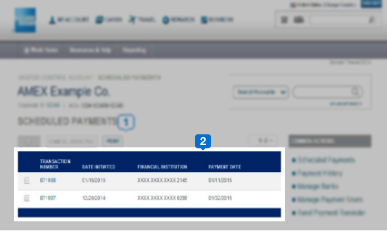

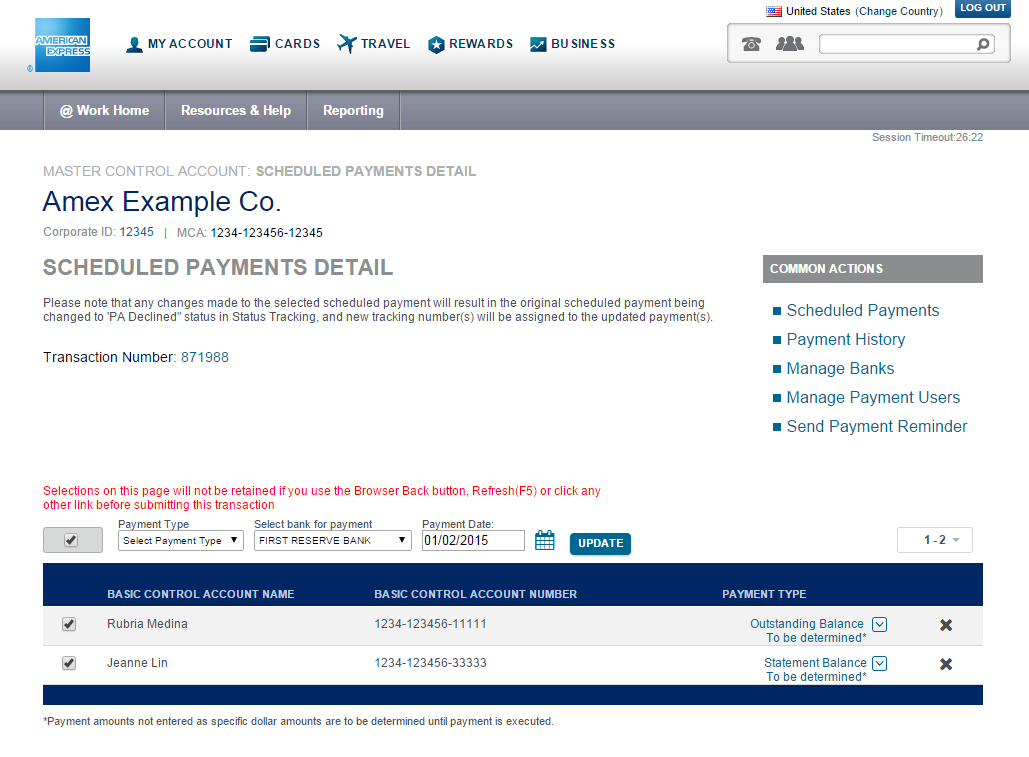

Edit or Cancel Scheduled Payments

Offers Carousel

-

-

Cancel one or more Scheduled Payments - Cancel multiple future payment instructions.

-

Edit future payments -

Select a payment to change:

a.Amounts

b.Banks or

c.Dates

Update payment details on one or more accounts -

Select the checkbox on top to apply changes to all accounts included in your payment.

Select the checkbox of the accounts to update.

Editable fields include:

