Disputes Education Center

American Express has your back with information, insights and solutions to help you prevent disputes and stay focused on your business.

Disputes Education Center

American Express has your back with information, insights and solutions to help you prevent disputes and stay focused on your business.

Understanding Disputes

In 2025, less than 0.030% of US Card Member transactions turned into disputes that reached merchants.1

And what’s more…

we saw an increase in the number of transactions made by American Express US Card Members, while at the same time reducing the rate at which a dispute reaches a merchant.2

Disputes 101

Learn about the types of disputes, tools and best practices to help you be ready if a dispute comes your way.

Understanding the Disputes Process

Amex Disputes Solutions Explained

Disputes Reference Guide

Videos

Understanding the Disputes Process

Video opens with the American Express logo and illustration of the Disputes process.

Voice over:

"Disputes can seem complicated, but we're here to help make the process clear. So here's what to expect if a charge is disputed.

First, we'll work directly with the Card Member, and can often clear up the dispute without having to contact you. If we must reach out to you, we’ll do so in one of two ways.

The first is an inquiry. If we ask for your help, you'll have 20 days to respond with the requested information. These inquiries have two potential outcomes. If you reply on time with sufficient information, there won't be a Chargeback. If you don't, your account will be debited.

The second way we reach out is an upfront Chargeback. This means if the Card Member provides enough information, we may debit your account. You'll then have 20 days to send information that might reverse the Chargeback. If you reply on time with sufficient information, we'll issue a reversal. If you don't, the Chargeback will stand.

Go to AmericanExpress.com/ManageDisputes for more information on how to help stop disputes before they start."

Common Dispute Prevention Tips

Video opens with the American Express logo and illustration of three common disputes and ways to help prevent them.

Voice over:

"We know disputes can be frustrating, so we're here with three common disputes and ways to help prevent them.

A No Knowledge Dispute happens when your customer doesn't recognize the transaction or your business name on a statement. To help avoid this, contact your processor to make sure your business name is accurate and familiar to your customers.

A Returned Dispute happens when your customer claims a product was returned but doesn't see a statement credit. If your customer returns an item, issue their credit within seven days. You should also prominently display your cancellation and return policies on all receipts and points of sale.

A Not Received Dispute occurs when your customer claims goods or services were never received. In the future, notify customers about any fulfillment delays, and wait to process charges until the items have shipped or until the service date.

To learn more on helping to manage and prevent disputes, visit AmericanExpress.com/ManageDisputes."

Webinars

Dispute Prevention Tips

Additional one-page resources to help you prevent potential disputes during the sales process.

