Create A New Transfer

Below are step-by-step instructions on how to initiate funds transfers into or out of your American Express® Savings account.

You can make a one-time transfer or set up recurring transfers – the choice is yours. It may take up to three business days before transfers appear at your external bank account.3

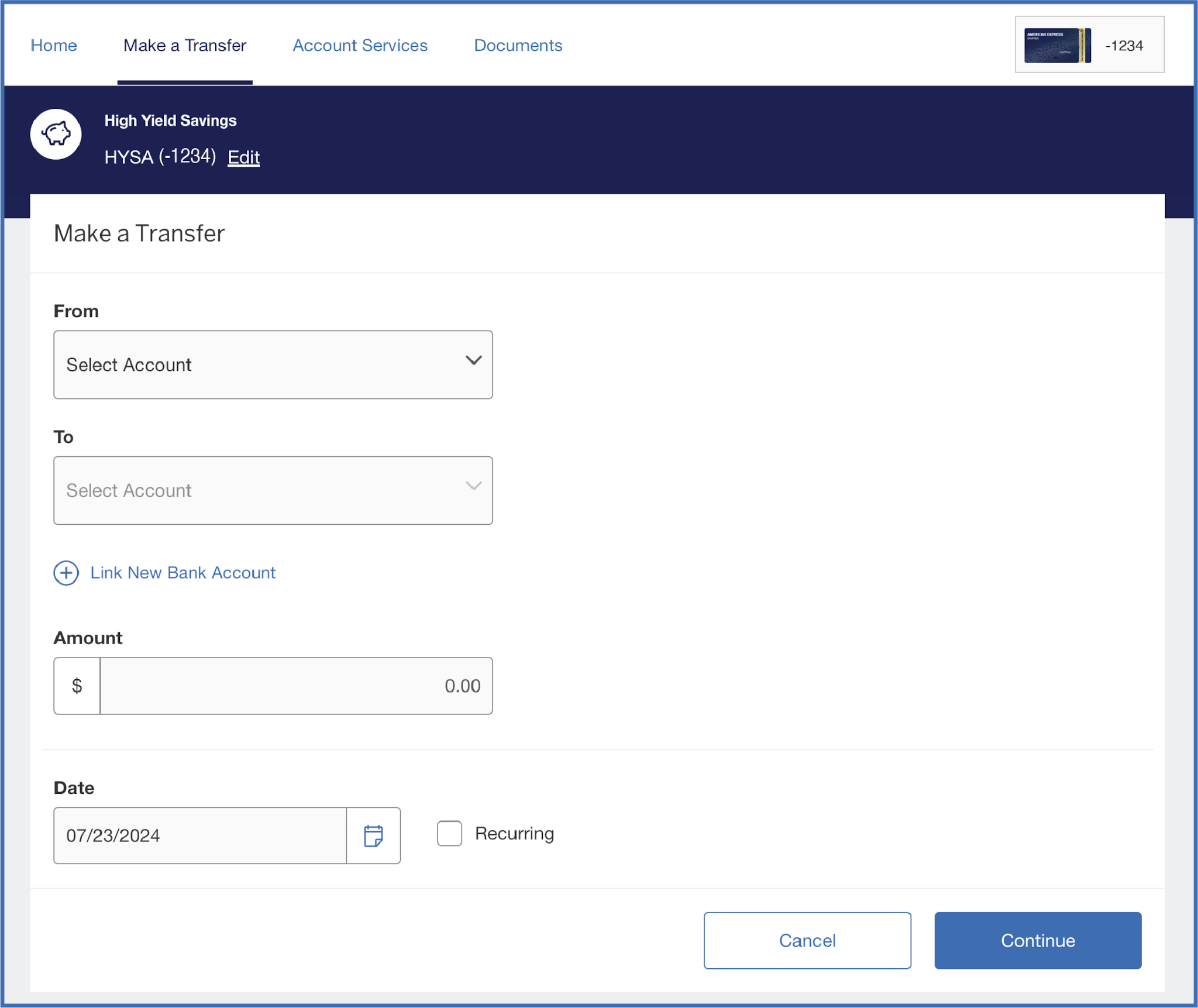

Step 1: Set Up Your Transfer

Log in to Savings and select Make a Transfer. You will be asked for the following information:

- Transfer Amount

- Frequency (defaults to 'one time'): if set to a frequency of every one or two weeks, these will occur on the same day of the week; less frequent options will repeat on the same date of the month

- Date (for a one-time transfer): date the transfer will be initiated

- Start Date (for recurring transfers only): if scheduled date is a non-business day the transfer will begin processing on the next business day

- End Date (for recurring transfers only): if not set for recurring transfers, the transfer will recur indefinitely

