Multi-Currency

Accept payment in your customers’

currency – and get paid in yours.

Overview

Why Multi-Currency?

Multi-Currency is a cross-border payment feature that enables frictionless online sales by offering your products and services in your customers’ local currency.

Multi-Currency benefits

at a glance:

Multi-Currency benefits at a glance:

- International Expansion

Reach Card Members across borders using over 100 submission currencies and 18 settlement currencies without the cost of establishing a local presence. - Sales Generation

Attract new international customers and help drive revenue via currency localization. - Efficient Foreign Exchange Management

Convert currency automatically if submission is different than settlement currency. - Simplified Operations

Enjoy a more simplified processing experience from flexible settlement options to centralized account management.

How it works

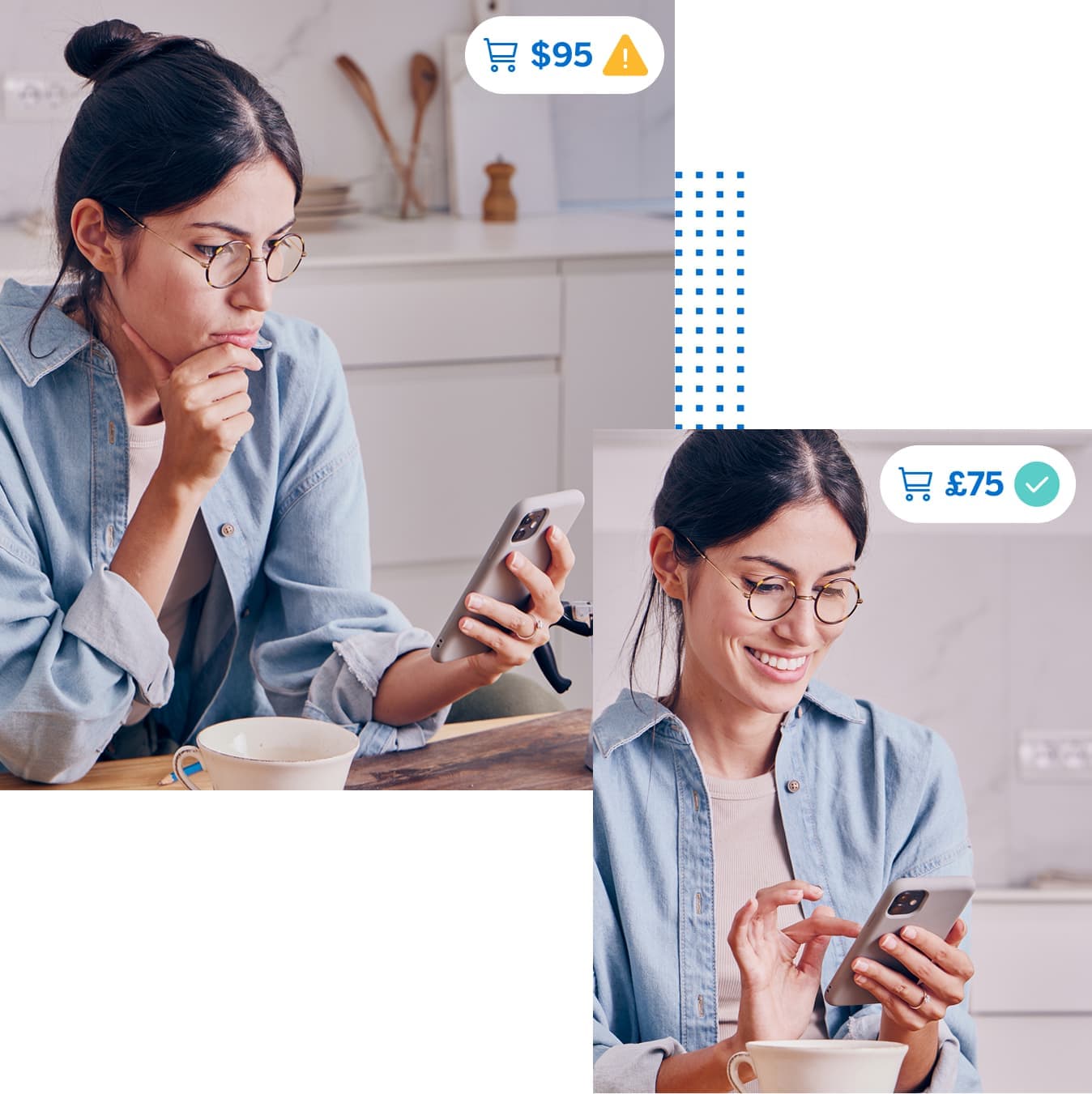

- A Card Member from U.K. visits a U.S. merchant’s website and chooses GBP as the currency.

- The U.S. merchant’s site changes the list of prices from USD to GBP.

-

The U.K. Card Member completes their purchase on the U.S. website by paying in GBP with their American Express® Card. -

The U.S. merchant receives payment in USD.

Multi-Currency

at work

The scenario

An international vinyl record company noticed a sharp drop-off in global sales and a high cart abandonment rate.

The solution

With Multi-Currency, the vinyl store saw higher conversions and sales, as customers were no longer surprised by currency conversion. Transparency in pricing led to customer confidence and a smooth shopping experience.

How to get started

Contact your Amex representative to select your available submission and settlement currencies and to establish your Multi-Currency merchant account.

Work with your certified payment processing partner and Amex to enable currency and connectivity for submission.

Begin accepting Amex Card transactions in your selected foreign countries and receive payments in your selected currencies via your preferred settlement option.

FAQs

Cross-border payments are transactions where a customer purchases goods or services from a business in a different country. Cross-border payments are an important part of global e-commerce businesses.

