Focus on growth with a business line of credit.

American Express®

Business Line of Credit

‡offers line sizes from $2,000 to $250,000.

Only select customers receive initial line sizes over $150k.

Already a small business Card Member with American Express?

Sign in to see if you're pre-approved

What's required to apply?

To submit your Business Line of Credit application, you must meet the minimum requirements, including but not limited to:

Be At least 18 years of age

Have started your business at least a year ago

Have a FICO score of at least 660* at time of application

Have recent average monthly revenue of at least $3,000

All businesses are unique and are subject to review and approval.

*The required FICO score may be higher based on your relationship with American Express, credit history, and other factors.

How do I apply for a Business Line of Credit?

Make your application process smoother by preparing these items in advance.

So that we can assess your eligibility for a Business Line of Credit, you will need to provide some basic information, including:

- Your business Tax ID (EIN) number

- Your social security number

- The industry of your business

- An estimated annual gross revenue for your business

You will also need to link a business bank account to your application.

You can follow these step-by-step instructions to help you link a bank account.

Understanding Business Funding

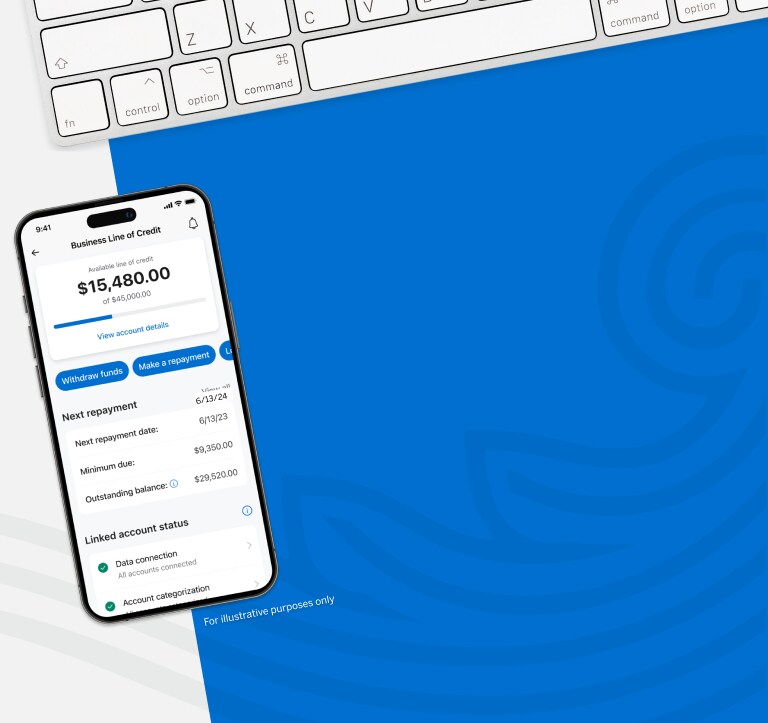

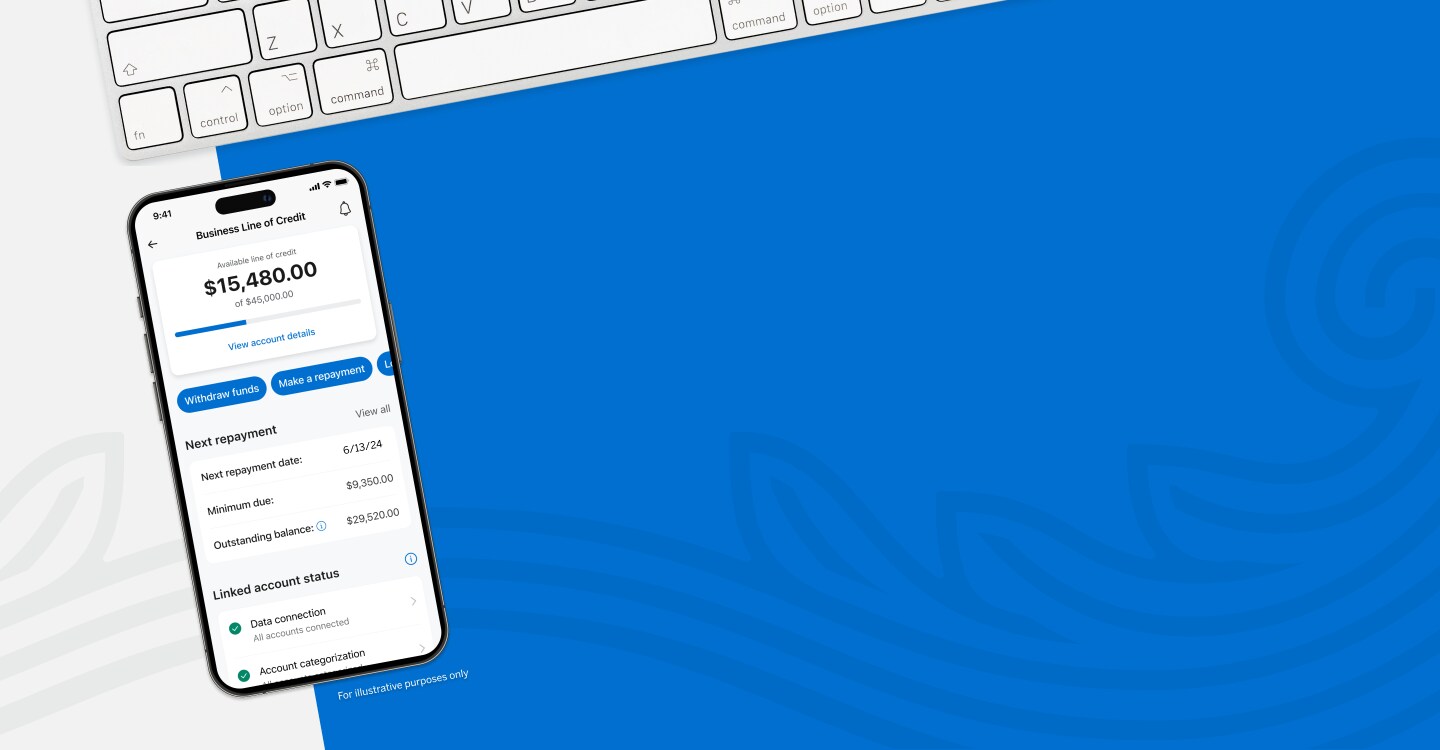

A business line of credit provides flexible access to business funding, allowing you to draw as needed from your credit line up to your available line amount. You draw funds from the line in the form of individual loans.‡ With some lines of credit, like American Express® Business Line of Credit, you can have more than one outstanding loan at one time, up to your approved line size.

As repayments are made, the amount of funds available replenish, allowing you to make additional draws. Note that your line could be adjusted by a lender at any time based on many factors, like your business' health.

A business line of credit can open up possibilities and adapt to your unique business demands. You can hire seasonal help or offer signing bonuses to attract top talent, update equipment or order supplies, or stock up on additional inventory when prices are low. You could also consider using it to smooth out gaps in your cash flow.

Hello, American Express®

small Business Card Members

You may be pre-approved for an American Express® Business Line of Credit. Sign in and follow a few straightforward steps to find out.

Focus on growth with an American Express® Business Line of Credit

American Express® Business Line of Credit offers line sizes from $2,000 to $250,000. Initial line sizes above $150,000 are only available to select borrowers who have a pre-existing American Express relationship and meet other criteria.

Quick application

Apply online in minutes.‡ When you connect your business accounts to your Business Line of Credit application, your financial info is reviewed in real time for an efficient decision.

Flexible access

Use what you need when you need it — with no prepayment penalties.

Term length options

6-, 12-, 18-, or 24- month loan term options with a corresponding monthly fee.‡

Pay for what you use

Pay a fee only on the amount you use, during the months you have an outstanding balance.‡

Instant Deposit

When you draw from your business line of credit and select your American Express® Business Checking account as your deposit account, your funds are available immediately.*

*Funds are typically available within seconds but may take longer to post due to unexpected issues

“Thanks to American Express Business Line of Credit, I was able to acquire the company of a retiring competitor. That expansion has already paid for itself!”