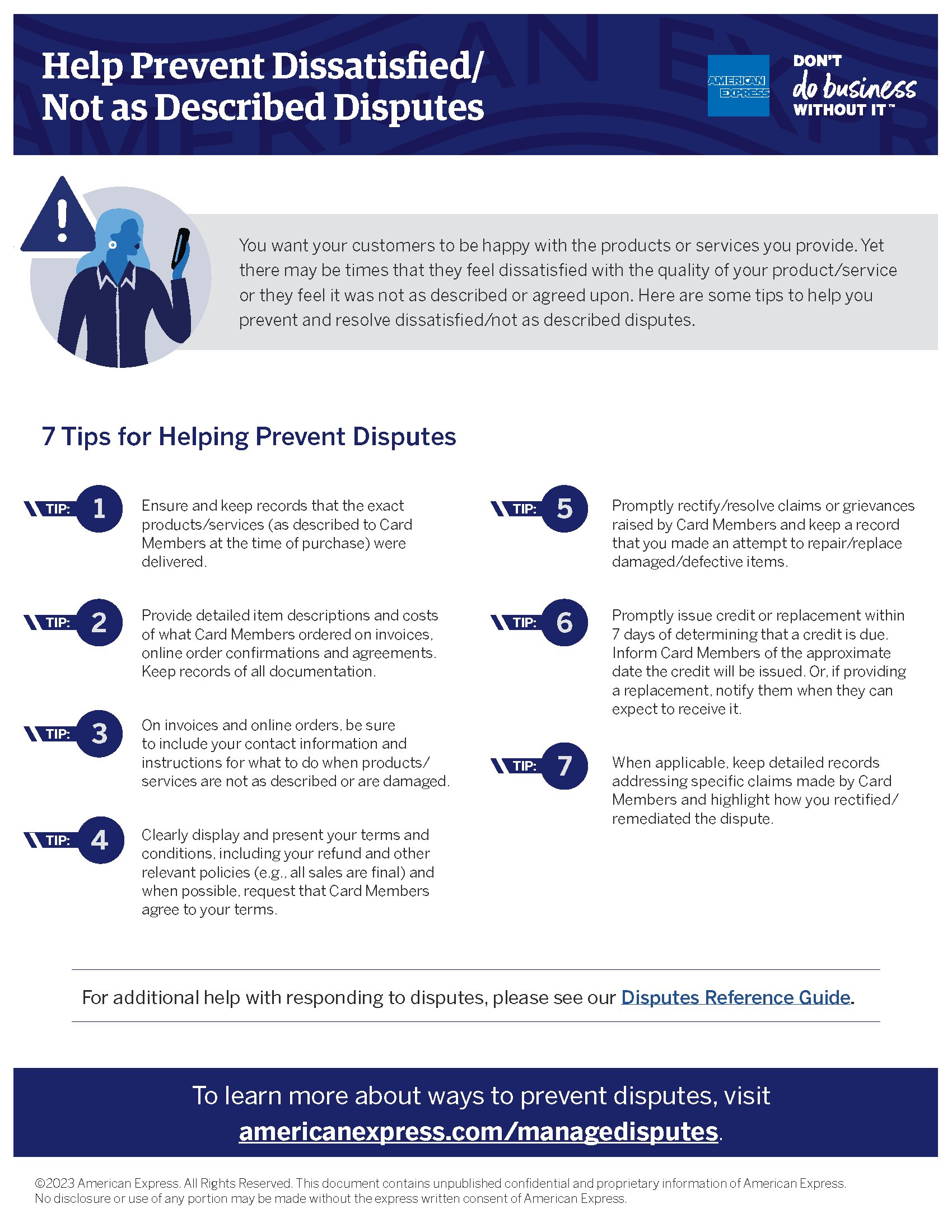

Avoiding Dissatisfied/Not as Described Disputes

Preventing Disputes on Recurring Transactions

Avoiding Card-Not-Present Disputes

Presenting Compelling Evidence

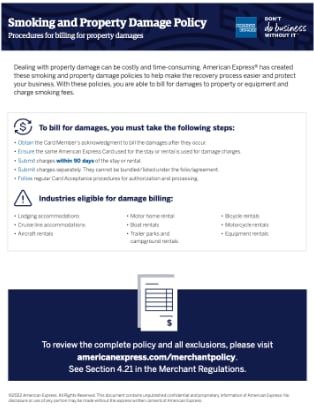

Billing for Damages

Removing Signature at Checkout

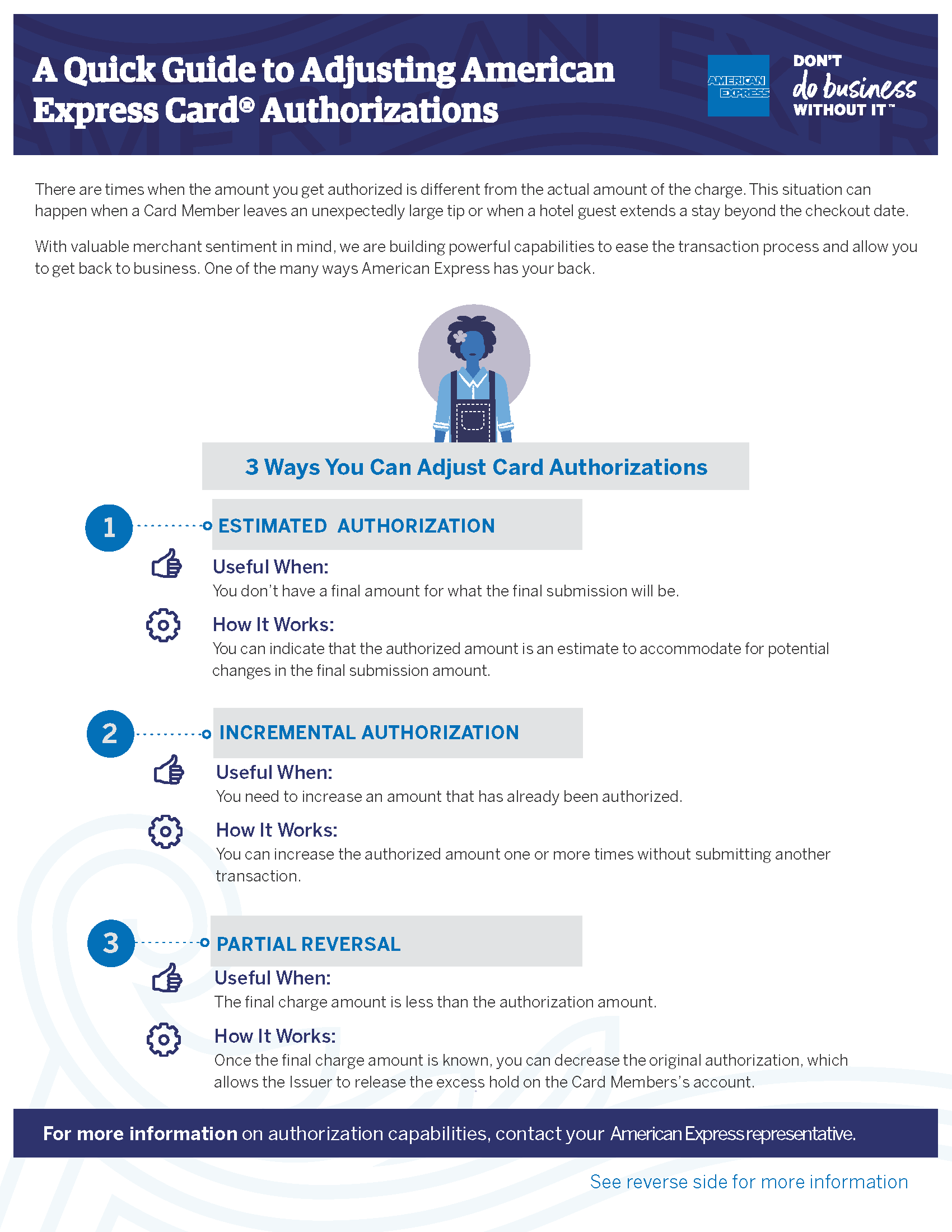

Adjusting American Express Authorizations *New!

AMEX Solutions

American Express is continually enhancing our policies and solutions to help you prevent and manage disputes.

Policy updates and enhancements

Shorter Time for Filing Disputes – We have reduced the timeframe for processing a Chargeback to 120 days.3

Limits on Redisputes – Disputes on the same transaction can only be raised twice.

Capabilities

Accelerated Dispute Resolution - Get added flexibility to resolve disputes.

Authorization on Credit

Capabilities Video

Video opens with an illustration of American Express dispute capabilities.

Voice over:

"You’re in business to do business. And we’re here to help you if a potential dispute gets in your way.

In fact… in 2023, less than point-zero three five percent of US Card Member transactions turned into disputes that reached merchants. Here’s how we do it:

Substitute Receipts: If a customer raises a “does not recognize” dispute with American Express, we can create an itemized receipt without having to contact the merchant.

We can help resolve the issue alone 81.4% of the time for US Card Members, to potentially minimize interruptions to your business.