The American Express Multi-Currency merchant account enables seamless cross-border payments so you can price in a foreign currency and get paid in one of the available settlement currencies, helping to reduce the complexity of managing cross-border e-commerce so you can focus on reaching new customers.

A

- Albanian Lek.................................ALL

- Algerian Dinar...............................DZD

- Armenian Dram............................AMD

- Aruban Florin................................AWG

- Australian Dollar*.......................AUD

- Azerbaijan Manat.........................AZN

B

- Bahamian Dollar...........................BSD

- Bahraini Dinar...............................BHD

- Bangladesh Taka..........................BDT

- Barbados Dollar............................BBD

- Belize Dollar..................................BZD

- Bermudian Dollar..........................BMD

- Bhutan Ngultrum..........................BTN

- Bosnia and Herzegovina

Convertible Mark..........................BAM - Botswana Pula.............................BWP

- Brunei Dollar.................................BND

C

- Cabo Verde Escudo......................CVE

- Cambodian Riel............................KHR

- Canadian Dollar*.........................CAD

- Cayman Islands Dollar..................KYD

- CFA Franc BCEAO (West Africa)

......................................................XOF - CFA Franc BEAC

(Central Africa)..............................XAF - CFP Franc

(Change Franc Pacifique).............XPF - Chilean Peso................................CLP

- Chinese Yuan Renminbi...............CNY

- Colombian Peso...........................COP

- Comorian Franc............................KMF

- Costa Rica Colon..........................CRC

- Czech Koruna*............................CZK

D

- Danish Krone*.............................DKK

- Djibouti Franc................................DJF

- Dominican Peso............................DOP

E

- East Caribbean Dollar...................XCD

- Egyptian Pound............................EGP

- Eswatini Lilangeni.........................SZL

- Ethiopian Birr.................................ETB

- Euro*.............................................EUR

F

- Fiji Dollar.........................................FJD

G

- Gambian Dalasi..............................GMD

- Georgian Lari..................................GEL

- Ghanaian Cedi................................GHS

- Gibraltar Pound..............................GIP

- Guatemalan Quetzal.......................GTQ

- Guinean Franc................................GNF

- Guyana Dollar.................................GYD

H

- Honduran Lempira.....................HNL

- Hong Kong Dollar*...................HKD

- Hungarian Forint*.....................HUF

I

- Icelandic Krona...........................ISK

- Indian Rupee...............................INR

- Indonesian Rupiah......................IDR

- Israeli Shekel...............................ILS

J

- Jamaican Dollar...........................JMD

- Japanese Yen*............................JPY

- Jordanian Dinar............................JOD

K

- Kazakhstan Tenge.......................KZT

- Kenyan Shilling............................KES

- Kuwaiti Dinar................................KWD

- Kyrgyzstan Som...........................KGS

L

- Lebanese Pound...........................LBP

- Lesotho Loti..................................LSL

- Liberian Dollar...............................LRD

M

- Macau Pataca...............................MOP

- Macedonian Denar........................MKD

- Malagasy Ariary.............................MGA

- Malawian Kwacha.........................MWK

- Malaysian Ringgit..........................MYR

- Maldivian Rufiyaa..........................MVR

- Mauritanian Ouguiya.....................MRU

- Mauritius Rupee............................MUR

- Mexican Peso*.............................MXN

- Moldovan Leu................................MDL

- Mongolian Tugrik...........................MNT

- Moroccan Dirham..........................MAD

- Mozambique Metical.....................MZN

N

- Namibian Dollar.............................NAD

- Nepalese Rupee............................NPR

- Netherlands Antillean Guilder

......................................................ANG - New Taiwan Dollar.........................TWD

- New Zealand Dollar*...................NZD

- Nicaraguan Córdoba.....................NIO

- Nigerian Naira................................NGN

- Norwegian Krone*.......................NOK

O

- Omani Rial.....................................OMR

P

- Pakistani Rupee.............................PKR

- Papua New Guinea Kina................PGK

- Peruvian Sol...................................PEN

- Philippine Peso..............................PHP

- Polish Zloty*.................................PLN

Q

- Qatari Rial..............................QAR

R

- Romanian Leu........................RON

- Rwandan Franc......................RWF

S

- Samoan Tala...........................WST

- São Tome and Principe Dobra

................................................STN - Saudi Riyal..............................SAR

- Serbian Dinar...........................RSD

- Seychelles Rupee....................SCR

- Sierra Leonean Leone..............SLE

- Singapore Dollar*...................SGD

- Solomon Islands Dollar............SBD

- South African Rand*..............ZAR

- South Korean Won...................KRW

- Sri Lankan Rupee.....................LKR

- Swedish Krona*......................SEK

- Swiss Franc*...........................CHF

T

- Tajikistan Somoni......................TJS

- Tanzanian Shilling.....................TZS

- Thai Baht..................................THB

- Tongan Pa’anga.......................TOP

- Trinidad and Tobago Dollar

.................................................TTD - Tunisian Dinar...........................TND

- Turkish Lira...............................TRY

- Turkmenistan New Manat

.................................................TMT

U

- Ugandan Shilling......................UGX

- Ukrainian Hryvnia.....................UAH

- United Arab Emirates Dirham

.................................................AED - United Kingdom Pound Sterling*

.................................................GBP - United States Dollar*.............USD

- Uruguayan Peso......................UYU

- Uzbekistan Som......................UZS

V

- Vanuatu Vatu............................VUV

- Vietnamese Dong.....................VND

Z

- Zambian Kwacha......................ZMW

*Indicates the currency is supported as a submission and settlement currency. All other currencies are submission only. Some currencies may have restrictions due to regulatory requirements.

TERMS AND CONDITIONS

All products and services may not be available to all merchants.