a.Amounts

b.Banks

c.Dates

You will receive a NEW tracking number

User profile maintenance

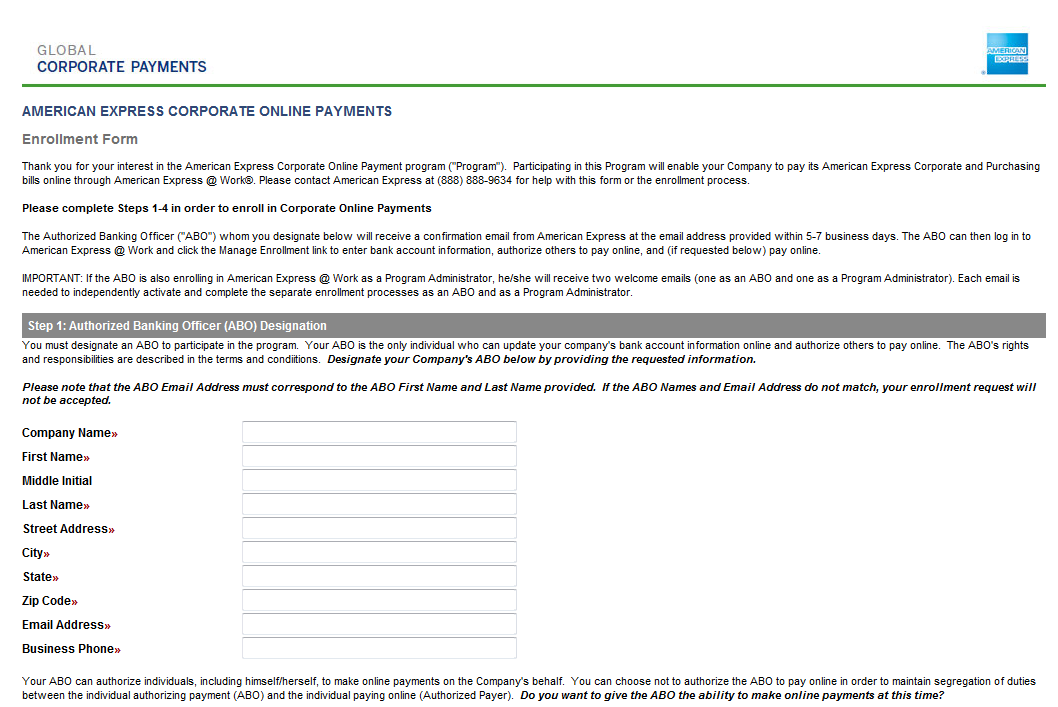

Create an Authorized Banking Officer profile

The Authorized Banking Officer (ABO for short) must go to the URL shown below and enroll in @ Work – EVEN if this person is already enrolled. A unique ID and password is required to act as an ABO.

Enroll in Corporate Online Payments - https://corporateforms.americanexpress.com/forms/US_COPEnroll_PA_Online_ClientEnrollForm

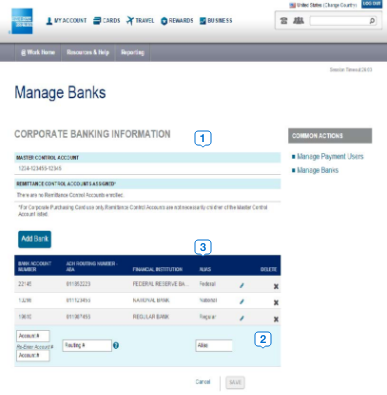

Manage Bank Information

Offers Carousel

-

-

Control Account List - Identify the control accounts that can be paid with your bank list

-

Add Bank accounts to pay your program - Include up to 5 checking accounts to pay your Corporate Program.

-

Edit or delete an existing bank - Manage your bank list, update or delete your banking information

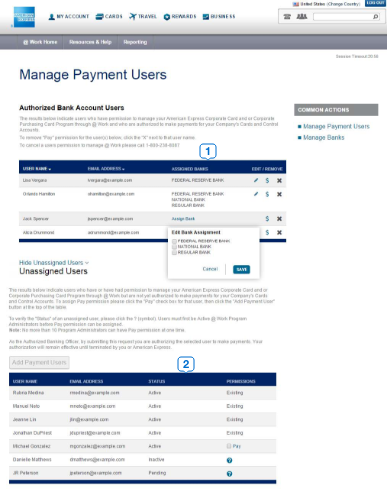

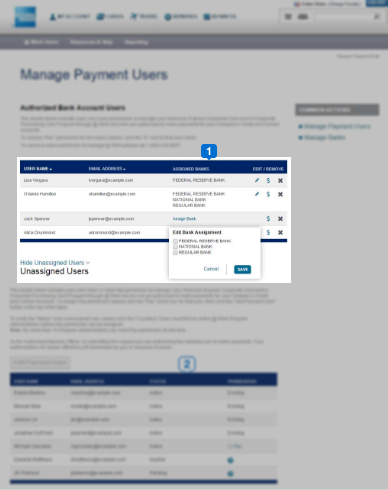

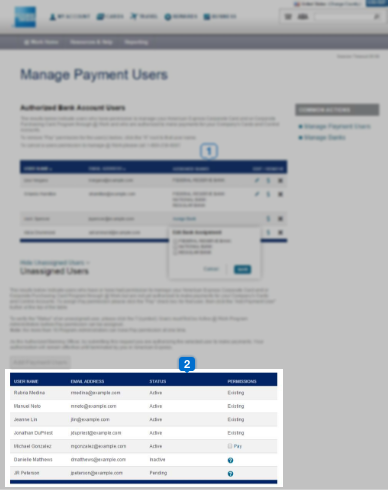

Manage Payment Permissions & Assign Banks

Offers Carousel

-

-

Assign banks - Select the banks that your Program Administrator can use to pay your accounts.

-

Assign pay permissions - Provide your Program Administrators permissions to make payments to the accounts in their control.