- From Account and To Account information

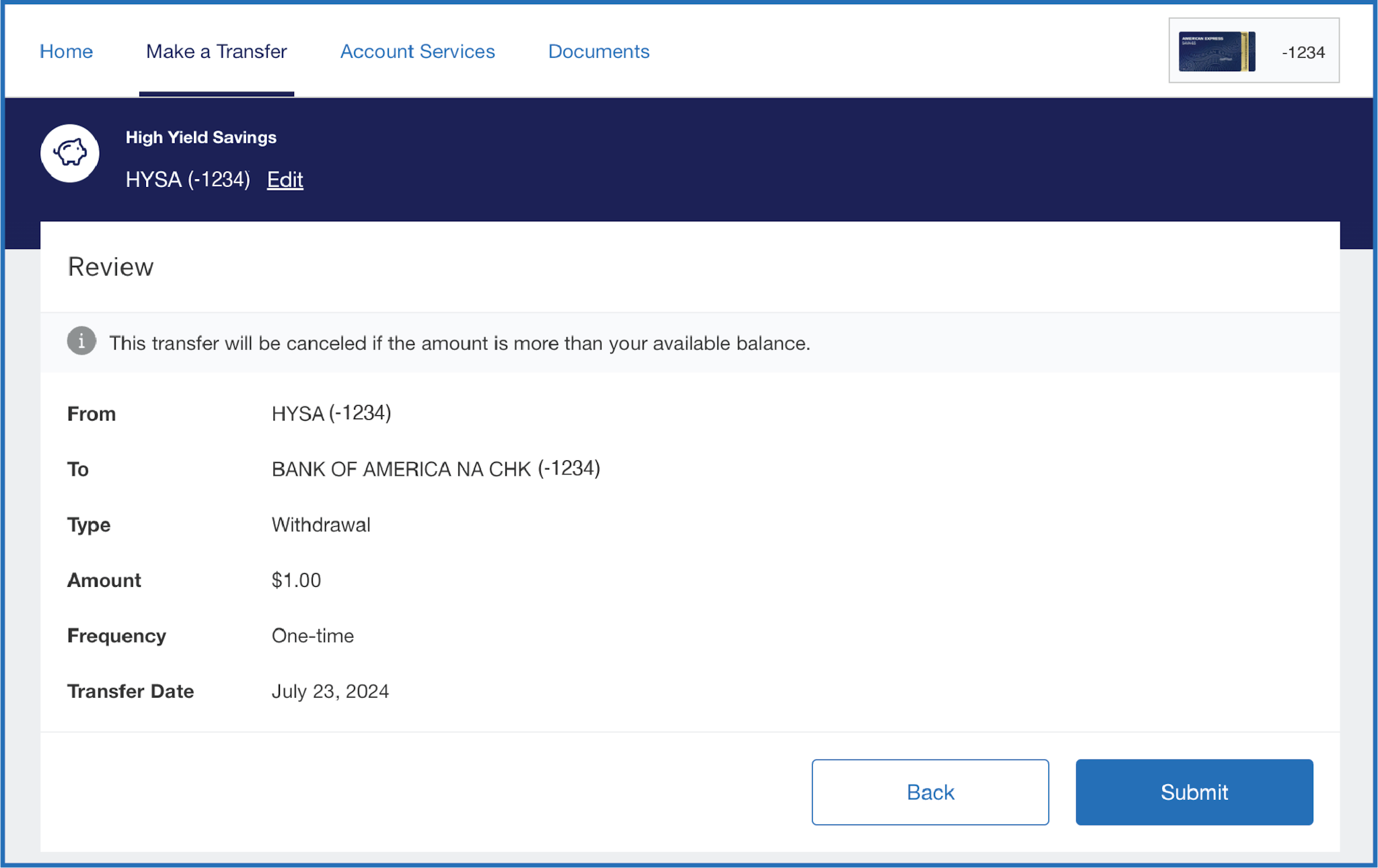

Step 2: Review Your Transfer

You will review your transfer summary and have an opportunity to edit it prior to submitting by pressing the Back button. Once you finish reviewing, press Submit to continue.

Please note, if you withdraw your full balance and do not close your account, accrued interest from your current statement cycle may be posted after your transfer is completed and remain in your account until withdrawn separately.