Digital Receipts: Customers reviewing Amex transactions online or on the app can simply click or tap to view a receipt. So if they have a question, they get an answer. Amex merchants that implemented digital receipts saw fewer disputes reach them than Amex merchants that did not implement digital receipts.

And finally, Authorization on Credit: If a customer makes a return, their refund is posted as pending in near-real-time on the Amex app. So they don’t have to call anyone to see that their pending refund is on the way.

Three American Express tools that get ahead of disputes before they cross your desk—just one more way we’ve got your back."

Substitute Receipts – American Express helped resolve 83% of disputes raised by US Card Members as a “does not recognize” transaction with our Substitute Receipt capability without needing to contact merchants for help resolving the dispute.4

Digital Receipts – Merchants who implemented American Express Digital Receipts saw 15-20% fewer non-fraud disputes than merchants who did not implement Digital Receipts over the period from July 2020 to October 2021.5

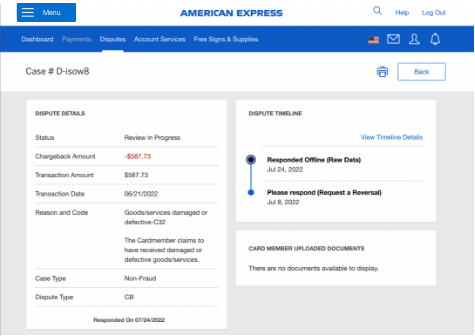

Merchant Website

For an easy and convenient way to manage disputes, anytime, visit our Merchant website.

Not enrolled? Sign up today.

Industry & Policy Guides

From restaurants to hotels, different businesses have unique needs when it comes to processing transactions and helping prevent and manage disputes. Check out these industry and policy resources to help you protect your unique business.