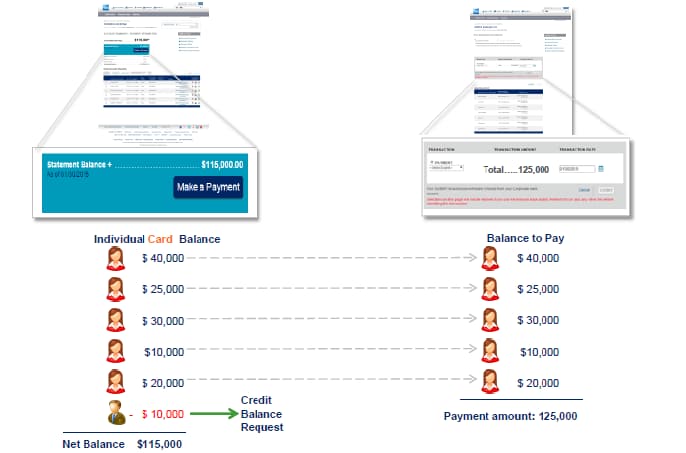

Credit Balances

Payments with accounts with a Credit Balance

When we have an account with a Credit Balance, the negative amount will not be reduced from the amount due on the Confirmation page.

How to request a Credit Balance Refund?

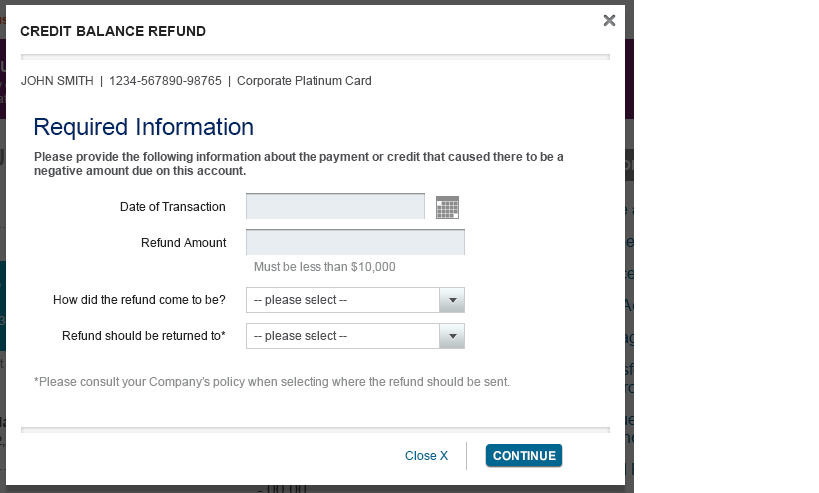

Credit Balances can be requested online through @ Work Card Member Profile page

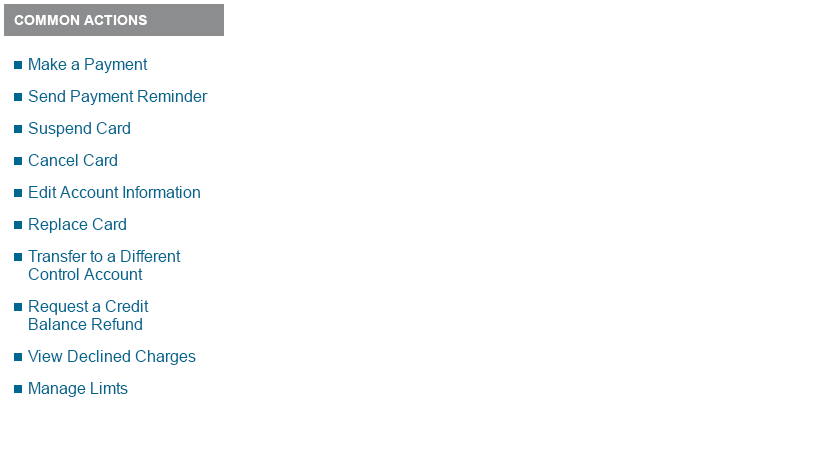

Start your request from the @ Work - Click on the Common Actions link to start your Credit Balance request.

Fill the request form - Fill the form information according to your Company’s policy.

To learn more:

Review our Frequently Asked Questions

Take a Virtual Tour

Send an email the At_Work_Feedback mailbox

Our Customer Care Professionals will be prepared to help you navigate through the new experience and can be reached by contacting the @ Work Help Desk.

Terms & Conditions

1Use of American Express @ Work ® is restricted to employees, contractors and/or agents that the Company, and its representatives designate for the sole purpose of performing online account queries and maintenance, including accessing and/or creating reports relating to the Company's American Express® Corporate Card programs. @ Work is available to all companies with an American Express Corporate Card program.

Enrollment is required. To enroll in @ Work please contact your American Express Representative or call 1-888-800-8564.

© 2021 American Express.

Recommended Articles

Statements & Payments

Remittance Implementation Guide

American Express' portfolio of payment products assists companies in managing their expenses more effectively. This portfolio includes Individual Billing/Company Payment (IB/CP), which allows companies to consolidate Card Member payments to American Express.

Statements & Payments

Learn how to view statements and pay bills to avoid mis-postings and account delinquencies