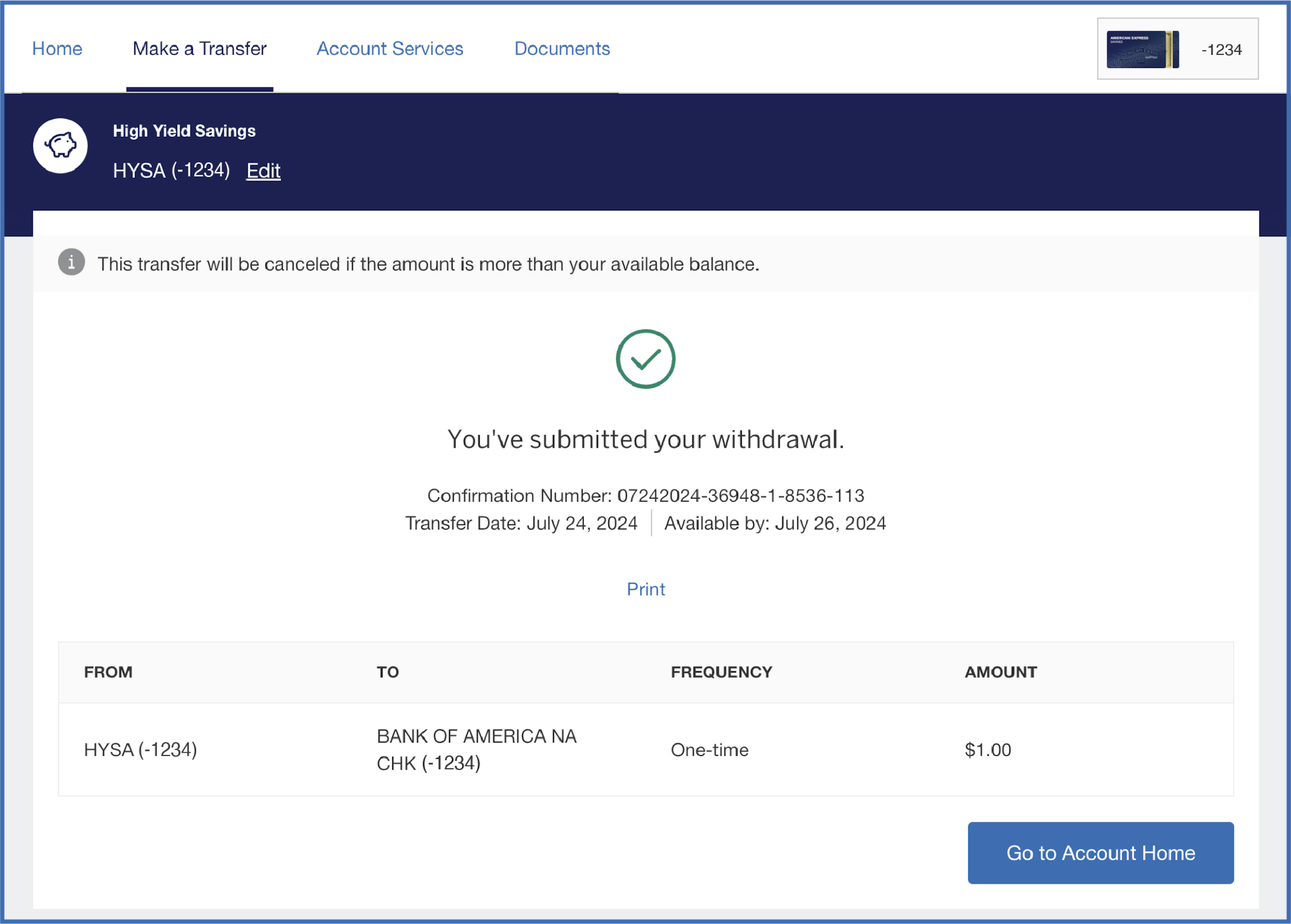

Step 3: Transfer Confirmation

Your transfer is all set, and will begin processing on the date(s) provided in the on-screen confirmation.

Each transfer you initiate online has a unique Confirmation Number; you may print this page or keep the Confirmation Number for your records.

There’s nothing more you need to do – we’ll take it from here.

Important Reminder

Your electronic transfer request will leave or be received by our bank and be reflected in your Savings balance on the date listed. However, the external banks generally take 1-3 days to reflect the transfer on their system. Please see FAQs below for more specific timing on the movement of your funds. On the day of processing, transfers are subject to the availability of sufficient funds.

Make A Transfer

Accounts offered by American

Express National Bank. Member FDIC. Each depositor is insured to at least $250,000 per depositor, per insured bank, per ownership category.

* The Annual Percentage Yield (APY) as advertised is accurate as of . Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is opened. Interest Rate and APY of a Certificate of Deposit account is fixed once the account is funded.

** The national rate referenced is from the FDIC's published Monthly Rate Cap Information for Savings deposit products. Visit the FDIC website for details.

1 There is no minimum balance required to open your Account, to avoid being charged a fee, or obtain the Annual Percentage Yield (APY) disclosed to you.

2 For a CD account, rates are subject to change at any time without notice before the account is funded. The rate received will either be (i) the rate reflected during your application process or (ii) the rate being offered when your CD is funded, whichever is higher. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after completing your account-opening deposit. After a CD is opened, additional deposits to the account are not permitted. Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. Please see the Consumer Deposit Account Agreement and Savings Schedules for additional terms and conditions and Truth-in-Savings disclosures.

3 For purposes of transferring funds to or from an external bank, business days are Monday through Friday, excluding holidays. Transfers can be initiated 24/7 via the website or phone, but any transfers initiated after 7:00 PM Eastern Time or on non-business days will begin processing on the next business day. Funds deposited into your account may be subject to holds. See the Funds Availability section of your Consumer Deposit Account Agreement and Savings Schedules for more information.

4 Calculations are estimates of expected interest earned. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates. The first recurring deposit is assumed to begin in the second period after any initial deposit.

5 IRA Contributions are subject to aggregate annual limits across all IRA plans held at American Express or other institutions. IRA distributions may be taxed and subject to penalties based on IRS guidelines. Required minimum distribution, if applicable, is only relevant to this IRA plan and does not take into consideration other IRA plans held at American Express or other institutions. Please see IRS.gov for more information. We recommend you consult with a financial or tax advisor when making contributions to and distributions from an IRA plan account.