For Retailers

For Restaurants

For Hotels & Lodging

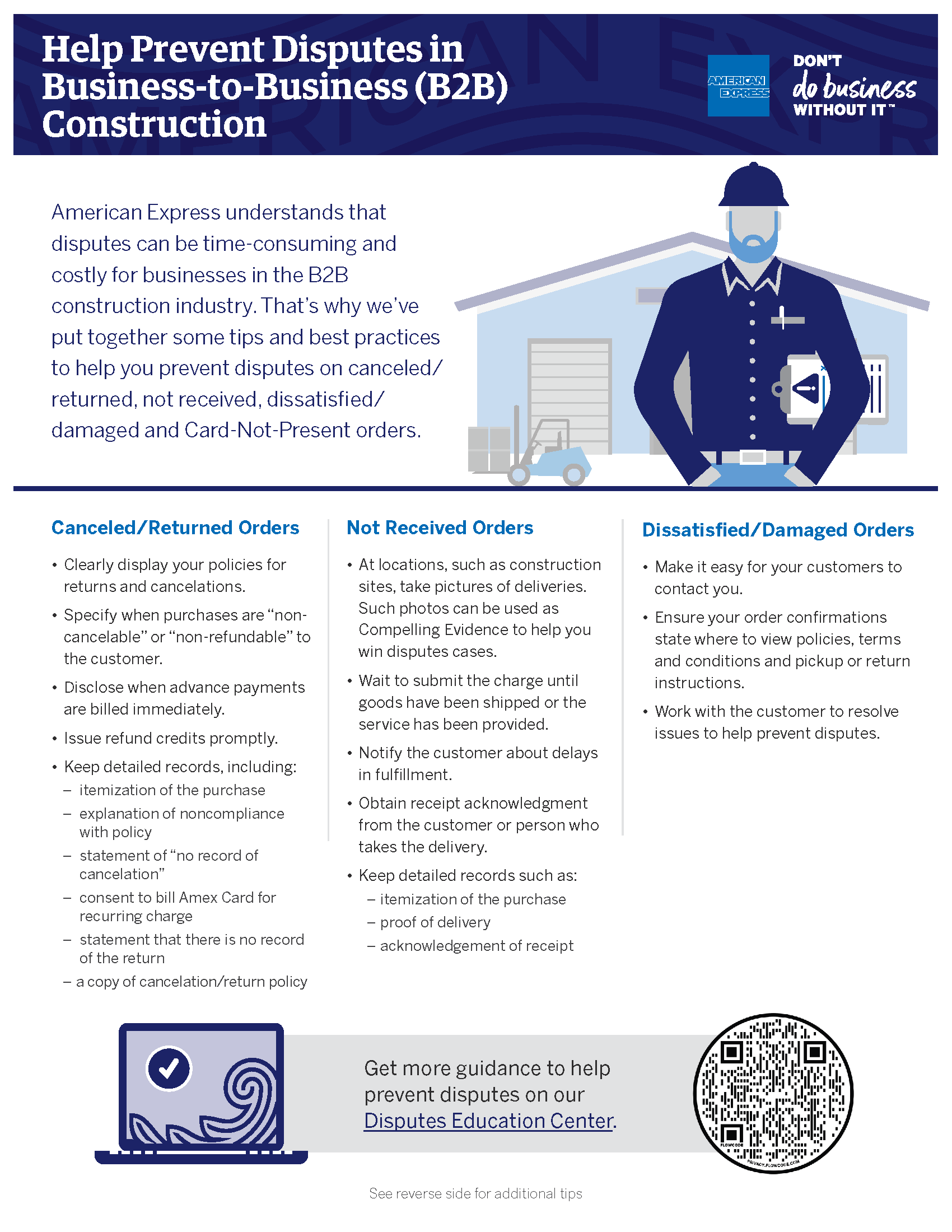

For B2B Merchants

For Card-Not-Present Transactions (Coming 2024)

For B2B Construction Merchants

For Online Merchants

Additional Resources

Access offers on curated services to help support your business

Help make payments simple, smart, and secure

Webinars, articles, and more to help your business adapt

1 Internal American Express data comparing January – December 2025 vs January – December 2024.

2 Internal American Express data comparing January – December 2025 vs January – December 2024.

3 Except for these dispute categories: 1. Goods/services not received. 2. Goods/services returned/canceled. 3. Redisputes. In these instances, the timeframe can extend slightly.

4 Data based on the success results of 596,759 Substitute Receipts sent to US Card Members for ‘does not recognize’ disputes between January 1, 2025 and December 31, 2025. This capability is available for all American Express merchants.

5 Merchants who implemented Digital Receipts had an average 2021 net charge volume of $13B. Digital Receipts is only available on transactions of merchants who have enabled the capability.