Chandra Franklin Womack, P.E., Aran+Franklin Engineering Inc.

Real American Express® Business Line of Credit customer aware that this testimonial may be featured.

Have questions about American Express® Business Line of Credit?

Check out our FAQs for more information about how a small business line of credit with American Express® works.

American Express® Business Line of Credit offers line sizes from $2,000 to $250,000. Initial line sizes above $150,000 are only available to select borrowers who have a pre-existing American Express relationship and meet other criteria.

Yes, American Express obtains reports from consumer reporting agencies. American Express will also report your funding account payment status to consumer credit reporting agencies in accordance with the loan agreement.

The fee is calculated and determined within the documented fee ranges based on the underwriting analysis and creditworthiness and other factors.

The fee structure works like this: the fee is higher in the first months of the loan term and lower in the final months.

You're only charged loan fees during the months you have an outstanding balance. Plus, there are no prepayment penalties — you can pay off your loan at any time.

To help you budget with confidence, you'll see your monthly fees and the payment due dates for the loan term before you take out a loan.

6-month loan term: Fee is higher in the first two months and lower in the final four months.

12-month loan term: Fee is higher in the first six months and lower in the final six months.

18-month loan term: Fee is higher in the first nine months and lower in the final nine months.

24-month loan term: Fee is higher in the first twelve months and lower in the final twelve months.

To link an external bank account, follow this guide.

Once an American Express® Business Line of Credit application is completed and approved and after you draw on the line of credit and sign the loan agreement, funds are sent to the verified business bank account you designate for disbursement (this may or may not be the same as your autopay account, depending on the settings you choose). Funds may take 1 to 3 business days to process and post, depending on your bank.

- After receiving a disbursement of funds from your line of credit you will begin to receive a monthly invoice to make repayments. Depending on your cycle date this may be as early as 21 days from disbursement or as long as 51 days after disbursement.

- Each month you will be billed for a portion of your loan principal, plus a loan fee, any late fees (if applicable), any prior minimum monthly payment(s) remaining unpaid, and any billed but unpaid fees. Your business' loans incur a loan fee every month you have an outstanding balance.

- You'll always know your repayment schedule in advance, and can find more complete details here.

American Express® Business Line of Credit loans are issued by American Express National Bank.

More resources to help fuel your growth

What is a Business Line of Credit and How Does it Work?

Learn the basics of what a line of credit is and how it can be used to provide additional funding for your business.

Small Business Loans and Lending

Develop an understanding of the differences between funding options and identify the situations best suited for each.

Business Line of Credit vs. Credit Cards.

Explore the similarities and differences between the options, and learn how to effectively use both to help your business thrive.

Explore more

Check out these products designed to help you run your business.

American Express® Business Checking

Earn 1.30% APY1 on balances up to $500,000. Terms apply. Member FDIC.

Meet Business CheckingAmerican Express Business Blueprint™

View your select business products and accounts‡ in one place.

Explore cash flow management